Horngren's Financial & Managerial Accounting Plus Mylab Accounting With Pearson Etext -- Access Card Package (5th Edition) (miller-nobles Et Al., The Horngren Accounting Series)

5th Edition

ISBN: 9780134077345

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

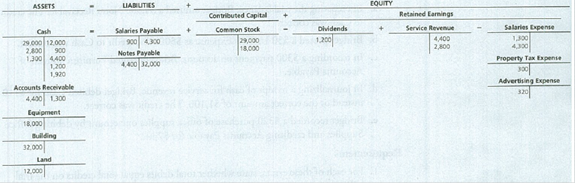

Chapter 2, Problem 2.23E

Preparing a

The T-accounts of Morris Farm Equipment Repair follow as of May 31, 2016.

Prepare Morris Farm Equipment Repair’s trial balance as of May 31, 2016.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

provide correct answer general accounting question

What is the operating income using absorption costing ?

Please solve this accounting problem not use ai and chatgpt

Chapter 2 Solutions

Horngren's Financial & Managerial Accounting Plus Mylab Accounting With Pearson Etext -- Access Card Package (5th Edition) (miller-nobles Et Al., The Horngren Accounting Series)

Ch. 2 - The detailed record of the changes in a particular...Ch. 2 - Which of the following accounts is a liability? a....Ch. 2 - The left side of an account is used to record...Ch. 2 - Which of the following statements is correct? a....Ch. 2 - Prob. 5QCCh. 2 - Prob. 6QCCh. 2 - Posting a 2,500 purchase of office supplies on...Ch. 2 - Prob. 8QCCh. 2 - Which sequence correctly summarizes the accounting...Ch. 2 - Nathville Laundry reported assets of 800 and...

Ch. 2 - Identify the three categories of the accounting...Ch. 2 - What is the purpose of the chart of accounts?...Ch. 2 - What does a ledger show? Whats the difference...Ch. 2 - Prob. 4RQCh. 2 - Prob. 5RQCh. 2 - Prob. 6RQCh. 2 - When are credits increases? When are credits...Ch. 2 - Prob. 8RQCh. 2 - What are source documents? Provide examples of...Ch. 2 - Prob. 10RQCh. 2 - Explain the five steps in journalizing and posting...Ch. 2 - Prob. 12RQCh. 2 - Prob. 13RQCh. 2 - What is the purpose of the trial balance?Ch. 2 - Prob. 15RQCh. 2 - If total debits equal total credits on the trial...Ch. 2 - What is the calculation for the debt ratio?...Ch. 2 - Identifying accounts Consider the following...Ch. 2 - Identifying increases and decreases in accounts...Ch. 2 - Identifying normal balances For each account,...Ch. 2 - Prob. 2.4SECh. 2 - Journalizing transactions Arkansas Sales...Ch. 2 - Prob. 2.6SECh. 2 - Prob. 2.7SECh. 2 - Preparing a trial balance Henderson Floor...Ch. 2 - Calculating debt ratio Vacuum Magic Carpet Care...Ch. 2 - Using accounting vocabulary March the accounting...Ch. 2 - Creating a chart of accounts Raymond Autobody Shop...Ch. 2 - Identifying accounts, increases in accounts, and...Ch. 2 - Identifying increases and decreases in accounts...Ch. 2 - Identifying source documents For each transaction,...Ch. 2 - Analyzing and journalizing transactions As the...Ch. 2 - Use the following information to answer Exercises...Ch. 2 - Use the following information to answer Exercises...Ch. 2 - Use the following information to answer Exercises...Ch. 2 - Use the following information to answer Exercises...Ch. 2 - Analyzing transactions from T-accounts The first...Ch. 2 - Journalizing transactions from T-accounts In...Ch. 2 - Preparing a trial balance The accounts of Aker...Ch. 2 - Preparing a trial balance from T-accounts The...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Prob. 2.25ECh. 2 - Prob. 2.26ECh. 2 - Correcting errors in a trial balance The following...Ch. 2 - Prob. 2.28ECh. 2 - Problems Group A Journalizing transactions,...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Correcting errors in a trial balance The trial...Ch. 2 - Preparing financial statements from the trial...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Journalizing transactions, posting journal entries...Ch. 2 - Prob. 2.38BPCh. 2 - Prob. 2.39BPCh. 2 - Prob. 2.40BPCh. 2 - Journalizing transactions, posting to T-accounts,...Ch. 2 - Journalizing transactions, posting to T-accounts,...Ch. 2 - Your friend, Dean McChesney, requested that you...Ch. 2 - Prob. 2.1CTEICh. 2 - Roy Akins was the accounting manager at Zelco, a...Ch. 2 - Prob. 2.1CTFSCCh. 2 - In 35 words or fewer, explain the difference...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial Accountingarrow_forwardKhayyam Company, which sells tents, has provided the following information: Sales price per unit Variable cost per unit $40 19 $12,800 Fixed costs per month What are the required sales in units for Khayyam to break even? (Round your answer up to the nearest whole unit.) OA. 217 units B. 674 units OC. 610 units D. 320 unitsarrow_forwardPlease need help with this accounting question answer do fastarrow_forward

- Jingle Ltd. and Bell Ltd. belong to the same industry. A snapshot ofsome of their financial information is given below: Jingle Ltd. Bell Ltd. Current Ratio 3.2 : 1 2 : 1 Acid - Test Ratio 1.7 : 1 1.1 : 1 Debt-Equity Ratio 30% 40% Times Interest earned 6 5 You are a loans officer and both companies have asked for an equal2-year loan. i) If you could facilitate only one loan, which company wouldyou refuse? Explain your reasoning brieflyii) If both companies could be facilitated, would you be willingto do so? Explain your argument briefly.arrow_forwardDetermine the total fixed costs of these accounting questionarrow_forwardPerreth Drycleaners has capacity to clean up to 5,000 garments per month. Requirements 1. Complete the schedule below for the three volumes shown. 2. Why does the average cost per garment change? 3. Suppose the owner, Dale Perreth, erroneously uses the average cost per unit at full capacity to predict total costs at a volume of 2,000 garments. Would he overestimate or underestimate his total costs? By how much? Requirement 1. Complete the following schedule for the three volumes shown. (Round all unit costs to the nearest cent and all total costs to the nearest whole dollar.) Total variable costs Total fixed costs Total operating costs Variable cost per garment Fixed cost per garment 2,000 Garments 3,500 Garments 5,000 Garments $ 2,800 2.00 Average cost per garment Requirement 2. Why does the average cost per garment change? The average cost per garment changes as volume changes, due to the component of the dry cleaner's costs. The cost per unit decreases as volume , while the variable…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY