Concept explainers

Equity-Method income Statement

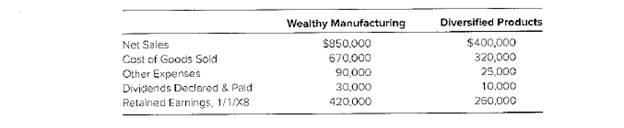

Wealthy Manufacturing Company purchased 40 percent of the voting shares of Diversified Products Corporation on March 23, 20X4. On December 31, 20X8,Wealthy Manufacturing’s controller attempted to prepare income statements and

Wealthy manufacturing uses the equity method in accounting for its investment in Diversified

Products. The controller was also aware of the following specific transactions for Diversified Products in 20X8, which were not included in the preceding data:

1. Diversified sold its entire Health Technologies division on September 30, 20X8, for $375.000.The book value of Health Technologies division’s net assets on that date was $331,000. Thedivision incurred an operating loss of $15,000 in the first nine months of 20X8.

2. During 20X8,Diversified sold one of its delivery trucks after it was involved in an accidentand recorded a gain of $10,000.

Required

a. Prepare an income statement and retained earnings statement for Diversified Products for 20X8.

b. Prepare an income statement and retained earnings statement for Wealthy Manufacturing for 20X8.

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

ADVANCED FINANCIAL ACCT.(LL) >CUSTOM<

- I need the correct answer to this financial accounting problem using the standard accounting approach.arrow_forwardWhich of the following is included in the basic accounting equation? A) Assets = Liabilities + EquityB) Assets = Revenue - ExpensesC) Liabilities = Assets + EquityD) Assets = Expenses + Liabilitiesarrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

- Please provide the solution to this financial accounting question with accurate financial calculations.arrow_forwardIf a company purchases equipment for $10,000 with a useful life of 5 years and no residual value, what is the annual depreciation using the straight-line method?no aiarrow_forwardI am trying to find the accurate solution to this financial accounting problem with the correct explanation.arrow_forward

- If a company purchases equipment for $10,000 with a useful life of 5 years and no residual value, what is the annual depreciation using the straight-line method?need helparrow_forwardGeneral Accounting 5.6arrow_forwardIf a company purchases equipment for $10,000 with a useful life of 5 years and no residual value, what is the annual depreciation using the straight-line method?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning