EBK CORNERSTONES OF COST MANAGEMENT

3rd Edition

ISBN: 8220100474972

Author: MOWEN

Publisher: CENGAGE L

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 7CE

Jean and Tom Perritz own and manage Happy Home Helpers. Inc. (HHH), a house-cleaning service. Each cleaning (cleaning one house one time) takes a team of three house cleaners about 1.5 hours. On average, HHH completes about 15,000 cleanings per year. The following total costs are associated with the total cleanings:

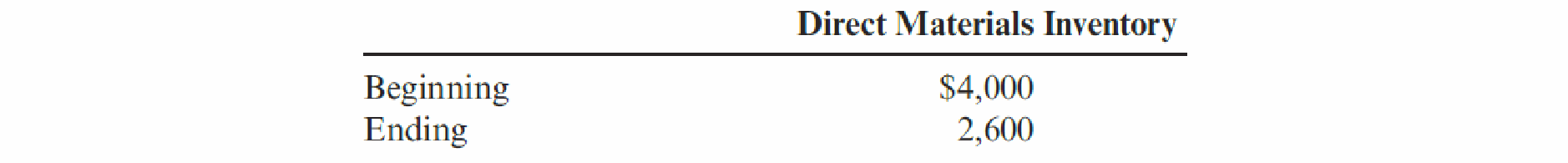

Next year, HHH expects to purchase $25,600 of direct materials. Projected beginning and ending inventories for direct materials are as follows:

There is no work-in-process inventory and no finished goods inventory; in other words, a cleaning is started and completed on the same day.

Required:

- 1. Prepare a statement of cost of services sold in good form.

- 2. How does this cost of services sold statement differ from the cost of goods sold statement for a manufacturing firm?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the role of the accounting equation in the analysis of business transactions?

Explain how this theory can help individuals in at least two fields (business, medical, education, etc.) better work in intercultural settings.

Define the theory based on credible sources.

Discuss the development of the theory: how it originated and came to its current status.

Evaluate your scholarly sources, providing a brief comment on the theoretical aspects of each.

Discuss the link(s) between your chosen theory and career field.

Discuss the implications of your case on individuals, society, and the public. How does an increased intercultural understanding affect these different groups?

In 8-10 pages in length. The paper should include support for the topic, your analyses and position(s) by citing course readings, and include at least five credible sources that you chose for your annotated bibliography. A credible source is defined as:

a scholarly or peer-reviewed journal article

which one is correct option?

Chapter 2 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

Ch. 2 - What is an accounting information system?Ch. 2 - What is the difference between a financial...Ch. 2 - What are the objectives of a cost management...Ch. 2 - Define and explain the two major subsystems of the...Ch. 2 - What is a cost object? Give some examples.Ch. 2 - Prob. 6DQCh. 2 - What is a direct cost? An indirect cost?Ch. 2 - Prob. 8DQCh. 2 - What is allocation?Ch. 2 - Explain how driver tracing works.

Ch. 2 - What is a tangible product?Ch. 2 - Prob. 12DQCh. 2 - Give three examples of product cost definitions....Ch. 2 - Prob. 14DQCh. 2 - Prob. 15DQCh. 2 - Pietro Frozen Foods, Inc., produces frozen pizzas....Ch. 2 - For next year, Pietro predicts that 50,000 units...Ch. 2 - Pietro expects to produce 50,000 units and sell...Ch. 2 - Refer to Cornerstone Exercises 2.2 and 2.3. Next...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Jean and Tom Perritz own and manage Happy Home...Ch. 2 - Prob. 9ECh. 2 - The following items are associated with a cost...Ch. 2 - Nizam Company produces speaker cabinets. Recently,...Ch. 2 - Three possible product cost definitions were...Ch. 2 - Wyandotte Company provided the following...Ch. 2 - For each of the following independent situations,...Ch. 2 - LeMans Company produces specialty papers at its...Ch. 2 - Kildeer Company makes easels for artists. During...Ch. 2 - Anglin Company, a manufacturing firm, has supplied...Ch. 2 - Lakeesha Barnett owns and operates a package...Ch. 2 - Millennium Pharmaceuticals, Inc. (MPI), designs...Ch. 2 - Jazon Manufacturing produces two different models...Ch. 2 - Ellerson Company provided the following...Ch. 2 - Prob. 22ECh. 2 - Prob. 23ECh. 2 - Prob. 24ECh. 2 - Prob. 25ECh. 2 - Prob. 26ECh. 2 - Selected information concerning the operations of...Ch. 2 - Brody Company makes industrial cleaning solvents....Ch. 2 - Wright Plastic Products is a small company that...Ch. 2 - The following items are associated with a...Ch. 2 - The actions listed next are associated with either...Ch. 2 - Spencer Company produced 200,000 cases of sports...Ch. 2 - Prob. 33PCh. 2 - Mason, Durant, and Westbrook (MDW) is a tax...Ch. 2 - Orman Company produces neon-colored covers for...Ch. 2 - High drug costs are often in the news. Consumer...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Net sales total $438,000. Beginning and ending accounts receivable are $35,000 and $37,000, respectively. Calculate days' sales in receivables. A.27 days B.30 days C.36 days D.31 daysarrow_forwardProvide correct answerarrow_forwardFor the system shown in figure below, the per unit values of different quantities are E-1.2, V 1, X X2-0.4. Xa-0.2 Determine whether the system is stable for a sustained fault. The fault is cleared at 8-60°. Is the system stable? If so find the maximum rotor swing. Find the critical clearing angle. E25 G X'd 08 CB X2 F CB V28 Infinite busarrow_forward

- Geisner Inc. has total assets of $1,000,000 and total liabilities of $600,000. The industry average debt-to-equity ratio is 1.20. Calculate Geisner's debt-to-equity ratio and indicate whether the company's default risk is higher or lower than the average of other companies in the industry.arrow_forwardHy expert give me solution this questionarrow_forwardBaker's Market began the current month with inventory costing $35,250, then purchased additional inventory at a cost of $78,400. The perpetual inventory system indicates that inventory costing $82,500 was sold during the month for $88,250. An inventory count at month-end shows that inventory costing $29,000 is actually on hand. What amount of shrinkage occurred during the month? a) $350 b) $1,150 c) $1,750 d) $2,150arrow_forward

- A pet store sells a pet waste disposal system for $60 each. The cost per unit, including the system and enzyme digester, is $42.50. What is the contribution margin per unit? A. $15.00 B. $17.50 C. $12.25 D. $19.00arrow_forwardNarchie sells a single product for $40. Variable costs are 80% of the selling price, and the company has fixed costs that amount to $152,000. Current sales total 16,000 units. What is the break-even point in units?arrow_forwardA company sells 32,000 units at $25 per unit. The variable cost per unit is $20.50, and fixed costs are $52,000. (a) Determine the contribution margin ratio. (b) Determine the unit contribution margin. (c) Determine the income from operations.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY