Concept explainers

Accounting for the Establishment of a Business

Nicole has decided that she is going to start her business. Nicole’s Getaway Spa (NGS). A lot has to be done when starting a new business. Here are some transactions that have occurred prior to April 30.

- a. Received 580,000 cash when issuing 8.000 new common shares.

- 1. h. Purchased land by paying $2,000 cash and signing a note payable for $7,000 due in three years.

- b. Hired a new aesthetician for a salary of $ l ,000 a month, starting next month,

- c. NGS purchased a company car for $18,000 cash (list price of $21,000) to assist in running errands for the business.

- d. Bought and received $1,000 in supplies for the spa on credit.

- e. Paid $350 of the amount owed in (e).

- f. Nicole sold 100 of her own personal shares to Raea Gooding for $300.

Required:

- 1. For each of the events, prepare

journal entries if a transaction exists, checking that debits equal credits. If a transaction does not exist, explain why there is no transaction. - 2. Assuming that the beginning balances in each of the accounts are zero, complete T-accounts to summarize the transactions (a)-(g).

- 3. Prepare a classified

balance sheet at April 30 using the information given in the transactions. - 4. Calculate the

current ratio at April 30. What does this ratio indicate about the ability of NGS to pay its current liabilities?

Requirement – 1

To record: The journal entries for given transactions.

Explanation of Solution

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and stockholders’ equities.

- Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

Journal entries of Company N are as follows:

a. Issuance of common stock:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Cash (+A) | 80,000 | |||

| Common stock (+SE) | 80,000 | |||

| (To record the issuance of common stock) |

Table (1)

- Cash is an assets account and it increased the value of asset by $80,000. Hence, debit the cash account for $80,000.

- Common stock is a component of stockholder’s equity and it increased the value of stockholder’s equity by $80,000. Hence, credit the common stock for $80,000.

b. Land purchased on account and in cash:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Land (+A) | 9,000 | |||

| Cash (-A) | 2,000 | |||

| Notes payable (+L) | 7,000 | |||

| (To record purchase of equipment on account and in cash) |

Table (2)

- Land is an assets account and it increased the value of asset by $9,000. Hence, debit the land account for $9,000.

- Cash is an assets account and it decreased the value of asset by $2,000. Hence, credit the cash account for $2,000.

- Notes payable is a liability account, and it increased the value of liabilities by $7,000. Hence, credit the notes payable for $7,000.

c. Hired a new aesthetician:

In this case, no entry required, because it is not a business transaction.

d. Equipment purchased in cash:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Equipment (+A) | 18,000 | |||

| Cash (-A) | 18,000 | |||

| (To record purchase of equipment and in cash) |

Table (3)

- Equipment is an assets account and it increased the value of asset by $18,000. Hence, debit the equipment account for $18,000.

- Cash is an assets account and it decreased the value of asset by $18,000. Hence, credit the cash account for $18,000.

e. Purchase of supplies on account:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Supplies (+A) | 1,000 | |||

| Accounts payable (+L) | 1,000 | |||

| (To record purchase of supplies on account) |

Table (4)

- Supplies are an assets account and it increased the value of asset by $1,000. Hence, debit the supplies account for $1,000.

- Accounts payable is a liability account and it increased the value of liability by $1,000. Hence, credit the liability account by $1,000.

f. Cash paid to creditors:

| Date | Accounts title and explanation | Ref. | Debit ($) | Credit ($) |

| Accounts payable (+A) | 350 | |||

| Cash (+L) | 350 | |||

| (To record cash paid to creditors) |

Table (5)

- Accounts payable is a liability account, and it decreased the value of liabilities by $350. Hence, debit the accounts payable for $350.

- Cash is an assets account and it decreased the value of asset by $350. Hence, credit the cash account for $350.

g. Stockholder sold their stock to another stockholder:

In this case, no entry required, because it is not a business transaction.

Requirement – 2

To prepare: T-account for each account listed in the requirement 1.

Explanation of Solution

T-account:

T-account refers to an individual account, where the increasesor decreases in the value of specific asset, liability, stockholder’s equity, revenue, and expenditure items are recorded.

This account is referred to as the T-account, because the alignment of the components of the account resembles the capital letter ‘T’.’ An account consists of the three main components which are as follows:

- (a) The title of the account

- (b) The left or debit side

- (c) The right or credit side

T-accounts of Company N are as follows:

| Cash (A) | |||

| Beg. | 0 | ||

| (a) | 80,000 | 2,000 | (b) |

| 18,000 | (d) | ||

| 350 | (f) | ||

| End. | 59,650 | ||

| Supplies (A) | |||

| Beg. | 0 | ||

| (e) | 1,000 | ||

| End. | 1,000 | ||

| Equipment (A) | |||

| Beg. | 0 | ||

| (c) | 18,000 | ||

| End. | 18,000 | ||

| Land (A) | |||

| Beg. | 0 | ||

| (b) | 9,000 | ||

| End. | 9,000 | ||

| Accounts payable (L) | |||

| 0 | Beg. | ||

| (f) | 350 | 1,000 | (e) |

| 650 | End. | ||

| Notes Payable (long-term) (L) | |||

| 0 | Beg. | ||

| 7,000 | (b) | ||

| 7,000 | End. | ||

| Common stock (SE) | |||

| 0 | Beg. | ||

| 80,000 | (a) | ||

| 80,000 | End. | ||

Requirement – 3

To prepare: The classified balance sheet of Company N at December 31, 2013.

Explanation of Solution

Classified balance sheet:

This is the financial statement of a company which shows the grouping of similar assets and liabilities under subheadings.

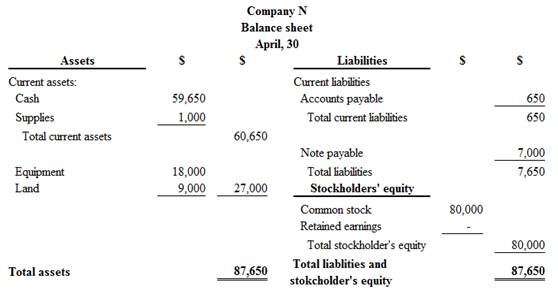

Classified balance sheet of Company N is as follows:

Figure (1)

Therefore, the total assets of Company N are$87,650 and the total liabilities and stockholders’ equity is$87,650.

Requirement – 4

To calculate: The current ratio of Company N and indicate the ability to repay the liabilities.

Explanation of Solution

Current Ratio:

A part of liquidity ratios, current ratio reflects the ability to oblige the short term debts of a company. It is calculated based on the current assets and current liabilities; a company has in an accounting period. A current ratio is a useful tool for analysis of financials of a company.

Calculate the current ratio of Company N as follows:

Here,

Current assets = $60,650

Current liabilities= $650

Therefore, the current ratio of Company N is 93.31.

Above calculation clearly shows Company N has better position to repay the liabilities.

Want to see more full solutions like this?

Chapter 2 Solutions

Connect 1 Semester Access Card for Fundamentals of Financial Accounting

- ook int rences View transaction list Journal entry worksheet 1 2 3 4 5 6 7 8 ..... 23 Sold services for $30,000 in cash and $20,000 on credit during the first week of January. Note: Enter debits before credits. Date January 07, 20X2 General Journal Debit Credit Record entry clear View general journalarrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forwardI am looking for help with this general accounting question using proper accounting standards.arrow_forward

- I need help solving this general accounting question with the proper methodology.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardI am looking for the correct answer to this general accounting problem using valid accounting standards.arrow_forward

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardI need guidance with this general accounting problem using the right accounting principles.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forward

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardPlease explain the correct approach for solving this general accounting question.arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning