Concept explainers

Financial statements

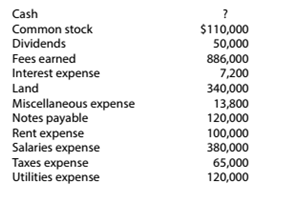

Padget Home Services began its operations on January 1, 20Y7 (see Problem 2-3). After its second year of operations, the following amounts were taken from the accounting records of Padget Home Services, Inc., as of December 31, 20Y8.

Instuctions

Prepare a

Balance sheet- It is a financial statement that records the company's assets, liabilities and stockholder's equity at a point in time. The balance sheet also known as statement of financial condition is expressed in the accounting equation as:

The balance sheet is prepared using accounting equation in vertical form. Also, the balance on assets side must be equal to sum of balances of liabilities and stockholder's equity.

To prepare the balance sheet of company P for the year ended December 31, 20Y8.

Answer to Problem 2.4.3P

The balance sheet of Company P reports total assets of $500000 is equal to the sum of total liabilities of $120000 and stockholder's equity of $380000.

Explanation of Solution

Computation of balance sheet of company P for the year ended December 31, 20Y8:

Computation of purchase of land during year ended December 31, 20Y8:

Computation of issue of notes payable during year ended December 31, 20Y8:

Computation of retained earnings balance for the year ended December 31, 20Y8:

Computation of issue of common stock during year ended December 31, 20Y8:

Computation of Cash balance of company P for the year ended December 31, 20Y8:

Computation of Net Income

Want to see more full solutions like this?

Chapter 2 Solutions

Bundle: Survey of Accounting, Loose-Leaf Version, 8th + CengageNOWv2, 1 term Printed Access Card

Additional Business Textbook Solutions

Marketing: An Introduction (13th Edition)

Horngren's Accounting (12th Edition)

Fundamentals of Management (10th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Intermediate Accounting (2nd Edition)

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardI am trying to find the accurate solution to this financial accounting problem with appropriate explanations.arrow_forward

- I need help finding the correct solution to this financial accounting problem with valid methods.arrow_forwardCan you help me solve this general accounting problem with the correct methodology?arrow_forwardI need help with this financial accounting problem using proper accounting guidelines.arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardWhen incorporating his sole proprietorship, Joe transfers all of its assets and liabilities. Included in the $30,000 of liabilities assumed by the corporation is $500 that relates to a personal expenditure. Under these circumstances, the entire $30,000 will be treated as boot. / Provide explanation please a. True b. Falsearrow_forward

- In determining whether § 357(c) applies, assess whether the liabilities involved exceed the bases of all assets a shareholder transfers to the corporation./ Provide explanation please. a. True b. Falsearrow_forwardI will unhelpful if wrong.arrow_forwardplease don't solve using wrong values i will mark as unhelpful.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning