a.

Evaluate the amount of

a.

Answer to Problem 58E

The amount of goodwill implied in the acquisition of the subsidiary is

Explanation of Solution

An acquisition is when one company acquires most or all of the shares of another company to gain control over that company. Acquisition accounting is a set of formal directives defining how an acquired company's assets, liabilities, non-controlling interest (NCI) and goodwill must be recorded by the purchaser on its consolidated financial statement.

Goodwill is an intangible asset associated with one company being purchased from another. In particular, goodwill is the portion of the purchase price which is higher than the sum of the net fair value of all the assets purchased during the acquisition and the liabilities assumed during the acquisition process.

Price paid by the investor company to acquire its subsidiary company is $1,200,000.

On the date of acquisition, Property equipment is undervalued by $150,000 and Licenses are undervalued by $250,000.

Common stock of the subsidiary is

Additional paid-in capital is

Calculate book value of identifiable net assets (BVINA) of the subsidiary:

Calculate the fair value of the identifiable net assets (FVINA) for the subsidiary:

Calculate goodwill:

Hence, the amount of goodwill is

b.

Prepare the required journal entries to apply pushdown accounting for the subsidiary.

b.

Explanation of Solution

Push down accounting is a mechanism of bookkeeping which businesses use when buying out another company. Accounting base of the acquirer is used to prepare the purchased entity's financial statements. In this method, the target company's assets and liabilities are updated to reflect buying costs, rather than historical costs.

Topic 805 requires an "acquirer" to establish a new accounting basis in its books for acquired assets and assumed liabilities when it acquires control of a business in business combinations. The acquiree subsequently adopts the basis of the newly established acquirer to report its own assets and liabilities in its independent finances.

The required journal entriesfor the subsidiary to apply pushdown accountingare as follows:

| Date | Account title and Explanation | Post Ref | Debit ($) | Credit ($) |

| Property & Equipment, net | ||||

| Licenses | ||||

| Goodwill | ||||

| Pushdown equity | ||||

| (To record the effects of AAP on the |

Table (1)

| Date | Account title and Explanation | Post Ref | Debit ($) | Credit ($) |

| Retained earnings | ||||

| Pushdown equity | ||||

| (Entry required to eliminate retained earnings and establish pushdown-type contributed capital) |

Table (2)

Working Notes:

On the date of acquisition, Property equipment is undervalued by $150,000 and Licenses are undervalued by $250,000.

Goodwill is calculated in above part(a) is $200,000.

On date of acquisition, contributed capital of subsidiary is

Retained earnings of the subsidiary are $300,000.

c.

Prepare the consolidation entries on the date of acquisition.

c.

Explanation of Solution

Consolidated financial statements are a group of entities financial statements that are presented as those of a single economic entity. They are the financial statements of a group in which the parent company and its subsidiaries introduce their assets, liabilities, equity, revenue, expenses and

Consolidated accounting is used to club a parent company's financial information and one or more subsidiaries. The parent prepares consolidated financial statements through

The required consolidation

| Date | Account title and Explanation | Post Ref | Debit ($) | Credit ($) |

| [E] Common stock | ||||

| APIC | ||||

| Pushdown equityc | ||||

| Equity investment | ||||

| (To eliminate the |

Table (3)

Working Notes:

Common stock of subsidiary is

On date of acquisition, contributed capital of subsidiary is

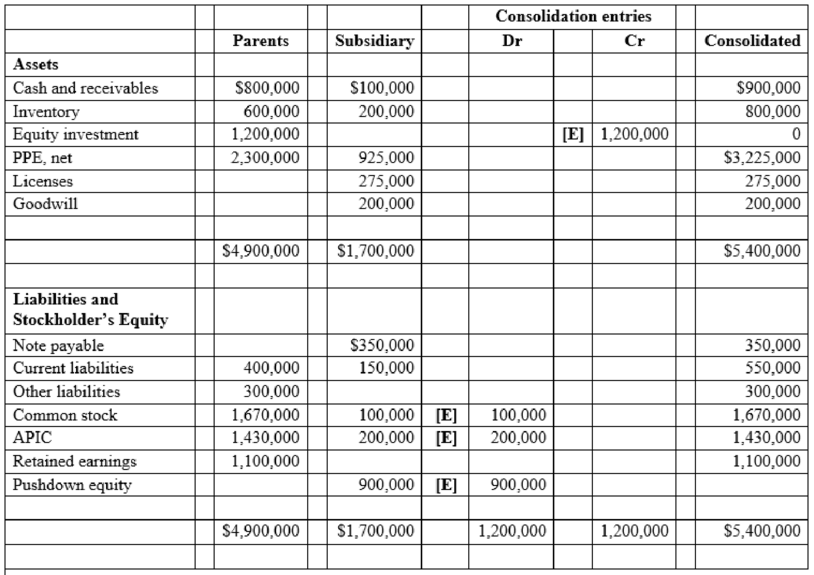

d.

Prepare the consolidated

d.

Explanation of Solution

Consolidated financial statements are a group of entities financial statements that are presented as those of a single economic entity. They are the financial statements of a group in which the parent company and its subsidiaries introduce their assets, liabilities, equity, revenue, expenses and cash flows as those of a single business organization.

A consolidated balance sheet provides a parent company’s assets and liabilities and all of its subsidiaries in a legal document, without any differentiation on which items pertain to which companies.

The consolidated balance sheet on the date of acquisition is shown below:

Table (4)

Want to see more full solutions like this?

Chapter 2 Solutions

ADVANCED ACCOUNTING

- Cher Industries has total material costs of $56,200, and total conversion costs are $74,600. The equivalent units of production are materials 18,250 and conversion costs 22,150. Compute the unit costs for materials and conversion costs.arrow_forwardHello expertarrow_forwardHow much are equivalent unit for materials if the FIFO method is used?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education