Concept explainers

(a)

Concept Introduction: The value analysis is more of a systematic production review which includes the purchase process and the design of product to make sure the costs are reduced. This can be done using a set of activities including the product designs to make use of parts that have low-tolerance which are affordable, to switch to the components that cost low, including standardization of the parts to ensure the volume discounts are achieved.

To Prepare: The value analysis schedule and the determination and distribution of excess schedules.

(a)

Explanation of Solution

Given: Quail company purchases 80 of the common stock of Commo Company for $800000. At the time of purchase, Commo has framed its

Calculating fair value of total assets.

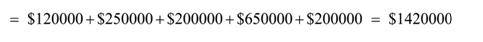

Fair value of total assets = Cash equivalents + Inventory + Land + Building + Equipment

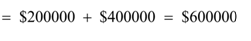

Calculating net liabilities,

Net liabilities = Current liabilities + Bonds payable

Now, calculate the fair value of net assets:

Fair value of net assets = Fair value of total assets - Liabilities payable = $1420000-$600000 = $820000

Value analysis schedule.

| Value analysis Schedule | Company-implied fair value | Parent Price (80%) | Non-controlling interest value (20%) |

| Company fair value | $1000000 | $800000 | $200000 |

| Fair value of net assets excluding | $820000 | $656000 | $164000 |

| Goodwill | $180000 | $1440000 | $36000 |

Along with total equity and excess of fair value over book value.

| Value analysis Schedule | Company-implied fair value | Parent Price (80%) | Non-controlling interest value (20%) |

| Fair value of subsidiary | $1000000 | $800000 | $200000 |

| Less: Book value of interest acquired Common stock Paid-in capital excess of par | $100000 $150000 $250000 | ||

| Total equity | $500000 | $500000 | $500000 |

| Interest acquired | 80% | 20% | |

| Book value (b) | $500000 | $400000 | $100000 |

| Excess of fair value over book value (a)-(b) | $500000 | $400000 | $100000 |

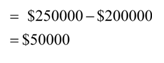

Inventory Adjustment = Fair value - book value

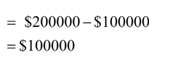

Land Adjustment = Fair value - book value

Building Adjustment = Fair value - book value

Equipment Adjustment = Fair value - book value

Adjustment of Identifiable Accounts

| Particulars | Adjustments | Worksheet key |

| Inventory | $1000000 | Debit D1 |

| Land | $100000 | Debit D2 |

| Building | $200000 | Debit D3 |

| Equipment | (30000) | Credit D4 |

| Goodwill | $180000 | Debit D5 |

| Total | $500000 |

(b)

Concept Introduction: The value analysis is more of a systematic production review which includes the purchase process and the design of product to make sure the costs are reduced. This can be done using a set of activities including the product designs to make use of parts that have low-tolerance which are affordable, to switch to the components that cost low, including standardization of the parts to ensure the volume discounts are achieved.

The value analysis schedule and the determination and distribution of excess schedules.

(b)

Explanation of Solution

Given: Quail company purchases 80% of the common stock of Commo Company for $800000. At the time of purchase, Commo has framed its balance sheet.

Market value of shares = Total number of shares x value per share

= 4000 shares x $45 per share = $980000

Goodwill under market value

| Value analysis Schedule | Company-implied fair value | Parent Price (80%) | Non-controlling interest value (20%) |

| Fair value of company | $980000 | $800000 | $180000 |

| Fair value of net assets excluding goodwill | $820000 | $656000 | $164000 |

| Goodwill | $160000 | $144000 | $16000 |

Value analysis schedule

| Value analysis Schedule | Company-implied fair value | Parent Price (80%) | Non-controlling interest value (20%) |

| Fair value of subsidiary (a) | $980000 | $800000 | $180000 |

| Less: Book value of interest acquired Common stock Paid-in capital excess of par retained earnings | $100000 $150000 $250000 | ||

| Total equity | $500000 | $500000 | $500000 |

| Interest acquired | 80% | 20% | |

| Book value (b) | $500000 | $400000 | $100000 |

| Excess of fair value over book value (a)-(b) | $500000 | $400000 | $100000 |

Adjustment of identifiable accounts

| Particulars | Adjustments | Worksheet Key |

| Inventory | $50000 | Debit D1 |

| Land | $100000 | Debit D2 |

| Building | $200000 | Debit D3 |

| equipment | ($30000) | Credit D4 |

| Goodwill | $160000 | Debit D6 |

| Total | $480000 |

c.

Concept Introduction: The value analysis is more of a systematic production review which includes the purchase process and the design of product to make sure the costs are reduced. This can be done using a set of activities including the product designs to make use of parts that have low-tolerance which are affordable, to switch to the components that cost low, including standardization of the parts to ensure the volume discounts are achieved.

The value analysis schedule and the determination and distribution of excess schedules.

c.

Explanation of Solution

Given: Quail company purchases 80 of the common stock of Commo Company for $800000. At the time of purchase, Commo has framed its balance sheet.

Value analysis schedule

| Value analysis Schedule | Company-implied fair value | Parent Price (80%) | Non-controlling interest value (20%) |

| Fair value of subsidiary (a) | $964000 | $800000 | $164000 |

| Less: Book value of interest acquired Common stock Paid-in capital excess of par retained earnings | $100000 $150000 $250000 | ||

| Total equity | $500000 | $500000 | $500000 |

| Interest acquired | 80% | 20% | |

| Book value (b) | $500000 | $400000 | $100000 |

| Excess of fair value over book value (a)-(b) | $464000 | $400000 | $64000 |

Adjustment of Identifiable Accounts

| Particulars | Adjustments | Worksheet Key |

| Inventory | $50000 | Debit D1 |

| Land | $100000 | Debit D2 |

| Building | $200000 | Debit D3 |

| equipment | ($30000) | Credit D4 |

| Goodwill | $144000 | Debit D6 |

| Total | $464000 |

Want to see more full solutions like this?

Chapter 2 Solutions

Advanced Accounting

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardGalaxy Enterprises reports its accounts receivable on the balance sheet. The gross receivable balance is $75,000, and the allowance for uncollectible accounts is estimated at 12% of gross receivables. At what amount will accounts receivable be reported on the balance sheet?arrow_forwardHi expert please given correct answer with accountingarrow_forward

- Can you demonstrate the proper approach for solving this financial accounting question with valid techniques?arrow_forwardAstoria Manufacturing's May 1, 2022, beginning work in process was 1,245 units. During May Astoria put into production an additional 3,675 units were put into production. At the end of May, all units were completed except for 820 units. Use this information to determine the number of units completed.arrow_forwardCan you help me solve this general accounting question using valid accounting techniques?arrow_forward

- I need guidance with this financial accounting problem using the right financial principles.arrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forwardNova Consulting estimates its consultants will work 25,000 direct labor hours per year. The company's projected total indirect costs are $320,000. The direct labor rate is $95 per hour. The company uses direct labor hours as the allocation base for indirect costs. If Nova performs a job requiring 32 hours of direct labor, what is the total job cost?arrow_forward

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning