Concept explainers

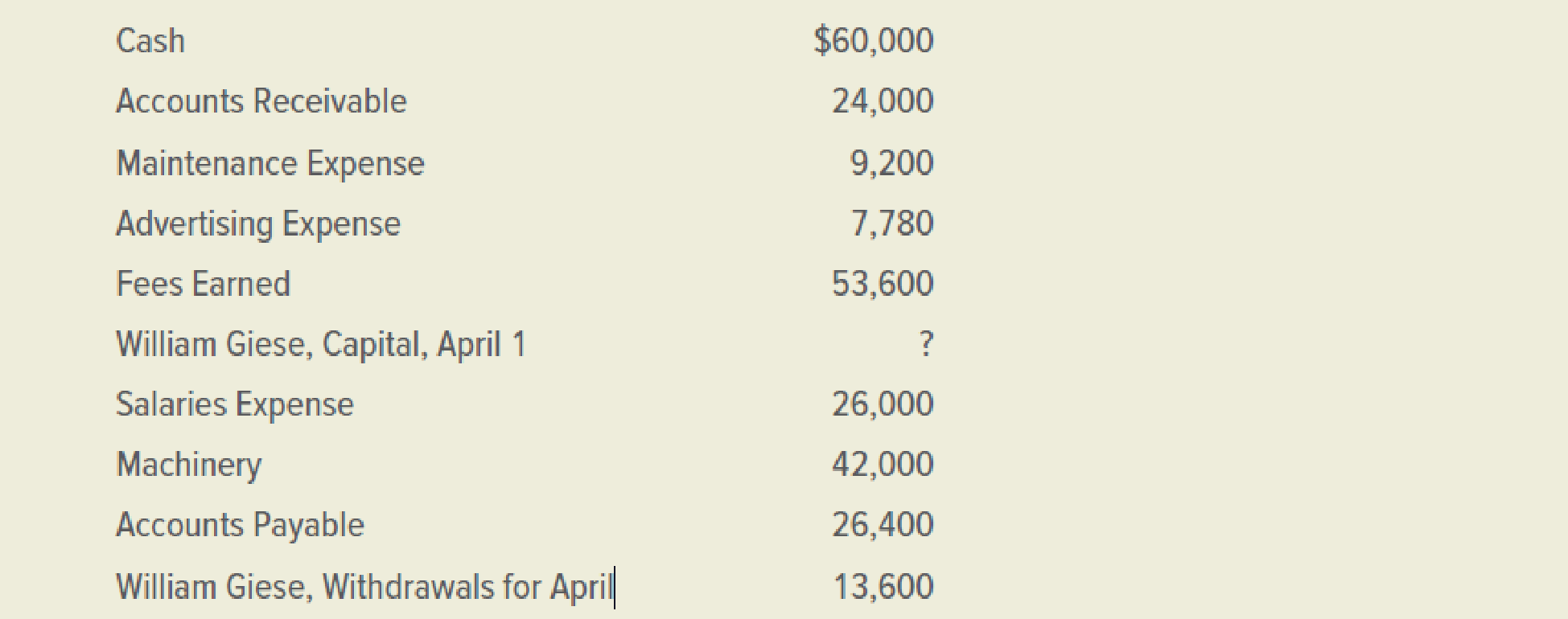

The following account balances are for William Giese, Certified Public Accountant, as of April 30, 2019.

INSTRUCTIONS

Using the

Analyze: What net change in owner’s equity occurred during the month of April?

Calculate the amount of WG, Capital at April 1, 2019 by using accounting equation.

Explanation of Solution

Accounting equation: Accounting equation is an accounting tool expressed in the form of equation, by creating a relation between resources or assets of a company and claims of resources to creditors and owners. Accounting equation is expressed as shown below:

Calculate the amount of WG, Capital at April 1, 2019 by using accounting equation.

Working notes: Calculate the amount of total expenses.

Hence, the amount of WG, Capital at April 1, 2019 is $102,580.

Prepare an income statement and a statement of owner’s equity for WG, Certified Public Accountant for the month of April and a balance sheet at April 30, 2019 from the information given.

Explanation of Solution

Income statement: Income statement is a financial statement that shows the net income or net loss by deducting the expenses from the revenues and vice versa.

Prepare an income statement for WG, Certified Public Accountant for the month of April.

| WG, Certified Public Accountant | ||

| Income Statement | ||

| For the Month ended April 30, 2019 | ||

| Fees earned | $53,600 | |

| Expenses | ||

| Advertising expense | $7,780 | |

| Maintenance expense | $9,200 | |

| Salaries expense | $26,000 | |

| Total expenses | $42,980 | |

| Net income | $10,620 | |

Table (1)

Statement of owner's’ equity: This statement reports the beginning owner’s equity and all the changes which led to ending owner's’ equity. Additional capital, net income from income statement is added to and net loss from income statement and drawings are deducted from beginning owner’s equity to arrive at the end result, ending owner’s equity.

Prepare a statement of owner’s equity for WG, Certified Public Accountant for the month of April.

| WG, Certified Public Accountant | ||

| Statement of Owner's Equity | ||

| For the Month ended April 30, 2019 | ||

| WG Capital, April 1, 2019 | $102,580 | |

| Net income for the month of April | $10,620 | |

| Withdrawals | $(13,600) | |

| Decrease in Capital | $(2,980) | |

| WG Capital, April 30, 2019 | $99,600 | |

Table (2)

Balance Sheet: Balance Sheet summarizes the assets, the liabilities, and the Shareholder’s equity of a company at a given date. It is also known as the statement of financial status of the business.

Prepare a balance sheet for WG, Certified Public Accountant at April 30, 2019.

| WG, Certified Public Accountant | |

| Balance Sheet | |

| At April 30, 2019 | |

| Assets | |

| Cash | $60,000 |

| Accounts Receivable | 24,000 |

| Machinery | 42,000 |

| Total assets | $126,000 |

| Liabilities | |

| Accounts Payable | $26,400 |

| Owners’ Equity | |

| WG, capital, April 30, 2019 | 99,600 |

| Total liabilities and owners’ equity | $126,000 |

Table (3)

Analyze: The owner’s equity is decreased by $2,980

Want to see more full solutions like this?

Chapter 2 Solutions

LooseLeaf for College Accounting: A Contemporary Approach

- Financial accounting questionarrow_forwardOn November 30, Sullivan Enterprises had Accounts Receivable of $145,600. During the month of December, the company received total payments of $175,000 from credit customers. The Accounts Receivable on December 31 was $98,200. What was the number of credit sales during December?arrow_forwardPaterson Manufacturing uses both standards and budgets. For the year, estimated production of Product Z is 620,000 units. The total estimated cost for materials and labor are $1,512,000 and $1,984,000, respectively. Compute the estimates for: (a) a standard cost per unit (b) a budgeted cost for total production (Round standard costs to 2 decimal places, e.g., $1.25.)arrow_forward

- Question: Gujri Place Clock Shop sold a grandfather clock for $2,250 subject to a 9% sales tax. The entry in the general journal will include a credit to Sales for a) $2,250.00 b) $2,092.50 c) $2,452.50. choose the correct optionarrow_forwardPlease help mearrow_forwardAccounting questionarrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College