Concept explainers

To determine: The current rate of one-year, two-year, three-year and four-year treasury security.

Answer to Problem 8P

The current rate of one-year is 6%, two-year is 6.50%, three-year is 6.83% and four-year treasury security is 7.09%.

Explanation of Solution

Determine the current rate of one-year and two-year treasury security

The current rate of one-year treasury security is already given, which is 6%.

Therefore, the current rate of two-year treasury security is 6.50%.

Determine the current rate of three-year treasury security

Therefore, the current rate of three-year treasury security is 6.83%.

Determine the current rate of four-year treasury security

Therefore, the current rate of four-year treasury security is 7.09%.

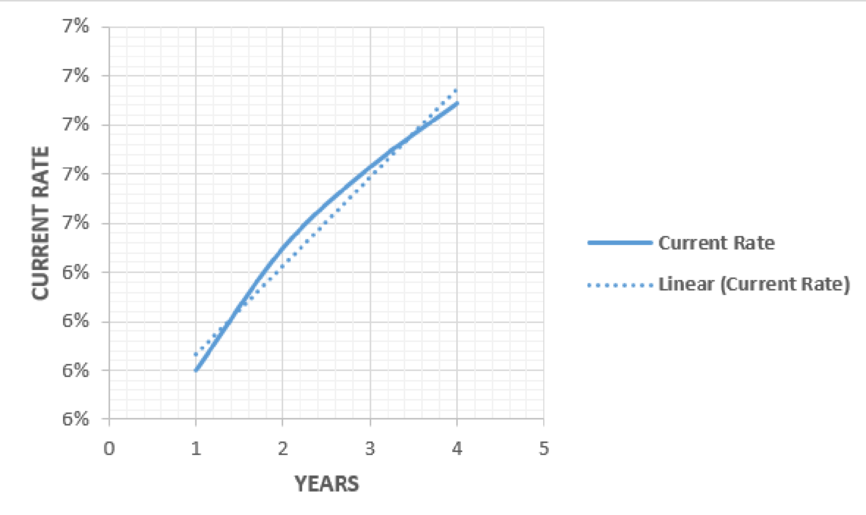

To determine: The yield curve for the current rate.

Explanation of Solution

The yield curve is as follows:

Want to see more full solutions like this?

Chapter 2 Solutions

Financial Markets and Institutions

- No chatgpt!! What is the purpose of a credit rating? A) To set a company’s stock priceB) To measure a borrower’s creditworthinessC) To determine future cash flowsD) To calculate tax obligationsarrow_forwardWhat is the purpose of a credit rating? A) To set a company’s stock priceB) To measure a borrower’s creditworthinessC) To determine future cash flowsD) To calculate tax obligationsarrow_forwardWhat is the formula for calculating Net Present Value (NPV)? A) Future Value ÷ (1 + r)^nB) Σ [Cash Flow / (1 + r)^t] - Initial InvestmentC) (Net Income ÷ Sales) × 100D) Total Assets - Total Liabilitiesneed answer!arrow_forward

- What is the formula for calculating Net Present Value (NPV)? A) Future Value ÷ (1 + r)^nB) Σ [Cash Flow / (1 + r)^t] - Initial InvestmentC) (Net Income ÷ Sales) × 100D) Total Assets - Total Liabilitiesarrow_forwardNeed help! What is the formula for calculating Net Present Value (NPV)? A) Future Value ÷ (1 + r)^nB) Σ [Cash Flow / (1 + r)^t] - Initial InvestmentC) (Net Income ÷ Sales) × 100D) Total Assets - Total Liabilitiesarrow_forwardNeed help! What does "liquidity" refer to in finance? A) The profitability of a companyB) The ability to meet short-term obligationsC) The total assets of a companyD) The debt-to-equity ratioarrow_forward

- I need answer in this problem!! What does a negative net present value (NPV) indicate? a) The project is profitable.b) The project is not viable.c) The project’s return is equal to the discount rate.d) The project has no cash inflows.arrow_forwardWhat does "liquidity" refer to in finance? A) The profitability of a companyB) The ability to meet short-term obligationsC) The total assets of a companyD) The debt-to-equity ratioarrow_forwardWhat does a negative net present value (NPV) indicate? a) The project is profitable.b) The project is not viable.c) The project’s return is equal to the discount rate.d) The project has no cash inflows. I need help in this .arrow_forward

- No Ai The time value of money concept is based on the idea that: a) Money loses value over time.b) A dollar today is worth more than a dollar tomorrow.c) Future money is worth more than present money.d) Inflation has no effect on money.arrow_forwardThe time value of money concept is based on the idea that: a) Money loses value over time.b) A dollar today is worth more than a dollar tomorrow.c) Future money is worth more than present money.d) Inflation has no effect on money.arrow_forwardWhat does a high price-to-earnings (P/E) ratio indicate? a) A company is undervalued. b) A company is overvalued. c) High investor confidence. d) Low profitability. need help!!arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education