Managerial Accounting (5th Edition)

5th Edition

ISBN: 9780134067254

Author: Braun

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2.52SC

Calculate operating income (Learning Objective 5)

This case is a continuation of the Caesars Entertainment Corporation serial case that began in Chapter 1 Refer to the introductory story in Chapter 1 for additional background. (The components of the Caesars serial case can be completed in any order.)

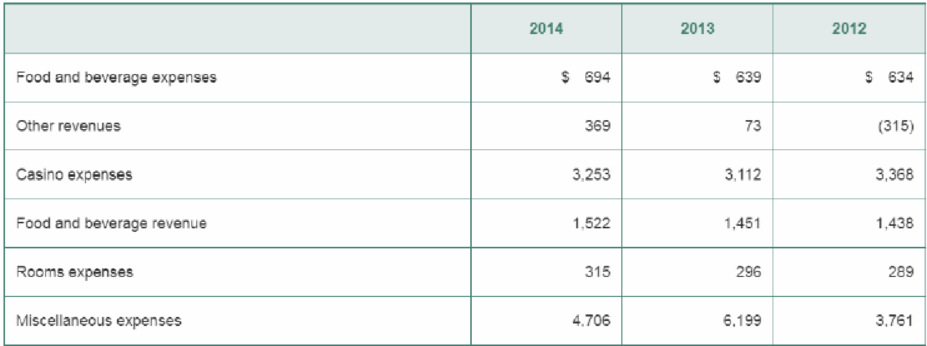

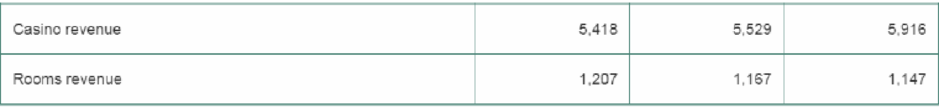

What follows is a table listing condensed revenue and expense figures for Caesars Entertainment Corporation for the years ending December 31, 2012 through 2014.

Requirements

- 1. Using the data provided, construct income statements for each of the three years; include the proper headings.

- 2. Did Caesars’s operating income increase or decrease over the three-year period presented?

- 3. Which division, Food and Beverage, Casino, Rooms, or Other generated the most revenue for Caesars in 2014? Which division generated the most operating income in 2014?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Could you explain the steps for solving this financial accounting question accurately?

Provide correct solution with accounting question

Inventory Valuation

If a company uses the FIFO method of inventory valuation and has the following purchases:

100 units at $10 each

150 units at $12 eachWhat is the value of inventory if 120 units are sold?need

Chapter 2 Solutions

Managerial Accounting (5th Edition)

Ch. 2 - (Learning Objective 1) Which of the following...Ch. 2 - (Learning Objective 2) Which of the following is...Ch. 2 - (Learning Objective 3) A cost that can be traced...Ch. 2 - (Learning Objective 4) Period costs are often...Ch. 2 - (Learning Objective 4) Conversion costs consist of...Ch. 2 - (Learning Objective 4) Which of the following is...Ch. 2 - Prob. 7QCCh. 2 - (Learning Objective 5) Which of the following...Ch. 2 - Prob. 9QCCh. 2 - Prob. 10QC

Ch. 2 - Short Exercises S2-1 Identify types of companies...Ch. 2 - Identify type of company from balance sheets...Ch. 2 - Classify costs by value chain function (Learning...Ch. 2 - Classify costs as direct or indirect (Learning...Ch. 2 - Prime costs Cost objects Product costs Assigned...Ch. 2 - Prob. 2.6SECh. 2 - Classify product costs and period costs (Learning...Ch. 2 - Classify a manufacturers costs (Learning Objective...Ch. 2 - Classify costs incurred by a dairy processing...Ch. 2 - Determine total manufacturing overhead (Learning...Ch. 2 - Prepare a retailers income statement (Learning...Ch. 2 - Compute Cost of Goods Sold for a merchandiser...Ch. 2 - Calculate direct materials used (Learning...Ch. 2 - Compute Cost of Goods Manufactured (Learning...Ch. 2 - Describe other cost terms (Learning Objectives 6...Ch. 2 - Classify costs as fixed or variable (Learning...Ch. 2 - Prob. 2.17SECh. 2 - Classify costs along the value chain for a...Ch. 2 - Classify costs along the value chain for a...Ch. 2 - Value chain and sustainability efforts (Learning...Ch. 2 - Prob. 2.21AECh. 2 - Construct an income statement using product and...Ch. 2 - Work backward to find missing amounts (Learning...Ch. 2 - Prepare a retailers income statement (Learning...Ch. 2 - Compute direct materials used and Cost of Goods...Ch. 2 - Compute Cost of Goods Manufactured and Cost of...Ch. 2 - Continues E2-26A: Prepare income statement...Ch. 2 - Determine whether information is relevant...Ch. 2 - Prob. 2.29AECh. 2 - Classify costs along the value chain for a...Ch. 2 - Classify costs along the value chain for a...Ch. 2 - Value chain and sustainability efforts (Learning...Ch. 2 - Classify and calculate a manufacturers costs...Ch. 2 - Construct an income statement using product and...Ch. 2 - Work backward to find missing amounts (Learning...Ch. 2 - Prob. 2.36BECh. 2 - Compute direct materials used and Cost of Goods...Ch. 2 - Compute Cost of Goods Manufactured and Cost of...Ch. 2 - Continues E2-38B: Prepare income statement...Ch. 2 - Determine whether information is relevant...Ch. 2 - Prob. 2.41BECh. 2 - Classify costs along the value chain (Learning...Ch. 2 - Determine ending inventory balances (Learning...Ch. 2 - Prepare income statements (Learning Objective 5)...Ch. 2 - Prob. 2.45APCh. 2 - Prob. 2.46APCh. 2 - Classify costs along the value chain (Learning...Ch. 2 - Determine ending inventory balances (Learning...Ch. 2 - Prepare income statements (Learning Objective 5)...Ch. 2 - Prob. 2.50BPCh. 2 - Prob. 2.51BPCh. 2 - Calculate operating income (Learning Objective 5)...Ch. 2 - Prob. 2.53ACT

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please explain the solution to this general accounting problem with accurate principles.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forwardInventory Valuation If a company uses the FIFO method of inventory valuation and has the following purchases: 100 units at $10 each 150 units at $12 eachWhat is the value of inventory if 120 units are sold?arrow_forward

- Accounting for Loans A company takes out a loan of $50,000 with a 5% annual interest rate. What is the journal entry to record the loan?arrow_forwardNet Income Calculation A company has the following financial information for the year: Revenue: $100,000 Cost of Goods Sold: $60,000 Operating Expenses: $20,000What is the company's net income?needarrow_forwardI need assistance with accounting questionarrow_forward

- Financial accounting questionarrow_forwardCan you help me solve this general accounting problem using the correct accounting process?arrow_forwardNet Income Calculation A company has the following financial information for the year: Revenue: $100,000 Cost of Goods Sold: $60,000 Operating Expenses: $20,000What is the company's net income?arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniquesarrow_forwardIf a company has current assets of $80,000 and current liabilities of $50,000, what is its working capital? Needarrow_forwardIf a company has current assets of $80,000 and current liabilities of $50,000, what is its working capital?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Survey of Accounting (Accounting I)

Accounting

ISBN:9781305961883

Author:Carl Warren

Publisher:Cengage Learning

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License