Bundle: Financial Management: Theory & Practice, 16th + MindTap, 1 term Printed Access Card

16th Edition

ISBN: 9780357252673

Author: Brigham, Eugene F., EHRHARDT, Michael C.

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 20SP

Begin with the partial model in the file Ch02 P20 Build a Model.xlsx on the textbook’s Web site.

- a. Britton String Corp. manufactures specialty strings for musical instruments and tennis racquets. Its most recent sales were $880 million; operating costs (excluding

depreciation ) were equal to 85% of sales; net fixed assets were $300 million; depreciation amounted to 10% of net fixed assets; interest expenses were $22 million; the state-plus-federal corporate tax rate was 25%; and it paid 40% of its net income out in dividends. Given this information, construct Britton String’s income statement. Also calculate total dividends and the addition toretained earnings . Report all dollar figures in millions. - b. Britton String’s partial

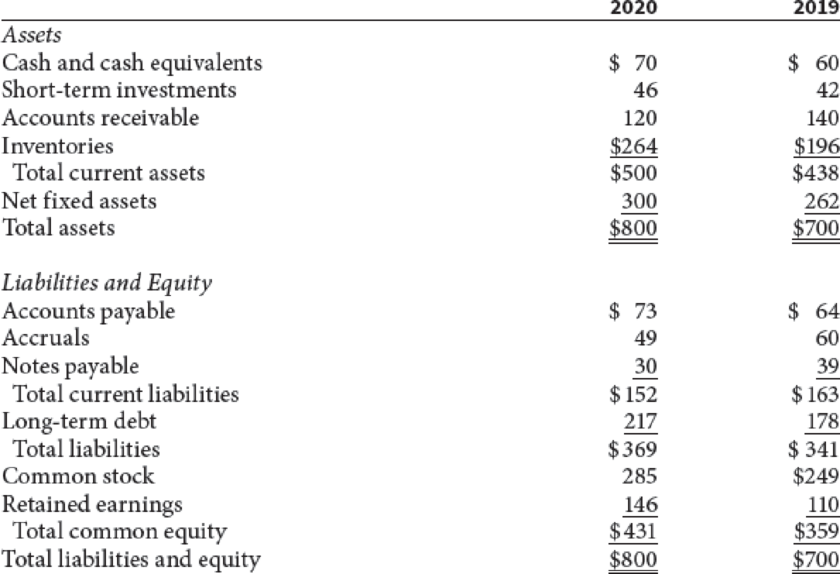

balance sheets follow. Britton issued $36 million of new common stock in the most recent year. Using this information and the results from part a, fill in the missing values for common stock, retained earnings, total common equity, and total liabilities and equity. - c. Construct the statement of cash flows for 2020.

Britton Strings Corp: Balance Sheets as of December 31 (Millions of Dollars)

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Please don't solve with incorrect values .

i will give unhelpful.

A project requires an initial investment of $100,000 and generates annual cash flows of $20,000 for 5 years. If the discount rate is 10%, what is the project's net present value (NPV)?

help..??

You are given the following information concerning four stocks:

Using 20X0 as the base year, construct three aggregate measures of the market that simulate the Dow Jones Industrial Average, the S&P 500 stock index, and the Value Line stock index (i.e., a simple average, a value-weighted average, and a geometric average).

a. What is the percentage change in each aggregate market measure from 20X0 to 20X1, and 20X0 to 20X2? Why are the results different even though only one stock’s price changed and in each case the price that changed doubled?

b. If you were managing funds and wanted a source to compare your results, which market measure would you prefer to use in 20X2?

*Show all work & necessary formula(s)

Chapter 2 Solutions

Bundle: Financial Management: Theory & Practice, 16th + MindTap, 1 term Printed Access Card

Ch. 2 - Define each of the following terms:

Annual report;...Ch. 2 - Prob. 2QCh. 2 - If a typical firm reports 20 million of retained...Ch. 2 - What is operating capital, and why is it...Ch. 2 - Prob. 6QCh. 2 - Prob. 7QCh. 2 - Prob. 8QCh. 2 - An investor recently purchased a corporate bond...Ch. 2 - Corporate bonds issued by Johnson Corporation...Ch. 2 - Hollys Art Galleries recently reported 7.9 million...

Ch. 2 - Nicholas Health Systems recently reported an...Ch. 2 - Kendall Corners Inc. recently reported net income...Ch. 2 - In its most recent financial statements,...Ch. 2 - Prob. 7PCh. 2 - Prob. 8PCh. 2 -

Carter Swimming Pools has $16 million in net...Ch. 2 - Prob. 10PCh. 2 - Prob. 11PCh. 2 - The Shrieves Corporation has 10,000 that it plans...Ch. 2 - The Moore Corporation has operating income (EBIT)...Ch. 2 - The Berndt Corporation expects to have sales of...Ch. 2 - Use the following income statement of Elliott Game...Ch. 2 - Prob. 16PCh. 2 - Athenian Venues Inc. just reported the following...Ch. 2 - Rhodes Corporations financial statements are shown...Ch. 2 - The Bookbinder Company had 500,000 cumulative...Ch. 2 - Begin with the partial model in the file Ch02 P20...Ch. 2 - Begin with the partial model in the file Ch02 P21...Ch. 2 -

Jenny Cochran, a graduate of the University of...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - What is Computrons net operating profit after...Ch. 2 - What is Computron’s free cash flow? What are...Ch. 2 - Calculate Computron’s return on invested capital...Ch. 2 - Jenny Cochran, a graduate of the University of...Ch. 2 - What happened to Computron’s Market Value Added...Ch. 2 - Prob. 9MCCh. 2 - Prob. 10MCCh. 2 - Prob. 11MCCh. 2 - Prob. 12MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- 7. If the inflation rate is 3% and the nominal return on an investment is 8%, what is the real return approximately? A) 5.0%B) 4.9%C) 5.2%D) 6.0%arrow_forward7. If the inflation rate is 3% and the nominal return on an investment is 8%, what is the real return approximately? A) 5.0%B) 4.9%C) 5.2%D) 6.0%need help properly.arrow_forwardWhich of the following formulas represents compound interest? A) I = PRTB) A = P(1 + rt)C) A = P(1 + r/n)^(nt)D) A = P - Ineed help!arrow_forward

- Which of the following formulas represents compound interest? A) I = PRTB) A = P(1 + rt)C) A = P(1 + r/n)^(nt)D) A = P - Iarrow_forwardA bond pays annual coupons of $60 and is currently priced at $1,050. What is its current yield? A) 6.0% B) 5.7% C) 5.5% D) 5.0% explainarrow_forward8. A bond pays annual coupons of $60 and is currently priced at $1,050. What is its current yield? A) 6.0%B) 5.7%C) 5.5%D) 5.0% helparrow_forward

- 8. A bond pays annual coupons of $60 and is currently priced at $1,050. What is its current yield? A) 6.0%B) 5.7%C) 5.5%D) 5.0%arrow_forwardWhat is the effective annual rate (EAR) if the nominal rate is 12% compounded quarterly? A) 12.55%B) 12.00%C) 12.36%D) 12.82% need help!arrow_forwardWhat is the effective annual rate (EAR) if the nominal rate is 12% compounded quarterly? A) 12.55%B) 12.00%C) 12.36%D) 12.82%arrow_forward

- A loan of $10,000 is to be repaid in equal annual installments over 4 years at 5% interest. What is the annual installment? A) $2,564.57B) $2,856.44C) $2,312.49D) $2,775.60arrow_forward1. What is the simple interest on a loan of $5,000 at 6% per annum for 3 years? A) $900B) $750C) $1,200D) $600arrow_forwardWhat is the monthly payment on a $12,000 loan at 6% annual interest, to be repaid over 1 year? A) $1,030.33B) $1,033.00C) $1,035.45D) $1,050.00need help!!arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Capital Budgeting Introduction & Calculations Step-by-Step -PV, FV, NPV, IRR, Payback, Simple R of R; Author: Accounting Step by Step;https://www.youtube.com/watch?v=hyBw-NnAkHY;License: Standard Youtube License