Glenn’s Cleaning Services Company is experiencing

Glenn made the following adjustments to these statements before showing them to his friend. He recorded $82,000 of revenue on account from Barrymore Manufacturing Company for a contract to clean its headquarters office building that was still being negotiated for the next month. Barrymore had scheduled a meeting to sign a contract the following week, so Glenn was sure that he would get the job. Barrymore was a reputable company, and Glenn was confident that he could ultimately collect the $82,000. Also, he subtracted $30,000 of accrued salaries expense and the corresponding liability. He reasoned that since he had not paid the employees, he had not incurred any expense.

Required

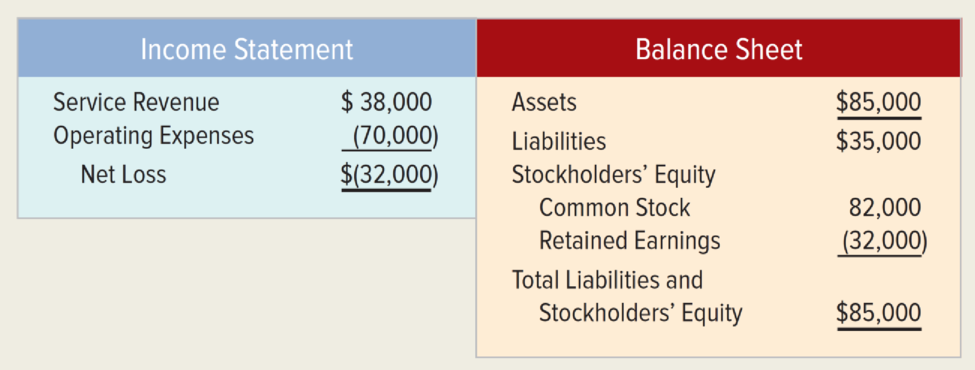

a. Reconstruct the income statement and

b. Write a brief memo explaining how Glenn’s treatment of the expected revenue from Barrymore violated the revenue recognition concept.

c. Write a brief memo explaining how Glenn’s treatment of the accrued salaries expense violates the matching concept.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Survey Of Accounting

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning