The financial managers take care of the financial health of an organization. They make the important financial decisions of the company on behalf of the shareholders since it is not feasible for the owners to have direct control over the huge firms.

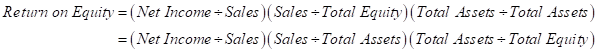

DuPont Identity

The DuPont Identity is named after the company who made it popular. It is a very popular tool used to measure the

Return on Equity (ROE)

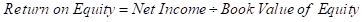

The return on equity (ROE) is a ratio which the financial managers and the analysts use to find out the return on the investment. Return on Equity is calculated by dividing the net income of the firm by the book value of equity. It can be represented as under:

To Identify:

The meaning of DuPont Identity and the manner in which the financial managers use DuPont Identity to access the firm’s Return on Equity (ROE).

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

EBK FUNDAMENTALS OF CORPORATE FINANCE

- Finance question. None please listen if you deslike my answer i will give your. Also if you will give more deslike bartleby site will be shut down.arrow_forwardCorrect solnarrow_forwardplease listen if you deslike my answer i will give in your answer. Bartleby also changed the rule for this change we all are responsible so please don't do this. Also if we will give more deslike bartleby site will be shut down.arrow_forward

- Muskoka Tourism has announced a rights offer to raise $30 million for a new magazine, titled ‘Discover Muskoka’. The magazine will review potential articles after the author pays a nonrefundable reviewing fee of $5,000 per page. The stock currently sells for $52 per share and there are 3.9 million shares outstanding. Required What is the maximum possible subscription price? What is the minimum? If the subscription price is set at $46 per share, how many shares must be sold? How many rights will it take to buy one share? What is the ex-rights price? What is the value of a right?arrow_forwardNorthern Escapes Inc. has 225,000 shares of stock outstanding. Each share is worth $73, so the company’s market value of equity is $16,425,000. Suppose the firm issues 30,000 new shares at the following prices: $73, $69, and $60. What will the effect be of each of these alternative offering prices on the existing price per share?arrow_forwardNeed answer correctly.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education