a.

To determine: The

a.

Answer to Problem 28PS

The present value at the end of each year is $12.50 billion.

Explanation of Solution

Determine the present value at the end of each year

Therefore the present value at the end of each year is $12.50 billion.

b.

To determine: The present value at the end of first year if the growth rate is 4%.

b.

Answer to Problem 28PS

The present value at the end of first year if the growth rate is 4% is $25 billion.

Explanation of Solution

Determine the present value at the end of first year if the growth rate is 4%

Therefore the present value at the end of first year if the growth rate is 4% is $25 billion.

c.

To determine: The present value at the end of 20 years.

c.

Answer to Problem 28PS

The present value at the end of 20 years is $9.82 billion.

Explanation of Solution

Determine the present value at the end of 20 years

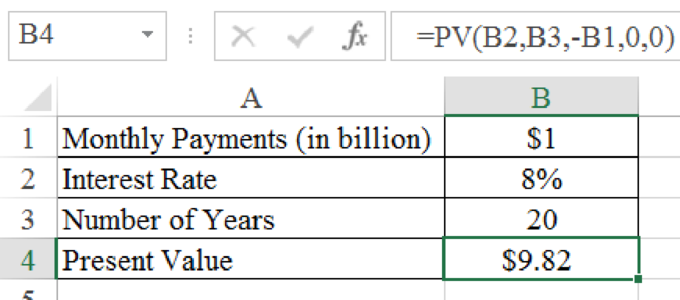

Excel Spreadsheet:

Therefore the present value at the end of 20 years is $9.82 billion.

d.

To determine: The present value if spread evenly for 20 years.

d.

Answer to Problem 28PS

The present value if spread evenly for 20 years is $10.20 billion.

Explanation of Solution

Determine the continuous compounded rate

Therefore the continuous compounded rate is 7.70%.

Determine the present value if spread evenly for 20 years

Therefore the present value if spread evenly for 20 years is $10.20 billion.

Want to see more full solutions like this?

Chapter 2 Solutions

EBK PRINCIPLES OF CORPORATE FINANCE

- 4. A company has $100,000 in assets and $50,000 in liabilities. What is its equity? Need a helpful..???arrow_forward4. A company has a debt-to-equity ratio of 1:2. If debt is $200,000, what is equity?arrow_forward9. If a company's current ratio is 2 and its current liabilities are $50,000, what are its current assets?no chatgpt???arrow_forward

- 5. Calculate the return on equity (ROE) for a company with net income $150,000 and equity $750,000.arrow_forward6. What is the price of a bond with face value $1,000, coupon rate 8%, and market interest rate 10%?arrow_forward9. A company has fixed costs $50,000, variable costs $10/unit, and sells products at $20/unit. What is the break-even point?arrow_forward

- 8. Calculate the weighted average cost of capital (WACC) for a company with 60% equity (cost 12%) and 40% debt (cost 8%). no gpt ..???arrow_forward8. Calculate the weighted average cost of capital (WACC) for a company with 60% equity (cost 12%) and 40% debt (cost 8%). Need a helpful..??arrow_forward3. If a company's net income is $100,000 and it has 10,000 shares outstanding, what is the earnings per share (EPS)? Correctly answer..???arrow_forward

- 10. If a stock's dividend yield is 5% and stock price is $100, what is the annual dividend payment? no gpt..???arrow_forward8. A stock has a beta of 1.2 and the market return is 10%. If the risk-free rate is 2%, what is the expected return? need a ai ..???arrow_forwardA corporation buys on terms of 2/8, net 45 days, it does not take discountes, and it actually pays after 62 days, what is the effective annual percentage cost of its non-free trade credit? Use a 365-day year) keep to the 6th decimal place for accuracyarrow_forward

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT