Managerial Accounting

5th Edition

ISBN: 9781259176494

Author: John J Wild, Ken Shaw Accounting Professor

Publisher: MCGRAW-HILL HIGHER EDUCATION

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2PSA

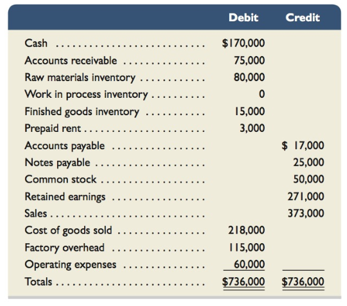

Bergamo Bay’s computer system generated the following

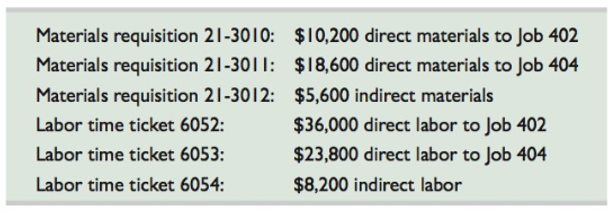

After examining various files, the manager identifies the following six source documents that need to be processed to bring the accounting records up to date.

Jobs 402 and 404 are the only units in process at year-end. The predetermined overhead rate is 200% of direct labor cost.

Required

- Use information on the six source documents to prepare

journal entries to assign the following costs. - Direct materials costs to Work in Process Inventory.

- Direct labor costs to Work in Process Inventory.

- Overhead cost to Work in Process Inventory.

- Indirect materials costs to the Factory Overhead account.

- Indirect labor costs to the Factory Overhead account.

- Determine the revised balance of the Factory Overhead account after making the entries in part 1. Determine whether there is any under- or overapplied overhead for the year. Prepare the

adjusting entry to allocate any over- or underapplied overhead to Cost of Goods Sold, assuming the amount is not material. - Prepare a revised trial balance.

- Prepare an income statement for 2015 and a

balance sheet of December 31, 2015.

Analysis Component

- Assume that the $5,600 on materials requisition 21-3012 should have been direct materials charged to Job 404. Without providing specific calculations, describe the impact of this error on the income statement for 2015 and the balance sheet at December 31, 2015.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

I need help solving this general accounting question with the proper methodology.

Managerial Accounting

Can you help me solve this general accounting problem with the correct methodology?

Chapter 2 Solutions

Managerial Accounting

Ch. 2 - Prob. 1MCQCh. 2 - A company uses direct labor costs to apply...Ch. 2 - Prob. 3MCQCh. 2 - Prob. 4MCQCh. 2 - Prob. 5MCQCh. 2 - Prob. 1DQCh. 2 - Prob. 2DQCh. 2 - Prob. 3DQCh. 2 - Prob. 4DQCh. 2 - Prob. 5DQ

Ch. 2 - Prob. 6DQCh. 2 - Prob. 7DQCh. 2 - What events cause debits to be recorded in the...Ch. 2 - GOOGLE Google applies overhead to product costs....Ch. 2 - Prob. 10DQCh. 2 -

11. Why must a company use predetermined...Ch. 2 - Prob. 12DQCh. 2 - Prob. 13DQCh. 2 - Prob. 14DQCh. 2 - Prob. 1QSCh. 2 - The left column lists the titles of documents and...Ch. 2 - Prob. 3QSCh. 2 - Prob. 4QSCh. 2 - Prob. 5QSCh. 2 - Prob. 6QSCh. 2 - Prob. 7QSCh. 2 - Prob. 8QSCh. 2 - Prob. 9QSCh. 2 - Prob. 10QSCh. 2 - Prob. 11QSCh. 2 - Prob. 12QSCh. 2 - Prob. 13QSCh. 2 - Prob. 14QSCh. 2 - Prob. 1ECh. 2 - Prob. 2ECh. 2 - Exercise 15-13 Analysis of cost flows C2

As of the...Ch. 2 - Prob. 4ECh. 2 - Prob. 5ECh. 2 - Prob. 6ECh. 2 - Exercise 15-7 Cost flows in a job order costing...Ch. 2 - Prob. 8ECh. 2 - Prob. 9ECh. 2 - Prob. 10ECh. 2 - Prob. 11ECh. 2 - Prob. 12ECh. 2 - Prob. 13ECh. 2 - In December 2014, Custom Mfg. established...Ch. 2 - In December 2014, Infodeo established its...Ch. 2 - Moonrise Bakery applies factory overhead based on...Ch. 2 - Prob. 17ECh. 2 - Prob. 18ECh. 2 - Prob. 19ECh. 2 - Prob. 1PSACh. 2 - Bergamo Bays computer system generated the...Ch. 2 - Widmer Watercrafts predetermined overhead rate for...Ch. 2 - Prob. 4PSACh. 2 - Prob. 5PSACh. 2 - Prob. 1PSBCh. 2 - Cavallo Mfg.s computer system generated the...Ch. 2 - Prob. 3PSBCh. 2 - In December 2014, Pavelka Companys manager...Ch. 2 - Prob. 5PSBCh. 2 - SERIAL PROBLEM Business Solutions P1 P2 P3 (This...Ch. 2 - Prob. 1GLPCh. 2 - Apples financial statements and notes in Appendix...Ch. 2 - Prob. 2BTNCh. 2 - Prob. 3BTNCh. 2 - COMMUNICATING IN PRACTICE C1 C2

BTN 15-4 Assume...Ch. 2 - Prob. 5BTNCh. 2 - Prob. 6BTNCh. 2 - Prob. 7BTNCh. 2 - Prob. 8BTNCh. 2 - Prob. 9BTN

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L

Pkg Acc Infor Systems MS VISIO CDFinanceISBN:9781133935940Author:Ulric J. GelinasPublisher:CENGAGE L Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College PubCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Pkg Acc Infor Systems MS VISIO CD

Finance

ISBN:9781133935940

Author:Ulric J. Gelinas

Publisher:CENGAGE L

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Accounting Changes and Error Analysis: Intermediate Accounting Chapter 22; Author: Finally Learn;https://www.youtube.com/watch?v=c2uQdN53MV4;License: Standard Youtube License