Concept explainers

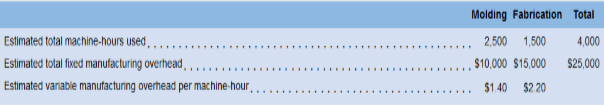

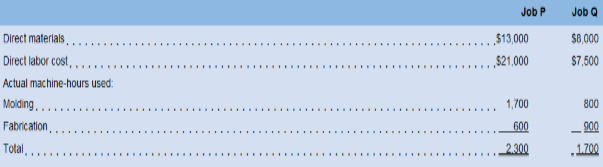

Sweeten Company bad no jobs in progress at the beginning of March and no beginning inventories. The company has two manufacturing departments Molding and Fabrication. It started, completed, and sold only two jobs during March—Job P and Job Q. The following additional information is available for the company as a whole and for Jobs P and Q (all data and questions relate to the month of March):

Sweeten Company bad no underapplied or overapplied

Required:

For questions 1-8, assume that Sweeten Company uses a plantwide predetermined overhead rate with machine-hours as the allocation base.

For questions 9-15, assume that the company uses departmental predetermined overhead rates with machine-hours as the allocation base in both departments.

1. What was the company’s plantwide predetermined overhead rate?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

BREWER ND LL INTRO MGRL ACTG CON+ AC

Additional Business Textbook Solutions

Intermediate Accounting (2nd Edition)

Horngren's Accounting (12th Edition)

Essentials of MIS (13th Edition)

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Operations Management: Processes and Supply Chains (12th Edition) (What's New in Operations Management)

- A truck costs $88,000 when new and has accumulated depreciation of $70,000. Suppose Falcon Hauling exchanges the truck for a new truck. The new truck has a market value of $65,000, and Falcon pays cash of $40,000. Assume the exchange has commercial substance. What is the result of this exchange? A. No gain or loss B. Gain of $7,000 C. Gain of $4,000 D. Loss of $7,000arrow_forwardneed answer of this finacian accountingarrow_forwardHow much overhead cost would be assigned?arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning