45AP

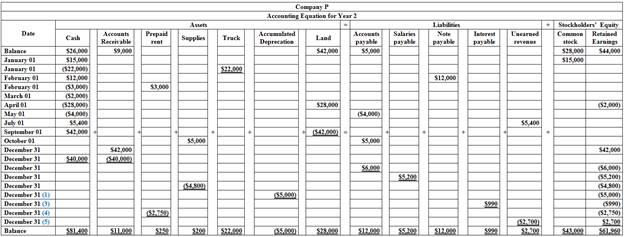

Prepare the transactions in general ledger accounts under the

45AP

Explanation of Solution

Prepare general ledger accounts under the accounting equation as given below:

Table (1)

Working Note:

Determine the amount of

Determine the amount of total interest payable.

Determine the amount of interest payable on note that would be recognized.

Determine the amount of prepaid rent to be recognized.

Determine the amount of recognized revenue.

a.

Identify the four additional adjustments and explain them.

a.

Explanation of Solution

The four additional adjustments are as follows:

- 1. Company P has acquired a truck on January 01 for that acquired truck depreciation expense.

- 2. On February 01, Company P issued note payable. Accrued interest expense on note payable should be recognized using

adjusting entry. - 3. On February 01, Company P paid rent in advance. Rent paid in advance should be recognized as rent expense for 11 months using adjusting entry.

- 4. On July 01, Company P received cash in advance. Unearned revenue should be recognized as revenue for 6 months using adjusting entry.

b.

Identify the amount of interest expense that would be reported on the income statement.

b.

Explanation of Solution

The amount of interest expense would be reported on the income statement is $990 (3).

c.

Identify the amount of net cash flow from operating activities that would be reported on the statement of

c.

Explanation of Solution

The net cash flow from operating activities would be reported on the statement of cash flows amounts to $38,400 (6).

Determine the amount of net cash flow from operating activities.

d.

Identify the amount of rent expense that would be reported on the income statement.

d.

Explanation of Solution

The amount of rent expense that would be reported on the income statement is $2,750 (4).

e.

Identify the amount of total liabilities that would be reported on the

e.

Explanation of Solution

The amount of total liabilities would be reported on the balance sheet $32,890

f.

Identify the amount of supplies expense that would be reported on the balance sheet.

f.

Explanation of Solution

The amount of supplies expense that would be reported on the income statement is $4,800

g.

Identify the amount of unearned revenue that would be reported on the balance sheet.

g.

Explanation of Solution

The amount of unearned revenue that would be reported on the balance sheet is $2,700 (5).

h.

Identify the amount of net cash flow from investing activities that would be reported on the statement of cash flows.

h.

Explanation of Solution

The net cash flow from investing activities that would be reported on the statement of cash flows is ($8,000) (7).

Determine the amount of net cash flow from investing activities.

i.

Identify the amount of interest payable that would be reported on the balance sheet.

i.

Explanation of Solution

The amount of interest payable that would be reported on the balance sheet is $990 (3).

j.

Identify the amount of total expense that would be reported on the income statement.

j.

Explanation of Solution

The amount of total expense that would be reported on the income statement is $24,740

k.

Identify the amount of

k.

Explanation of Solution

The retained earnings that would be reported on the balance sheet amounts to $62,460 (8).

Determine the amount of retained earnings.

l.

Identify the amount of service revenue that would be reported on the income statement.

l.

Explanation of Solution

The amount of service revenue that would be reported on the income statement is $44,700

m.

Identify the amount of net cash flow from financing activities that would be reported on the statement of cash flows.

m.

Explanation of Solution

The net cash flow from financing activities that would be reported on the statement of cash flows is $25,000 (9).

Determine the amount of net cash flow from financing activities.

n.

Identify the amount of net income that would be reported on the income statement.

n.

Explanation of Solution

The net income that would be reported on the income statement is $19,960

Want to see more full solutions like this?

Chapter 2 Solutions

Fundamental Financial Accounting Concepts

- I need help solving this general accounting question with the proper methodology.arrow_forwardPlease provide the correct answer to this financial accounting problem using accurate calculations.arrow_forwardRidgeway Manufacturing has sales of 2,500 units at $80 a unit. Variable expenses are 40% of the selling price. If total fixed expenses are $72,000, what is the degree of operating leverage?arrow_forward

- Can you demonstrate the accurate method for solving this financial accounting question?arrow_forwardProvide answerarrow_forwardParkview Industries collected $275,000 from customers in 2018. Of the amount collected, $135,000 was from services performed in 2017. In addition, Parkview performed services worth $192,000 in 2018, which will not be collected until 2019. Parkview Industries also paid $218,000 for expenses in 2018. Of the amount paid, $168,000 was for expenses incurred on account in 2017. In addition, Parkview incurred $187,000 of expenses in 2018, which will not be paid until 2019. Compute 2018 cash-basis net income. Helparrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education