Concept explainers

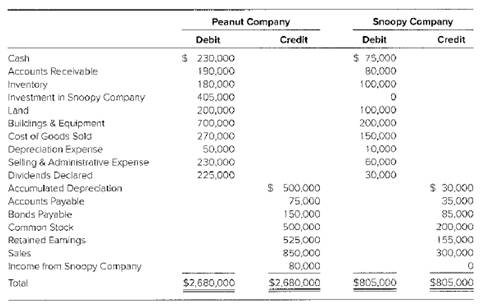

Consolidated Worksheet at End of the Second Year of Ownership (Equity Method)

Peanut Company acquired 100 percent of Snoopy Company’s outstanding common stock for

$300,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000.

Problem 2-21 summarizes the first year Peanut’s ownership of Snoopy. Peanut uses the equity method to account for investments. The following

Required

a. Prepare any equity-method

b. Prepare a consolidation worksheet for 20X9 in good form.

a.

Introduction

The consolidated balance sheet and the worksheets are the computed tools that are used to calculate the retained earnings and the dividend produced by the subsidiaries towards its parent company.

To prepare: A journal entry by equity method for the investment in S company for the year

Explanation of Solution

| Particular | Debit | Credit |

| Equity method entry on books | ||

| Investment in S co. | 300,000 | |

| Cash | 300,000 | |

| Record P co. share of the S co. income | ||

| Investment in S | 80,000 | |

| Income from S | 80,000 | |

| (To record P share in S income ) | ||

| Income from S | ||

| Investment in the S co. | ||

| Record P co. share in S co. Dividend | ||

| Total |

b.

Introduction

The consolidated balance sheet and the worksheets are the computed tools that are used to calculate the retained earnings and the dividend produced by the subsidiaries towards its parent company.

To prepare: the consolidated worksheet for the final values

Answer to Problem 2.22P

The consolidated worksheet is prepared and discussed.

Explanation of Solution

| Book value calculation | |||||

| Total book value | = | Common stock | + | Retained earnings | |

| Book value | |||||

| Net income | |||||

| Dividend | |||||

| Ending book value |

| Income statement | P | S | Dr. | Cr. | consolidated |

| Sales | |||||

| Less Cogs | |||||

| Depreciation Exp | |||||

| Sel. Exp | |||||

| Income from S | |||||

| Net income | |||||

| Statement of Retain Earning | P | S | Dr. | Cr. | Consolidated |

| Opening balance | |||||

| Net income | |||||

| Less dividend declared | |||||

| End balance |

| Income statement | P co | S co | Eliminated DR | Eliminated CR | consolidated |

| Cash | |||||

| Accounts received | |||||

| Inventory | |||||

| Investment in scissor co | |||||

| Land | |||||

| Building and equipment | |||||

| Less accumulated depreciation | |||||

| Total assets | |||||

| Account payable | |||||

| Bonds | |||||

| Common stocks | |||||

| Retained earnings | |||||

| Total liabilities |

Want to see more full solutions like this?

Chapter 2 Solutions

ADVANCED FINANCIAL ACCOUNTING-ACCESS

- I am searching for the correct answer to this financial accounting problem with proper accounting rules.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forwardI am searching for a clear explanation of this financial accounting problem with valid methods.arrow_forward

- I need help with this general accounting question using the proper accounting approach.arrow_forwardDonna Steakhouse, a high-end restaurant, began its operations in 2018. Its fixed assets had a book value of $1,250,000 in 2019. The restaurant did not purchase any fixed assets in 2019. The annual depreciation expense on fixed assets was $125,000, and the accumulated depreciation account had a balance of $250,000 on December 31, 2019. What was the original cost of fixed assets owned by the restaurant in 2018 when it started its operations?arrow_forwardI need help with this general accounting question using standard accounting techniques.arrow_forward

- Samantha Sullivan's monthly pay stub indicates that her monthly gross income is $5,800. However, $1,250 is withheld for income and Social Security taxes, $320 is withheld for her health and dental insurance, and another $350 is contributed to her retirement plan. How much is Samantha's disposable income?arrow_forwardWhat would the materials purchase price variance be?arrow_forwardNexus Manufacturing uses a single raw material in its production process. The standard price for a unit of material is $1.95. During the month, the company purchased and used 680 units of this material at a price of $2.15 per unit. The standard quantity required per finished product is 2 units, and during the month, the company produced 320 finished units. How much was the material quantity variance? A. $45 favorable B. $50 unfavorable C. $63 favorable D. $78 unfavorable. Helparrow_forward

- Please explain the correct approach for solving this general accounting question.arrow_forwardBianca Industries has an accounts receivable turnover of 12 and annual credit sales of $3,600,000. What is the average collection period? A) 32.75 days B) 30.42 days C) 28.33 days D) 35.17 daysarrow_forwardWhat must have been the total sales?arrow_forward