Concept explainers

Nordtown Company is a marketing firm. The company’s

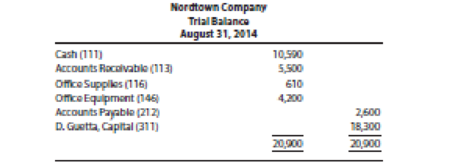

During the month of September, the company completed the following transactions:

Sept. 2 Paid rent for September, $650.

3 Received cash from customers on account, $2,300.

7 Ordered supplies, $380.

10 Billed customers for services provided, $2,800.

12 Made a payment on accounts payable, $1,300.

14 Received the supplies ordered on September 7 and agreed to pay for them in 30 days, $380.

17 Discovered some of the supplies were not as ordered and returned them for full credit, $80.

19 Received cash from a customer for services provided, $4,800.

24 Paid the utility bill for September, $250.

26 Received a bill, to be paid in October, for advertisements placed in the local newspaper during the month of September to promote Nordstrom Company, $700.

29 Billed a customer for services provided, $2,700.

30 Paid salaries for September, $3,800.

30 Made a cash withdrawal of $1,200.

Required

- 1. Open accounts in the ledger for the accounts in the trial balance plus the following accounts: D. Guetta, Withdrawals (313); Marketing Fees (411); Salaries Expense (511); Utilities Expense (512); Rent Expense (514); and Advertising Expense (516).

- 2. Enter the August 31, 2014, account balances from the trial balance.

- 3. Enter the September transactions in the general journal (page 22).

- 4.

Post the journal entries to the ledger accounts. Be sure to make the appropriate posting references in the journal and ledger as you post. - 5. Prepare a trial balance as of September 30, 2014.

- 6. Business Application ▶ Examine the transactions for September 3, 10, 19, and 29. What were the revenues, and how much cash was received from the revenues? What business issues might you see arising from the differences in these numbers?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Principles Of Accounting

- Which of the following is an intangible asset? A) InventoryB) CopyrightC) EquipmentD) Accounts Receivablearrow_forwardWhat does a ledger account represent? A) A detailed record of all business transactionsB) A summary of trial balancesC) An individual record for each accountD) The final balance of a financial statement Need help!arrow_forwardWhat is the primary purpose of accounting? A) To generate tax revenueB) To record, summarize, and report financial transactionsC) To determine the market value of assetsD) To manage payrollarrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning