Fundamentals of Financial Accounting

5th Edition

ISBN: 9780078025914

Author: Fred Phillips Associate Professor, Robert Libby, Patricia Libby

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2.9E

Inferring Investing and Financing Transactions and Preparing a Balance Sheet

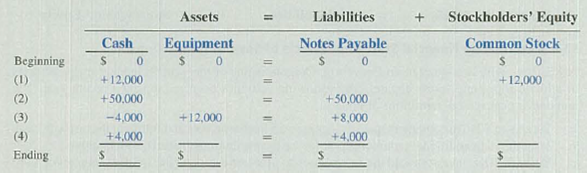

Home Comfort Furniture Company completed four transactions with the dollar effects indicated in the following schedule:

Required:

- 1. Write a brief explanation of transactions (1) through (4). Explain any assumptions that you made.

- 2. Compute the ending balance in each account.

- 3. Has most of the financing for Home Comfort’s investments in assets come from liabilities or stockholders’ equity?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

If total liabilities are $25,000 and owner’s equity is $15,000, total assets equal:A. $10,000B. $25,000C. $40,000D. $15,000

Don't use chatgpt

When a company pays rent in advance, it should record:A. Rent ExpenseB. Unearned Rent RevenueC. Prepaid Rent (Asset)D. Accrued Rent

No Chatgpt please

5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividend

Chapter 2 Solutions

Fundamentals of Financial Accounting

Ch. 2 - Define the following: a. Asset b. Current asset c....Ch. 2 - Define a transaction anti give an example of each...Ch. 2 - For accounting purposes, what is an account?...Ch. 2 - What is the basic accounting equation?Ch. 2 - Prob. 5QCh. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - What is a journal entry? What is the typical...Ch. 2 - What is a T-account? What is its purpose?Ch. 2 - Prob. 10Q

Ch. 2 - Prob. 11QCh. 2 - Which of the following is not an asset account? a....Ch. 2 - Which of the following statements describe...Ch. 2 - Total assets on a balance sheet prepared on any...Ch. 2 - The duality of effects can best be described as...Ch. 2 - The T-account is used to summarize which of the...Ch. 2 - Prob. 6MCCh. 2 - A company was recently formed with 50,000 cash...Ch. 2 - Which of the following statements would be...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 2.1MECh. 2 - Prob. 2.2MECh. 2 - Matching Terms with Definitions Match each term...Ch. 2 - Prob. 2.4MECh. 2 - Prob. 2.5MECh. 2 - Prob. 2.6MECh. 2 - Prob. 2.7MECh. 2 - Identifying Events as Accounting Transactions Half...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Preparing Journal Entries For each of the...Ch. 2 - Posting to T-Accounts For each of the transactions...Ch. 2 - Reporting a Classified Balance Sheet Given the...Ch. 2 - Prob. 2.13MECh. 2 - Prob. 2.14MECh. 2 - Identifying Transactions and Preparing Journal...Ch. 2 - Prob. 2.16MECh. 2 - Prob. 2.17MECh. 2 - Prob. 2.18MECh. 2 - Prob. 2.19MECh. 2 - Prob. 2.20MECh. 2 - Prob. 2.21MECh. 2 - Prob. 2.22MECh. 2 - Prob. 2.23MECh. 2 - Prob. 2.24MECh. 2 - Prob. 2.25MECh. 2 - Prob. 2.1ECh. 2 - Prob. 2.2ECh. 2 - Classifying Accounts and Their Usual Balances As...Ch. 2 - Determining Financial Statement Effects of Several...Ch. 2 - Prob. 2.5ECh. 2 - Recording Journal Entries Refer to E2-4. Required:...Ch. 2 - Prob. 2.7ECh. 2 - Analyzing the Effects of Transactions in...Ch. 2 - Inferring Investing and Financing Transactions and...Ch. 2 - Analyzing Accounting Equation Effects, Recording...Ch. 2 - Recording Journal Entries and Preparing a...Ch. 2 - Analyzing the Effects of Transactions Using...Ch. 2 - Explaining the Effects of Transactions on Balance...Ch. 2 - Prob. 2.14ECh. 2 - Prob. 2.15ECh. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Recording Transactions (in a Journal and...Ch. 2 - Determining Financial Statement Effects of Various...Ch. 2 - Prob. 2.2PBCh. 2 - Prob. 2.3PBCh. 2 - Prob. 2.1SDCCh. 2 - Prob. 2.2SDCCh. 2 - Prob. 2.4SDCCh. 2 - Prob. 2.5SDCCh. 2 - Accounting for the Establishment of a Business...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Don't use ai tool 4. A purchase of equipment for cash will:A. Increase assetsB. Decrease total assetsC. Have no effect on assetsD. Increase liabilitiesarrow_forwardNo AI tool 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forwardDon't use AI Which account is not closed at the end of the accounting period?A. RevenueB. ExpenseC. DividendsD. Suppliesarrow_forward

- No use chatgpt Which financial statement reports cash inflows and outflows?A. Balance SheetB. Statement of Cash FlowsC. Income StatementD. Statement of Retained Earningsarrow_forwardNo Chatgpt When a company collects cash from a customer in advance, it should:A. Recognize revenue immediatelyB. Record a liabilityC. Record it as equityD. Ignore it until revenue is earnedarrow_forwardPlease don't use ai 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forward

- Don't use ChatGPT! 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forwardNo chatgpt 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forwardNo chatgpt Which of the following transactions decreases stockholders' equity?A. Issuing sharesB. Paying dividendsC. Earning net incomeD. Receiving customer paymentsarrow_forward

- No chatgpt Which of the following is an adjusting entry?A. Payment of salariesB. Depreciation expenseC. Purchase of suppliesD. Payment of rent in advancearrow_forwardNo chatgpt Which financial statement reports cash inflows and outflows?A. Balance SheetB. Statement of Cash FlowsC. Income StatementD. Statement of Retained Earningsarrow_forwardNo chatgpt 2. When a company collects cash from a customer in advance, it should:A. Recognize revenue immediatelyB. Record a liabilityC. Record it as equityD. Ignore it until revenue is earnedarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License