SERIAL PROBLEM

Business Solutions P1 P2 P3

(This serial problem began in Chapter 1 and continues through most of the book. If previous chapter segments were not completed, the serial problem can begin at this point.)

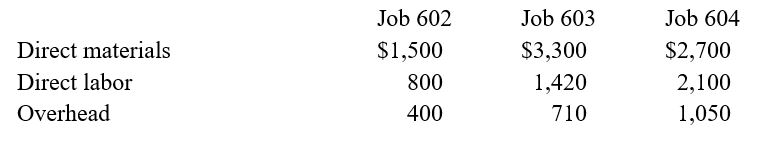

SP 15 The computer workstation furniture manufacturing that Santana Rey started Rey started in January is progressing well. As of the end of June, Business Solutions’s

Job 602 was started in production in May, and these costs were assigned to it in Ma: direct materials, $600; direct labor, $180; and

Required

1. What is the cost of the raw material used in June for each of the three jobs and in total?

Check (1) Total materials, $6,900

2. How much total direct labor cost is incurred in June?

3. What predetermined overhead rate is used in June?

(3) 50%

4. How much cost is transferred to Finished Goods Inventory in June?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

Managerial Accounting

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease provide the correct answer to this financial accounting problem using valid calculations.arrow_forwardPlease provide the solution to this general accounting question using proper accounting principles.arrow_forward

- Can you solve this financial accounting problem using appropriate financial principles?arrow_forwardI am looking for the correct answer to this financial accounting problem using valid accounting standards.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help solving this financial accounting question with the proper methodology.arrow_forwardPlease show me how to solve this financial accounting problem using valid calculation techniques.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education