Concept explainers

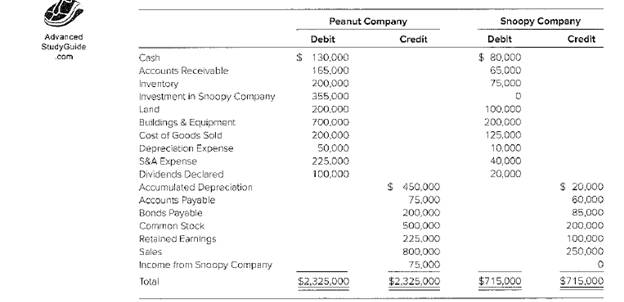

Consolidated Worksheet at End of the First Year of Ownership (Equity Method)

Peanut Company acquired 100 percent of Snoopy Company’s outstanding common stock for

$300,000 on January 1, 20X8, when the book value of Snoopy’s net assets was equal to $300,000.

Peanut uses the equity method to account for investments.

Required

a. Prepare the

b. Prepare a consolidation worksheet for 20X8 in good form.

a.

Introduction:

The consolidated balance sheet and the worksheets are the computed tools that are used to calculate the retained earnings and the dividend produced by the subsidiaries towards its parent company.

To prepare: A journal entry by equity method for the investment in S company in the year

Answer to Problem 2.21P

The journal entry so passed gives a debit of investment and credit the cash with the same amount.

Explanation of Solution

| Particular | Debit | Credit |

| Equity method entry on books | ||

| Investment in S co. | ||

| Cash | ||

| (Record P co. share of the S co. income) | ||

| Cash | ||

| Investment in the S co. | ||

| (Record P co. share in S co. dividend) | ||

| Investment in S | 75000 | |

| Income from S | 75000 | |

| (To record P share in S income ) |

b.

Concept introduction

The consolidated balance sheet and the worksheets are the computed tools that are used to calculate the retained earnings and the dividend produced by the subsidiaries towards its parent company.

To prepare: The consolidated worksheet for the final values

Explanation of Solution

| Book value calculation | |||||

| Total book value | = | Common stock | + | Retained earnings | |

| Book value | |||||

| Net income | |||||

| Dividend | |||||

| Ending book value |

| Income statement | P | S | Dr. | Cr. | consolidated |

| Sales | |||||

| Less Cogs | |||||

| Depreciation Exp | |||||

| Sel. Exp | |||||

| Income | |||||

| Net income |

| Statement of Retain Earning | P | S | Dr. | Cr. | Consolidated |

| Opening balance | |||||

| Net income | |||||

| Less dividend declared | |||||

| End balance |

| Income statement | P co | S co | Eliminated DR | Eliminated CR | consolidated |

| Cash | |||||

| Accounts received | |||||

| Inventory | |||||

| Investment in S co | |||||

| Land | |||||

| Building and equipment | |||||

| Less accumulated depreciation | |||||

| Total assets | |||||

| Account payable | |||||

| Bonds | |||||

| Common stocks | |||||

| Retained earnings | |||||

| Total liabilities |

Want to see more full solutions like this?

Chapter 2 Solutions

Advanced Financial Accounting

- Please provide the correct answer to this general accounting problem using accurate calculations.arrow_forwardPlease show me the correct way to solve this financial accounting problem with accurate methods.arrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

- Can you explain the process for solving this financial accounting problem using valid standards?arrow_forwardCan you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forward