FUND.ACCT.PRIN.-CONNECT ACCESS

25th Edition

ISBN: 9781260780185

Author: Wild

Publisher: MCG

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 3AA

Key comparative figures for Apple, Google, and Samsung follow

Required

- Compute Samsung's debt ratio for the current year and prior year.

- Is Samsung on a trend toward increased or decreased financial leverage? 3. Looking at the current-year debt ratio, is Samsung a more risky or less risky investment than (a) Apple and (b) Google?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

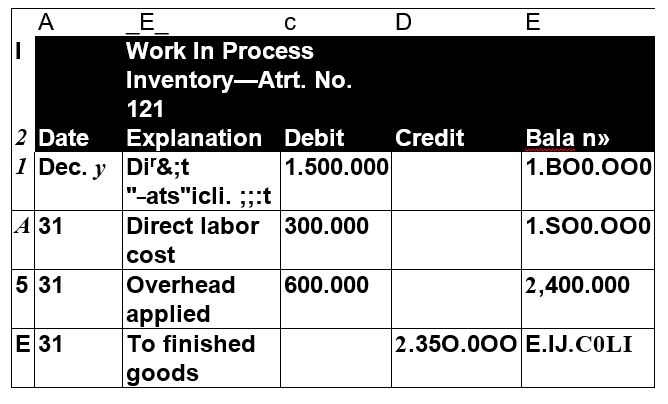

Use this information to determine the dollar amount of the FY 2023 Beginning work in process inventory.

Help

What should be Trilon Manufacturing predetermined overhead rate for October ?

Chapter 2 Solutions

FUND.ACCT.PRIN.-CONNECT ACCESS

Ch. 2 - Identifying source documents C1 Identify the items...Ch. 2 - Identifying financial statement accounts C2...Ch. 2 - Reading a chart of accounts C3 A chart of accounts...Ch. 2 - Identifying normal balance C4 Identify the normal...Ch. 2 - QS 2–5

Linking debit or credit with normal...Ch. 2 - Prob. 6QSCh. 2 - Prob. 7QSCh. 2 - Prob. 8QSCh. 2 - Prob. 9QSCh. 2 - Prob. 10QS

Ch. 2 - Prob. 11QSCh. 2 - Prob. 12QSCh. 2 - Prob. 13QSCh. 2 - Prob. 14QSCh. 2 - Prob. 15QSCh. 2 - Prob. 16QSCh. 2 - Prob. 17QSCh. 2 - Prob. 18QSCh. 2 - Prob. 19QSCh. 2 - Exercise 21 Steps in analyzing and recording...Ch. 2 - Prob. 2ECh. 2 - Prob. 3ECh. 2 - Exercise 2-3 Identifying a ledger and chart of...Ch. 2 - Prob. 5ECh. 2 - Prob. 6ECh. 2 - Prob. 7ECh. 2 - Prob. 8ECh. 2 - Prob. 9ECh. 2 - Prob. 10ECh. 2 - Prob. 11ECh. 2 - Exercise 2-10 Preparing a trial balance P2 After...Ch. 2 - Prob. 13ECh. 2 - Prob. 14ECh. 2 - Prob. 15ECh. 2 - Prob. 16ECh. 2 - Prob. 17ECh. 2 - Prob. 18ECh. 2 - Prob. 19ECh. 2 - Prob. 20ECh. 2 - Prob. 21ECh. 2 - Prob. 22ECh. 2 - Prob. 23ECh. 2 - Prob. 24ECh. 2 - Prob. 25ECh. 2 - Prob. 26ECh. 2 - Prob. 27ECh. 2 - Prob. 28ECh. 2 - Prob. 29ECh. 2 - Prob. 1PSACh. 2 - Prob. 2PSACh. 2 - Prob. 3PSACh. 2 - Prob. 4PSACh. 2 - Prob. 5PSACh. 2 - Prob. 6PSACh. 2 - Prob. 7PSACh. 2 - Prob. 1PSBCh. 2 - Prob. 2PSBCh. 2 - Prob. 3PSBCh. 2 - Prob. 4PSBCh. 2 - Problem 2-5B Computing net income from equity...Ch. 2 - Prob. 6PSBCh. 2 - Problem 2-7B Preparing an income statement,...Ch. 2 - SP 2 On October 1, 2019, Santana Rey launched a...Ch. 2 - Using transactions from the following assignments...Ch. 2 - Prob. 2GLPCh. 2 - Prob. 3GLPCh. 2 - Prob. 4GLPCh. 2 - Prob. 5GLPCh. 2 - Prob. 6GLPCh. 2 - Prob. 7GLPCh. 2 - Prob. 8GLPCh. 2 - Refer to Apple's financial statements in Appendix...Ch. 2 - Prob. 2AACh. 2 - Key comparative figures for Apple, Google, and...Ch. 2 - Prob. 1DQCh. 2 - What is the difference between a note payable and...Ch. 2 - Prob. 3DQCh. 2 - What kinds of transactions can be recorded in a...Ch. 2 - Are debits or credits typically listed first in...Ch. 2 - Should a transaction be recorded first in a...Ch. 2 - If assets are valuable resources asset accounts...Ch. 2 - Prob. 8DQCh. 2 - Prob. 9DQCh. 2 - Identify the four financial statements of a...Ch. 2 - Prob. 11DQCh. 2 - Prob. 12DQCh. 2 - Prob. 13DQCh. 2 - Prob. 14DQCh. 2 - Prob. 15DQCh. 2 - Prob. 1BTNCh. 2 - Prob. 2BTNCh. 2 - Prob. 3BTNCh. 2 - Prob. 4BTNCh. 2 - Prob. 5BTNCh. 2 - Prob. 6BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the accurate answer to this general accounting problem using appropriate methods.arrow_forwardgeneral accountingarrow_forwardJennifer Industries allocates overhead based on direct labor costs. Assume Jennifer expects to incur a total of $875,000 in overhead costs and $625,000 in direct labor costs. Actual overhead costs incurred totaled $890,000, and actual direct labor costs totaled $640,000. Jennifer's predetermined overhead rate is: a. 140.00% of direct labor cost. b. 128.13% of direct labor cost. c. 138.90% of direct labor cost. d. 130.95% of direct labor cost.arrow_forward

- Please provide the accurate solution to this financial accounting question using valid calculations.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

PFIN (with PFIN Online, 1 term (6 months) Printed...FinanceISBN:9781337117005Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

PFIN (with PFIN Online, 1 term (6 months) Printed...

Finance

ISBN:9781337117005

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Financial ratio analysis; Author: The Finance Storyteller;https://www.youtube.com/watch?v=MTq7HuvoGck;License: Standard Youtube License