Concept explainers

Cash versus accrual accounting;

• LO2–4, LO2–5, LO2–8

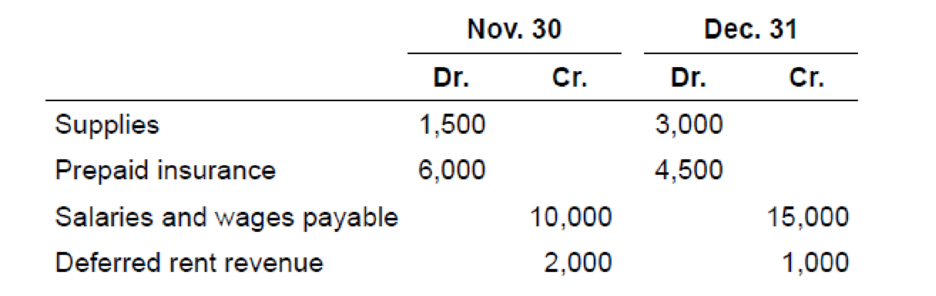

The Righter Shoe Store Company prepares monthly financial statements for its bank. The November 30 and December 31, 2018,

The following information also is known:

a. The December income statement reported $2,000 in supplies expense.

b. No insurance payments were made in December.

c. $10,000 was paid to employees during December for salaries and wages.

d. On November 1, 2018, a tenant paid Righter $3,000 in advance rent for the period November through January. Deferred rent revenue was credited.

Required:

1. What was the cost of supplies purchased during December?

2. What was the adjusting entry recorded at the end of December for prepaid insurance?

3. What was the adjusting entry recorded at the end of December for accrued salaries and wages?

4. What was the amount of rent revenue recognized in December? What adjusting entry was recorded at the end of December for deferred rent revenue?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

GEN CMB(LL)INTRM ACCTG

- If a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understated corre solutionarrow_forwardIf a company records an expense that was actually a capital expenditure, what will be the result?A. Assets overstatedB. Net income overstatedC. Expenses understatedD. Net income understatedarrow_forwardWhich of the following transactions would increase owner's equity?A. Paying rentB. Buying equipment with cashC. Earning service revenueD. Paying dividendsarrow_forward

- Which of the following transactions would increase owner's equity?A. Paying rentB. Buying equipment with cashC. Earning service revenueD. Paying dividendsneed helparrow_forwardWhich of the following transactions would increase owner's equity?A. Paying rentB. Buying equipment with cashC. Earning service revenueD. Paying dividendsarrow_forward1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstated Need helparrow_forward

- 1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forward1. If an adjusting entry is not made for accrued wages, what will be the result?A. Assets overstatedB. Liabilities understatedC. Equity understatedD. Expenses overstatedarrow_forwardNo ai What happens to the accounting equation when a company issues common stock for cash?A. Assets increase, liabilities increaseB. Assets increase, equity increasesC. Assets decrease, equity decreasesD. Assets increase, liabilities decreasearrow_forward

- What happens to the accounting equation when a company issues common stock for cash?A. Assets increase, liabilities increaseB. Assets increase, equity increasesC. Assets decrease, equity decreasesD. Assets increase, liabilities decreasehelparrow_forwardWhat happens to the accounting equation when a company issues common stock for cash?A. Assets increase, liabilities increaseB. Assets increase, equity increasesC. Assets decrease, equity decreasesD. Assets increase, liabilities decreasearrow_forwardPlease provide Accurate Answer of this Financial Accounting Questionarrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education