Accounting

27th Edition

ISBN: 9780357155899

Author: Carl S. Warren; James M. Reeve; Jonathan Duchac

Publisher: Cengage Learning US

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2.4EX

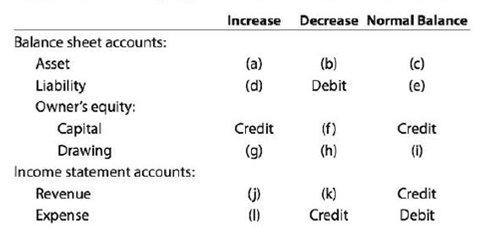

Rules of debit and credit

The following table summarizes the rules of debit and credit. For each of the items (a) through (1), indicate whether the proper answer is a debit or a credit.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Can you help me with of this question general accounting

What is the correct option? General accounting question

provide correct answer general accounting question

Chapter 2 Solutions

Accounting

Ch. 2 - What is the difference between an account and a...Ch. 2 - Prob. 2DQCh. 2 - Prob. 3DQCh. 2 - eCatalog Services Company performed services in...Ch. 2 - If the two totals of a trial balance are equal,...Ch. 2 - Assume that a trial balance is prepared with an...Ch. 2 - Assume that when a purchase of supplies of 2,650...Ch. 2 - Assume that Muscular Consulting erroneously...Ch. 2 - Assume that Sunshine Realty Co. borrowed 300,000...Ch. 2 - Checking accounts are a common form of deposits...

Ch. 2 - Rules of debit and credit and normal balances...Ch. 2 - Rules of debit and credit and normal balances...Ch. 2 - Journal entry for asset purchase Prepare a journal...Ch. 2 - Journal entry for asset purchase Prepare a journal...Ch. 2 - Journal entry for fees earned Prepare a journal...Ch. 2 - Journal entry for fees earned Prepare a journal...Ch. 2 - Journal entry for owner's withdrawal Prepare a...Ch. 2 - Journal entry for owner's withdrawal Prepare a...Ch. 2 - Prob. 2.5APECh. 2 - Missing amount from an account On August 1, the...Ch. 2 - Trial balance errors For each of the following...Ch. 2 - Trial balance errors For each of the following...Ch. 2 - Correcting entries The following errors took place...Ch. 2 - Correcting entries The following errors took place...Ch. 2 - Horizontal analysis Two income statements for...Ch. 2 - Horizontal analysis Two income statements for...Ch. 2 - Chart of accounts The following accounts appeared...Ch. 2 - Chart of accounts Oak Interiors is owned and...Ch. 2 - Chart of accounts Outdoor Leadership School is a...Ch. 2 - Rules of debit and credit The following table...Ch. 2 - Normal entries for accounts During the month,...Ch. 2 - Normal balances of accounts Identify each of the...Ch. 2 - Transactions Concrete Consulting Co. has the...Ch. 2 - Journalizing and posting On September 18, 2019,...Ch. 2 - Transactions and T accounts The following selected...Ch. 2 - Prob. 2.10EXCh. 2 - Account balances a.During February, 186,500 was...Ch. 2 - Capital account balance As of January 1, Terrace...Ch. 2 - Identifying transactions National Park Tours Co....Ch. 2 - Journal entries Based upon the T accounts in...Ch. 2 - Trial balance Based upon the data presented in...Ch. 2 - Trial balance The accounts in the ledger of...Ch. 2 - Effect of errors on trial balance Indicate which...Ch. 2 - Errors in trial balance The following preliminary...Ch. 2 - Effect of errors on trial balance The following...Ch. 2 - Errors in trial balance Identify the errors in the...Ch. 2 - Entries to correct errors The following errors...Ch. 2 - Entries to correct errors The following errors...Ch. 2 - Prob. 2.23EXCh. 2 - Prob. 2.24EXCh. 2 - Entries into T accounts and trial balance Connie...Ch. 2 - Journal entries and trial balance On January 1,...Ch. 2 - Journal entries and trial balance On June 1, 2019,...Ch. 2 - Journal entries and trial balance Elite Realty...Ch. 2 - Corrected trial balance The Colby Group has the...Ch. 2 - Entries into T accounts and trial balance Ken...Ch. 2 - Journal entries and trial balance On August 1,...Ch. 2 - Journal entries and trial balance On October 1,...Ch. 2 - Journal entries and trial balance Valley Realty...Ch. 2 - Corrected trial balance Tech Support Services has...Ch. 2 - The transactions completed by PS Music during June...Ch. 2 - Prob. 2.1CPCh. 2 - Prob. 2.5CPCh. 2 - Prob. 2.6CPCh. 2 - Prob. 2.7CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Khayyam Company, which sells tents, has provided the following information: Sales price per unit Variable cost per unit $40 19 $12,800 Fixed costs per month What are the required sales in units for Khayyam to break even? (Round your answer up to the nearest whole unit.) OA. 217 units B. 674 units OC. 610 units D. 320 unitsarrow_forwardPlease need help with this accounting question answer do fastarrow_forwardJingle Ltd. and Bell Ltd. belong to the same industry. A snapshot ofsome of their financial information is given below: Jingle Ltd. Bell Ltd. Current Ratio 3.2 : 1 2 : 1 Acid - Test Ratio 1.7 : 1 1.1 : 1 Debt-Equity Ratio 30% 40% Times Interest earned 6 5 You are a loans officer and both companies have asked for an equal2-year loan. i) If you could facilitate only one loan, which company wouldyou refuse? Explain your reasoning brieflyii) If both companies could be facilitated, would you be willingto do so? Explain your argument briefly.arrow_forward

- Determine the total fixed costs of these accounting questionarrow_forwardPerreth Drycleaners has capacity to clean up to 5,000 garments per month. Requirements 1. Complete the schedule below for the three volumes shown. 2. Why does the average cost per garment change? 3. Suppose the owner, Dale Perreth, erroneously uses the average cost per unit at full capacity to predict total costs at a volume of 2,000 garments. Would he overestimate or underestimate his total costs? By how much? Requirement 1. Complete the following schedule for the three volumes shown. (Round all unit costs to the nearest cent and all total costs to the nearest whole dollar.) Total variable costs Total fixed costs Total operating costs Variable cost per garment Fixed cost per garment 2,000 Garments 3,500 Garments 5,000 Garments $ 2,800 2.00 Average cost per garment Requirement 2. Why does the average cost per garment change? The average cost per garment changes as volume changes, due to the component of the dry cleaner's costs. The cost per unit decreases as volume , while the variable…arrow_forwardI need answer of this general accounting questionarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Understanding Credit; Author: UCBStudentAffairs;https://www.youtube.com/watch?v=EBdXREhOuME;License: Standard Youtube License