Financial Accounting, 8th Edition

8th Edition

ISBN: 9780078025556

Author: Robert Libby, Patricia Libby, Daniel Short

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 5E

Determining Financial Statement Effects of Several Transactions

Nike. Inc., with headquarters in Beaverton. Oregon, is one of the world’s leading manufacturers of athletic shoes and sports apparel. The following activities occurred during a recent year. The amounts are rounded to millions.

- a. Purchased additional buildings for $172 and equipment for $270: paid $432 in cash and signed a longterm note for the rest.

- b. Issued 100 shares of $2 par value common stock for $345 cash.

- c. Declared $145 in dividends to be paid in the following year.

- d. Purchased additional short-term investments for $7,616 cash.

- e. Several Nike investors sold their own stock to other investors on the stock exchange for $84.

- f. Sold $4,313 in short-term investments for $4,313 in cash.

Required:

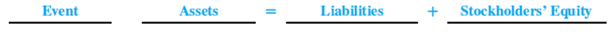

- 1. For each of the events (a) through (f). perform transaction analysis and indicate the account, amount, and direction of the effect on the

accounting equation . Check that the accounting equation remains in balance after each transaction. Use the following headings:

- 2. Explain your response to event (e).

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

1) Identify whethere the company is paying out dividends based on the attached statement.

2) Describe in detail how that the company’s dividend payouts have changed over the past five years.

3)Describe in detail the changes in “total equity” (representing the current “book value” of the company).

Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyneed help

Which is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiencyno ai

Chapter 2 Solutions

Financial Accounting, 8th Edition

Ch. 2 - Prob. 1QCh. 2 - Define the following: a. Asset b. Current asset c....Ch. 2 - Prob. 3QCh. 2 - Why are accounting assumptions necessary?Ch. 2 - For accounting purposes, what is an account?...Ch. 2 - What is the fundamental accounting model?Ch. 2 - Prob. 7QCh. 2 - Explain what debit and credit mean.Ch. 2 - Prob. 9QCh. 2 - Prob. 10Q

Ch. 2 - Prob. 11QCh. 2 - Prob. 12QCh. 2 - How is the current ratio computed and interpreted?Ch. 2 - Prob. 14QCh. 2 - Prob. 1MCQCh. 2 - Which of the following is not an asset? a....Ch. 2 - Total liabilities on a balance sheet at the end of...Ch. 2 - The dual effects concept can best be described as...Ch. 2 - The T-account is a tool commonly used for...Ch. 2 - Prob. 6MCQCh. 2 - The Cash T-account has a beginning balance of...Ch. 2 - Prob. 8MCQCh. 2 - At the end of a recent year, The Gap, Inc.,...Ch. 2 - Prob. 10MCQCh. 2 - Prob. 1MECh. 2 - Matching Definitions with Terms Match each...Ch. 2 - Identifying Events as Accounting Transactions...Ch. 2 - Classifying Accounts on a Balance Sheet The...Ch. 2 - Prob. 5MECh. 2 - Prob. 6MECh. 2 - Prob. 7MECh. 2 - Prob. 8MECh. 2 - Prob. 9MECh. 2 - Prob. 10MECh. 2 - Prob. 11MECh. 2 - Prob. 12MECh. 2 - Prob. 13MECh. 2 - Prob. 1ECh. 2 - Prob. 2ECh. 2 - Prob. 3ECh. 2 - Prob. 4ECh. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Prob. 6ECh. 2 - Prob. 7ECh. 2 - Analyzing the Effects of Transactions In...Ch. 2 - Prob. 9ECh. 2 - Prob. 10ECh. 2 - Prob. 11ECh. 2 - Prob. 12ECh. 2 - Prob. 13ECh. 2 - Prob. 14ECh. 2 - Prob. 15ECh. 2 - Prob. 16ECh. 2 - Inferring Typical Investing and Financing...Ch. 2 - Prob. 18ECh. 2 - Prob. 19ECh. 2 - Prob. 20ECh. 2 - Identifying Accounts on a Classified Balance Sheet...Ch. 2 - Prob. 2PCh. 2 - Prob. 3PCh. 2 - Prob. 4PCh. 2 - Prob. 5PCh. 2 - Prob. 6PCh. 2 - Prob. 1APCh. 2 - Prob. 2APCh. 2 - Prob. 3APCh. 2 - Prob. 4APCh. 2 - Prob. 1CPCh. 2 - Prob. 2CPCh. 2 - Prob. 3CPCh. 2 - Prob. 4CPCh. 2 - Prob. 5CPCh. 2 - Prob. 6CPCh. 2 - Prob. 7CPCh. 2 - Prob. 8CPCh. 2 - Prob. 1CC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardWhich is not an objective of internal controls?A. Safeguard assetsB. Improve profitsC. Ensure accurate recordsD. Promote operational efficiency no aiarrow_forwardPlease provide the accurate answer to this financial accounting problem using appropriate methods.arrow_forward

- Please provide the correct answer to this financial accounting problem using valid calculations.arrow_forward20 Nelson and Murdock, a law firm, sells $8,000,000 of four-year, 8% bonds priced to yield 6.6%. The bonds are dated January 1, 2026, but due to some regulatory hurdles are not issued until March 1, 2026. Interest is payable on January 1 and July 1 each year. The bonds sell for $8,388,175 plus accrued interest. In mid-June, Nelson and Murdock earns an unusually large fee of $11,000,000 for one of its cases. They use part of the proceeds to buy back the bonds in the open market on July 1, 2026 after the interest payment has been made. Nelson and Murdock pays a total of $8,456,234 to reacquire the bonds and retires them. Required1. The issuance of the bonds—assume that Nelson and Murdock has adopted a policy of crediting interest expense for the accrued interest on the date of sale.2. Payment of interest and related amortization on July 1, 2026.3. Reacquisition and retirement of the bonds.arrow_forward13 Which of the following is correct about the difference between basic earnings per share (EPS) and diluted earnings per share? Question 13 options: Basic EPS uses comprehensive income in its calculation, whereas diluted EPS does not. Basic EPS is not a required disclosure, whereas diluted EPS is required disclosure. Basic EPS uses total common shares outstanding, whereas diluted EPS uses the weighted-average number of common shares. Basic EPS is not adjusted for the potential dilutive effects of complex financial structures, whereas diluted EPS is adjusted.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY