Finding Unknowns

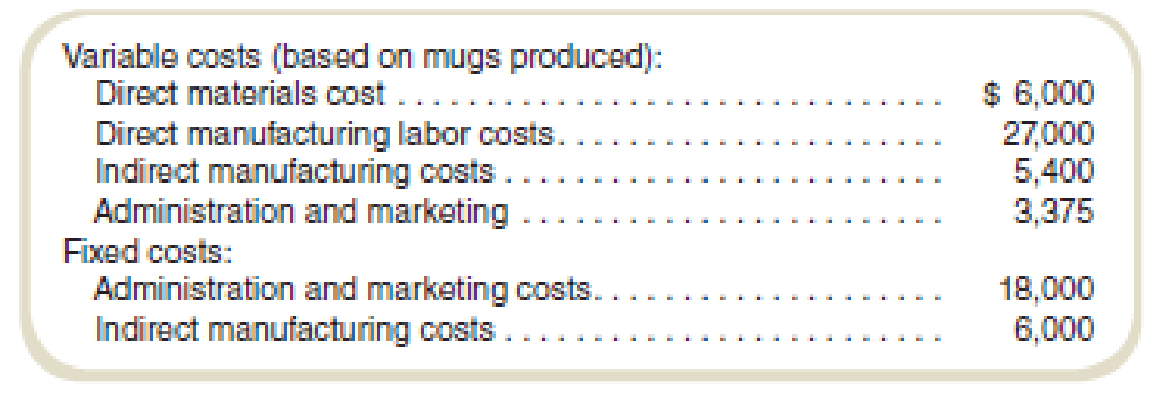

Mary’s Mugs produces and sells various types of ceramic mugs. The business began operations on January 1, year 1, and its costs incurred during the year include these:

On December 31, year 1, direct materials inventory consisted of 3,750 pounds of material. Production in that year was 20,000 mugs. All prices and unit variable costs remained constant during the year. Sales revenue for year 1 was $73,312. Finished goods inventory was $6,105 on December 31, year 1. Each finished mug requires 0.4 pounds of material.

Required

Compute the following:

- a. Direct materials inventory cost, December 31, year 1.

- b. Finished goods ending inventory in units on December 31, year 1.

- c. Selling price per unit.

- d. Operating profit for year 1.

a.

Calculate the value of closing direct material for Company M.

Answer to Problem 75P

The closing direct material is $2,812.

Explanation of Solution

Closing stock of direct material:

The material used in the production of the goods is known as direct material. Direct material cannot be separated from the finished product. It is also known as raw material. Business adds value in the raw material and sells it as the finished goods.

Calculate the closing direct material:

Thus, the closing stock of direct material is $2,812.

Working note 1:

Calculate the cost of direct material per pound:

Working note 2:

Calculate the cost of direct material per unit:

b.

Calculate the value of closing finished stock in units for Company M.

Answer to Problem 75P

The closing finished stock in units is $2,750.

Explanation of Solution

Closing stock of finished stock:

Finished stock is the cost of the goods that are ready to sell. Business put some value on the raw material by way of manufacturing overhead and direct labor and produces the finished goods. The stock left unsold at the end of the year is known as the closing stock of finished stock.

Calculate the closing finished stock in units:

Thus, the closing finished stock in units is 2,750.

Working note 3:

Calculate the manufacturing cost per unit:

Working note 4:

Calculate the total manufacturing cost:

| Particulars | Amount |

| Manufacturing cost: | |

| Direct material | $6,000 |

| Direct labor | $27,000 |

| Indirect manufacturing cost (variable cost) | $5,400 |

| Indirect manufacturing cost (fixed cost) | $6,000 |

| Total manufacturing cost | $44,400 |

Table: (1)

c.

Calculate the selling price per unit for Company M.

Answer to Problem 75P

The selling price per unit units is $4.25.

Explanation of Solution

Selling price:

Selling price is the amount that is charged per unit of finished goods sold to the customer. It is always set above the cost of the product to earn some margin over the cost of the product.

Calculate the selling price per unit:

Thus, the selling price per unit is $4.25.

Working note 5:

Calculate the units sold:

d.

Calculate the operating profit for Company M.

Answer to Problem 75P

The operating profit for Company M is $13,642.

Explanation of Solution

Operating profit:

Operating profit is calculated by deducting the full cost of the production from the sales of the business. Full cost of the production includes all the direct and indirect cost.

Calculate the operating profit:

| Particulars | Amount |

| Sales revenue | $73,312 |

| Less: cost of goods sold | $38,295 |

| Gross margin | $35,017 |

| Less: indirect manufacturing cost (variable cost) | $3,375 |

| Less: indirect manufacturing cost (fixed cost) | $18,000 |

| Operating profit | $13,642 |

Table: (2)

Thus, the operating profit is $13,642 for Company M.

Want to see more full solutions like this?

Chapter 2 Solutions

FUND.OF COST ACCT >CUSTOM<

- Accounting answer with helparrow_forwardAMC Enterprises is preparing its cash budget for October. The budgeted beginning cash balance is $22,000. Budgeted cash receipts total $195,000, and budgeted cash disbursements total $188,000. The desired ending cash balance for each month is $35,000. The company can borrow up to $150,000 at any time from a local bank but does not want to incur unnecessary interest charges by borrowing more than it needs to. What should the company do? a) borrow $5,000 b) borrow $6,000 c) borrow $150,000 d) borrow $3,000 e) borrow $10,000arrow_forwardWhat is the number of units transferred to finished goods?arrow_forward

- What was your total rate of returnarrow_forwardAMC Enterprises is preparing its cash budget for October. The budgeted beginning cash balance is $22,000. Budgeted cash receipts total $195,000, and budgeted cash disbursements total $188,000. The desired ending cash balance for each month is $35,000. The company can borrow up to $150,000 at any time from a local bank but does not want to incur unnecessary interest charges by borrowing more than it needs to. What should the company do? a) borrow $5,000 b) borrow $6,000 c) borrow $150,000 d) borrow $3,000 e) borrow $10,000 helparrow_forwardwhat is the standard quantity of per muffin?arrow_forward

- help me to solve this questionarrow_forwardStep by step Solutionarrow_forwardA proposed project has estimated sale units of 2,500, give or take 2 percent. The expected variable cost per unit is $12.79 and the expected fixed costs are $17,500. Cost estimates are considered accurate within a plus or minus 3 percent range. The depreciation expense is $2,850. The sale price is estimated at $15.40 a unit, give or take 3 percent. The company bases its sensitivity analysis on the expected case scenario. If a sensitivity analysis is conducted using a variable cost estimate of $13, what will be the total annual variable costs? Show me answerarrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College