1)a.

Whether the cost of instruction is fixed or variable cost

1)a.

Explanation of Solution

The cost of instruction is fixed cost as the total cost remains constant irrespectively of number of C Courses candidates attends the courses

b.

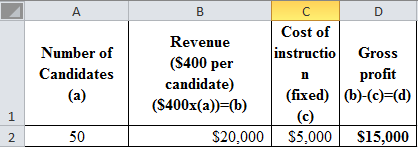

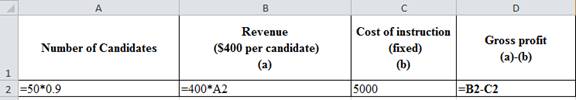

Determine the profit

b.

Explanation of Solution

Given information:

Number of candidates are 50. The salary of instructor is $5,000 per course taught. The review is charged for $400 per candidate.

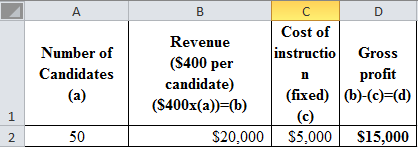

c.

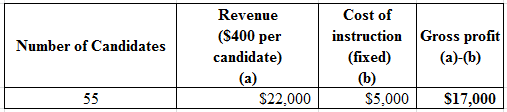

Determine the profit and 10% of increase in enrolment.

c.

Explanation of Solution

Given information:

Number of candidates are 55. The salary of instructor is $5,000 per course taught. The review is charged for $400 per candidate. Refer part a) for revenue calculation.

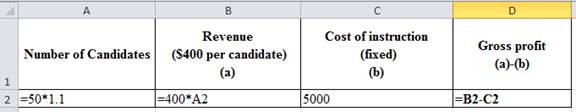

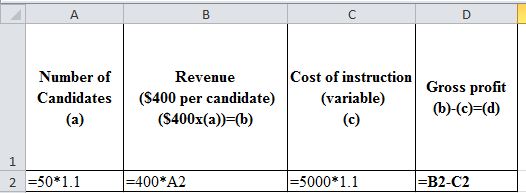

Excel spreadsheet:

Excel workings:

Percentage change in revenue and profitability:

Hence, the percentage change in profitability is 13.33%.

Percentage change in revenue:

Hence, the percentage change in profitability is 10%.

d.

Determine the profit and 10% of decrease in enrolment.

d.

Explanation of Solution

Given information:

Number of candidates are 45. The salary of instructor is $5,000 per course taught. The review is charged for $400 per candidate.

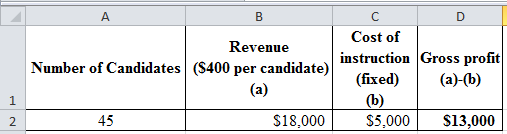

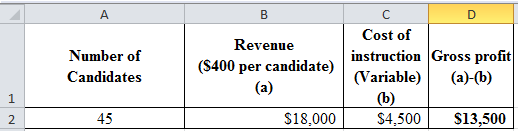

Excel spreadsheet:

Excel workings:

Percentage change in revenue and profitability:

Hence, the percentage change in profitability is 13.33%.

Hence, the percentage change in profitability is 13.33%.

e.

The reason for 10% shift in enrollment produces more than 10% shift in profitability and the term identifies this phenomenon.

e.

Explanation of Solution

The term which identifies these phenomena is operating leverage. This causes the percentage change in profitability to higher than the percentage change in revenue.

This is because that the fixed cost remains same and covered and there is no variable cost. So each additional dollar of revenue pays directly to the profitability.

2)f.

Whether the cost of instruction is fixed or variable cost

2)f.

Explanation of Solution

Given information:

The fee per candidate is $100.

The cost of instruction is variable cost as the total cost varies respectively of number of candidates attends the courses

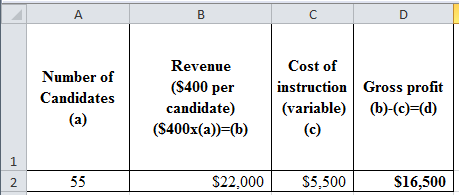

g.

Determine the profit

g.

Explanation of Solution

Given information:

Number of candidates are 50. The fee per candidate is $100. The review is charged for $400 per candidate.

h.

Determine the profit and 10% of increase in enrolment.

h.

Explanation of Solution

Given information:

Number of candidates are 55. The review is charged for $400 per candidate. Refer part a) for revenue calculation. The fee per candidate is $100

Excel spreadsheet:

Excel workings:

Percentage change in revenue and profitability:

Hence, the percentage change in profitability is 10%.

Hence, the percentage change in revenue is 10%.

i.

Determine the profit and 10% of decrease in enrolment.

i.

Explanation of Solution

Given information:

Number of candidates are 45. The review is charged for $400 per candidate. Refer part a) for revenue calculation. The fee per candidate is $100

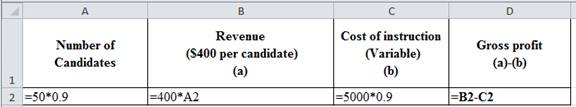

Excel spreadsheet:

Excel workings:

Percentage change in revenue:

Hence, the percentage change in profitability is 10%.

Hence, the percentage change in revenue is 10%.

j.

The reason for 10% shift in enrollment produces relative 10% shift in profitability.

j.

Explanation of Solution

The change in profit is relative to change in revenue because the revenue as well as cost changes relatively to the change in number of candidates attending the course.

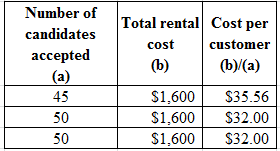

3)k.

The total cost and the cost per candidate

3)k.

Explanation of Solution

Given information:

The cost of the work book is $32 and selling price is $50. The numbers of candidates are 45, 50, or 55. The company printed 50 copies of books.

The formula to calculate the cost per candidate:

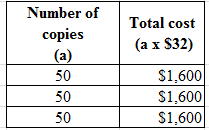

Compute the total cost:

Compute the cost per candidate:

l.

Whether the cost of work book is fixed or variable cost

l.

Explanation of Solution

The cost of work book is fixed cost as the cost incurred is before the sale of work book. Therefore, sales of number of work book will not affect the total cost.

Thus, it is fixed cost.

m.

The risk of holding inventory as it applies to workbooks

m.

Explanation of Solution

The risk faced by the company is that it produces very few or too many books. If the company produces too many books then the expenses will more due to wastage.

When the company produces less numbers then the will not get the opportunity to earn any additional profits.

It will also incur costs like maintenances, interest and storage.

n.

Whether just in time can reduce the cost and risk of holding inventory

n.

Explanation of Solution

JIT-Just in time produces only when there is any demand of goods. There will not be any risk on over or under production.

There will not be any stock piling of inventory as it will avoid the cost of storage, interest and maintenance

Want to see more full solutions like this?

Chapter 2 Solutions

Fundamental Managerial Accounting Concepts

- Calculate the gain or loss on the sale of equipmentarrow_forwardFennel Industries had 6,420 actual direct labor hours at an actual rate of $15.60 per hour. Original production had been budgeted for 950 units, but only 880 units were actually produced. Labor standards were 7.2 hours per completed unit at a standard rate of $16.10 per hour. What is the direct labor rate variance?arrow_forwardWhat is the bank costarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education