Exercise 2-27 Identifying transaction type and effect on the financial statements

Required

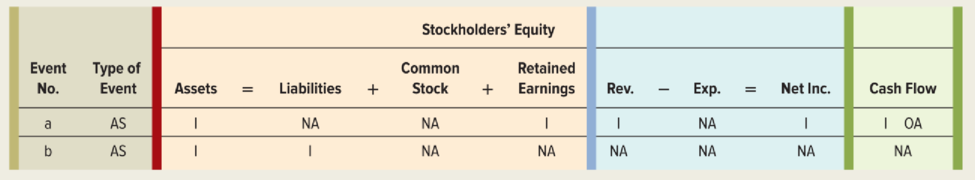

Identify whether each of the following transactions is an asset source (AS), asset use (AU), asset exchange (AE), or claims exchange (CE). Also show the effects of the events on the financial statements using the horizontal statements model. Indicate whether the event increases (I), decreases (D), or does not affect (NA) each element of the financial statements. In the

a. Provided services and collected cash.

b. Purchased supplies on account to be used in the future.

c. Paid cash in advance for one year’s rent.

d. Paid cash to purchase land.

e. Paid a cash dividend to the stockholders.

f. Received cash from the issue of common stock.

g. Paid cash on accounts payable.

h. Collected cash from

i. Received cash advance for services to be provided in the future.

j. Incurred other operating expenses on account.

k. Performed services on account.

l. Adjusted books to reflect the amount of prepaid rent expired during the period.

m. Paid cash for operating expenses.

n. Adjusted the books to record the supplies used during the period.

o. Recorded accrued salaries.

p. Paid cash for salaries accrued at the end of a prior period.

q. Recorded accrued interest revenue earned at the end of the accounting period.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

SURVEY OF ACCOUNTING(LL)>CUSTOM PKG.<

- I am looking for the most effective method for solving this financial accounting problem.arrow_forwardI am looking for a reliable way to solve this financial accounting problem using accurate principles.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- What is the cost of goods manufacturedarrow_forwardSullivan Manufacturing uses direct labor hours in its predetermined overhead rate.arrow_forwardA company purchased equipment for $85,000 on January 1, 2024. The equipment has an estimated useful life of 8 years and a salvage value of $5,000. Calculate the annual depreciation expense using the straight-line method.arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning

Auditing: A Risk Based-Approach (MindTap Course L...AccountingISBN:9781337619455Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:Cengage Learning