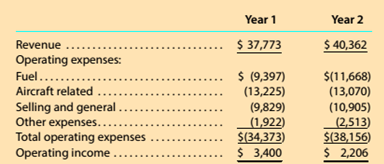

MBA 2-3 Common-sized income statements Delta Air Lines. Inc. (DAL) provides cargo and passenger services throughout the world. The following operating data (in millions) were adapted from recent financial statements of Delta.

Prepare common-sized income statements for Years 1 and 2. Round to one decimal place.

Using your answer to (1), analyze and comment on the performance of Delta in Year 2.

Trending nowThis is a popular solution!

Chapter 2 Solutions

Survey of Accounting - With CengageNOW 1Term

Additional Business Textbook Solutions

Essentials of MIS (13th Edition)

Foundations of Financial Management

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Financial Accounting, Student Value Edition (5th Edition)

Engineering Economy (17th Edition)

Business Essentials (12th Edition) (What's New in Intro to Business)

- Compute the number of days sales in account receivable.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardA business purchased a machine for $120,000 with an estimated useful life of 8 years and salvage value of $24,000. What is the annual straight-line depreciation amount?arrow_forward

- I am searching for the most suitable approach to this financial accounting problem with valid standards.arrow_forwardI need help with this financial accounting problem using proper accounting guidelines.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

- Need helparrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forwardRoxbury Designs applies manufacturing overhead costs to products at a budgeted indirect-cost rate of $75 per direct manufacturing labor hour. A client has requested a bid on a special order for a customized necklace. Estimates for this order include: Direct materials of $63,500, 380 direct manufacturing labor hours at $22 per hour, and a 35% markup rate on total manufacturing costs. What is the bid price for this special order?arrow_forward

- I need help with this general accounting question using the proper accounting approach.arrow_forwardLiam Corp. purchased 12,000 shares of Horizon Ltd.'s stock for $320,000 on August 15, 2014, classified as available for sale. Market value decreased to $195,000 by December 31, 2014. Liam reclassified this as trading securities in November 2015 when market value increased to $275,000. What effect on 2015 income should Liam report for Horizon Ltd. shares?arrow_forwardI am looking for the correct answer to this financial accounting question with appropriate explanations.arrow_forward

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning