Concept explainers

Recording Manufacturing Costs and Analyzing Manufacturing

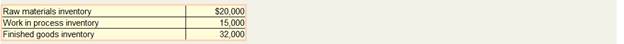

Christopher's Custom Cabinet Company uses a job order cost system with overhead applied as a percentage of direct labor costs. Inventory balance at the beginning of 2016 follow:

The following transactions occurred during January:

a. Purchased materials on account for $26,000.

b. Issued materials to production totaling $40,000, 80 percent of which was traced to specific jobs and the remainder of which was treated as indirect materials.

c. Payroll costs totaling $69,700 were recorded as follows:

$18,000 for assembly workers

5,200 for factory supervision

31,000 for administrative personnel

15,500 for sales commissions

d. Recorded

e. Recorded $4,000 of expired insurance. Forty percent was insurance on the manufacturing facility, with the remainder classified as an administrative expense.

f. Paid $7,800 in other

g. Applied manufacturing overhead at a rate of 300 percent of direct labor cost.

h. Completed all jobs but one; the

$3,000 for direct labor, and $9,000 for applied overhead. i. Solid jobs costing $70,000. The revenue earned on these jobs was $91,000.

Required:

Determine the amount of over- or underapplied overhead.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

MANAGERIAL ACCOUNTING W/CONNECT

- I am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

- Please provide the answer to this general accounting question using the right approach.arrow_forwardPlease provide the answer to this general accounting question with proper steps.arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forward

- Current Attempt in Progress The following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1. 2. Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3. 4. 5. 6. In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining…arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,