Concept explainers

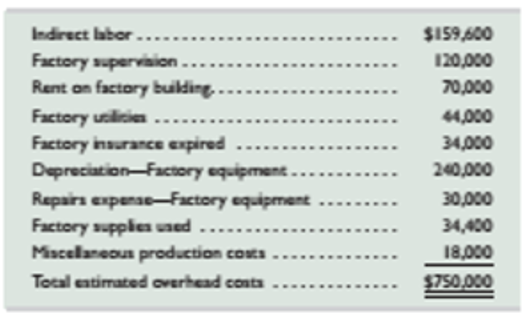

In December 2014, Pavelka Company’s manager established next year’s total direct labor cost assuming 50 persons working an average pf 2,000 hours each at an average wage rate of $15 per hour. The manager also estimated the following

At the end of 2015, records show the company incurred $725,000 of actual overhead costs. It completed and sold five jobs with the following direct labor costs: Job 625, $354,000; Job 626, $330,000; Job 627, $175,000; Job 628, $420,000; and Job 629, $184,000. In addition, Job 630 is in process at end of 2015 and had been charged $10,000 for direct labor. No jobs were in process at the end of 2014. The company’s predetermined overhead rate is based on direct labor cost.

Required

- Determine the following.

- Predetermined overhead rate for 2015.

- Total overhead cost applied to each of the six jobs during 2015.

- Over – or underapplied overhead at year- end 2015.

- Assuming that any over-or underapplied overhead is not material, prepare the

adjusting entry to allocate any over-or underapplied overhead to Cost of Goods Sold at the end of year 2015.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

MANAGERIAL ACCOUNTING FUND. W/CONNECT

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardMontu Consultants Corporation obtained a building, its surrounding land, and a computer system in a lump-sum purchase for $375,000. An appraisal set the value of the land at $184,500, the building at $144,000, and the computer system at $121,500. At what amount should Montu Consultants record each new asset on its books?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- I am trying to find the accurate solution to this financial accounting problem with the correct explanation.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardI am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forward

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardI am searching for a clear explanation of this financial accounting problem with valid methods.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forward

- Donna Steakhouse, a high-end restaurant, began its operations in 2018. Its fixed assets had a book value of $1,250,000 in 2019. The restaurant did not purchase any fixed assets in 2019. The annual depreciation expense on fixed assets was $125,000, and the accumulated depreciation account had a balance of $250,000 on December 31, 2019. What was the original cost of fixed assets owned by the restaurant in 2018 when it started its operations?arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forwardSamantha Sullivan's monthly pay stub indicates that her monthly gross income is $5,800. However, $1,250 is withheld for income and Social Security taxes, $320 is withheld for her health and dental insurance, and another $350 is contributed to her retirement plan. How much is Samantha's disposable income?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning