EBK ADVANCED FINANCIAL ACCOUNTING

11th Edition

ISBN: 8220102796096

Author: Christensen

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 2, Problem 2.18P

Changes ¡n the Number of Shares Held

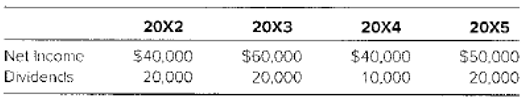

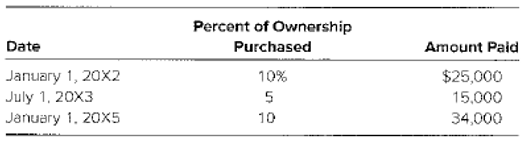

Idle Corporation hasbeen acquiring shares of Fast Track Enterprises at book value forthe last several years Fast Track provided data including the following:

Fast Track declares hind pays its annual dividend on November 1 5 each year. Its net book value on

January 1, 20X2, was $250,000. Idle purchased shares of Fast Track on three occasions:

Required

Give the journalentries to be recorded on Idle’s hooks in 20X5 related to its investment in FastTrack.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you solve this accounting problem using accurate calculation methods?

What will it be at the end of 2023?

I am looking for help with this financial accounting question using proper accounting standards.

Chapter 2 Solutions

EBK ADVANCED FINANCIAL ACCOUNTING

Ch. 2 - What types of investments in common stock normally...Ch. 2 - Prob. 2.2AQCh. 2 - When is equity method reporting considered...Ch. 2 - Prob. 2.4QCh. 2 - Prob. 2.5QCh. 2 - Prob. 2.6QCh. 2 - Prob. 2.7QCh. 2 - Prob. 2.8QCh. 2 - How does carrying securities at fair value...Ch. 2 - How does the fully adjusted equity method differ...

Ch. 2 - Prob. 2.11QCh. 2 - What is the modified equity method? When might a...Ch. 2 - Prob. 2.13AQCh. 2 - Prob. 2.14QCh. 2 - Prob. 2.15QCh. 2 - Prob. 2.16QCh. 2 - Prob. 2.17QCh. 2 - How are a subsidiary’s dividend declarations...Ch. 2 - Prob. 2.19QCh. 2 - Give a definition of consolidated retained...Ch. 2 - Prob. 2.21QCh. 2 - Prob. 2.22QCh. 2 - Choice of Accounting Method Slanted Building...Ch. 2 - Prob. 2.2CCh. 2 - Prob. 2.3ACCh. 2 - Prob. 2.4CCh. 2 - Prob. 2.5CCh. 2 - Prob. 2.6CCh. 2 - Prob. 2.1.1ECh. 2 - Multiple-Choice Questions on Accounting for Equity...Ch. 2 - Prob. 2.1.3ECh. 2 - Prob. 2.1.4ECh. 2 - Prob. 2.1.5ECh. 2 - Prob. 2.1.6ECh. 2 - Multiple-Choice Questions on Intercorporate...Ch. 2 - Prob. 2.2.2ECh. 2 - Prob. 2.3.1ECh. 2 - Prob. 2.3.2ECh. 2 - Prob. 2.3.3ECh. 2 - Prob. 2.3.4ECh. 2 - Cost versus Equity Reporting Winston Corporation...Ch. 2 - Prob. 2.5ECh. 2 - Prob. 2.6ECh. 2 - Prob. 2.7ECh. 2 - Income Reporting Grandview Company purchased 40...Ch. 2 - Prob. 2.9ECh. 2 - Carrying an Investment at Fair Value versus Equity...Ch. 2 - Investee with Preferred Stock Outstanding Reden...Ch. 2 - Prob. 2.12AECh. 2 - Prob. 2.13AECh. 2 - Prob. 2.14ECh. 2 - Prob. 2.15ECh. 2 - Prob. 2.16ECh. 2 - Prob. 2.17ECh. 2 - Changes ¡n the Number of Shares Held Idle...Ch. 2 - Prob. 2.19PCh. 2 - Carried at Fair Value Journal Entries Marlow...Ch. 2 - Prob. 2.21APCh. 2 - Equity-Method Income Statement Wealthy...Ch. 2 - Consolidated Worksheet at End of the First Year of...Ch. 2 - Consolidated Worksheet at End of the Second Year...Ch. 2 - Prob. 2.25PCh. 2 - Prob. 2.26PCh. 2 - Prob. 2.27BPCh. 2 - Prob. 2.28BP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solve this general accounting problemarrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forwardBrighton Co. had a Work-in-Process balance of $68,000 on January 1, 2023. The year-end balance of Work-in-Process was $51,000, and the Cost of Goods Manufactured was $510,000. Use this information to determine the total manufacturing costs incurred during the fiscal year 2023.arrow_forward

- Jackman Industries has two service departments, maintenance and power, and two operating departments, production and assembly. Management has decided to allocate maintenance costs on the basis of direct-labor hours in each department and power costs on the basis of machine hours. The following data were experienced by the company in the current period: Maintenance Power Production Assembly Direct labor hours 0 400 4,000 2,000 Machine hours 2,000 0 8,400 1,600 Department direct costs $ 9,000 $ 20,000 $ 70,000 $ 50,000 What is the total service cost allocated to the production department during the period if the direct method of cost allocation is used?Note: Do not round intermediate calculations. Multiple Choice $19,625 $22,800 None of the choices is correct. $ 6,200 $ 9,200arrow_forwardSpark Industries estimates that overhead costs for the next year will be $3,950,000 for indirect labor and $780,000 for factory utilities. The company uses machine hours as its overhead allocation base. If 120,000 machine hours are planned for the next year, what is the company's plantwide overhead rate? Help mearrow_forwardSolve with explanation and accounting questionarrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardWhat characterizes modified unit attribution in cost structures? (a) Complexity adds no value (b) Cost drivers reflect multi-level operational relationships (c) Attribution remains constant (d) Single drivers explain all costs. MCQarrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Accounting (Text Only)AccountingISBN:9781285743615Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting: The Impact on Decision Make...

Accounting

ISBN:9781305654174

Author:Gary A. Porter, Curtis L. Norton

Publisher:Cengage Learning

Accounting (Text Only)

Accounting

ISBN:9781285743615

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial instruments products; Author: fi-compass;https://www.youtube.com/watch?v=gvxozM3TUIg;License: Standard Youtube License