Financial Reporting, Financial Statement Analysis and Valuation

8th Edition

ISBN: 9781305176348

Author: WAHLEN, James M

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 18PC

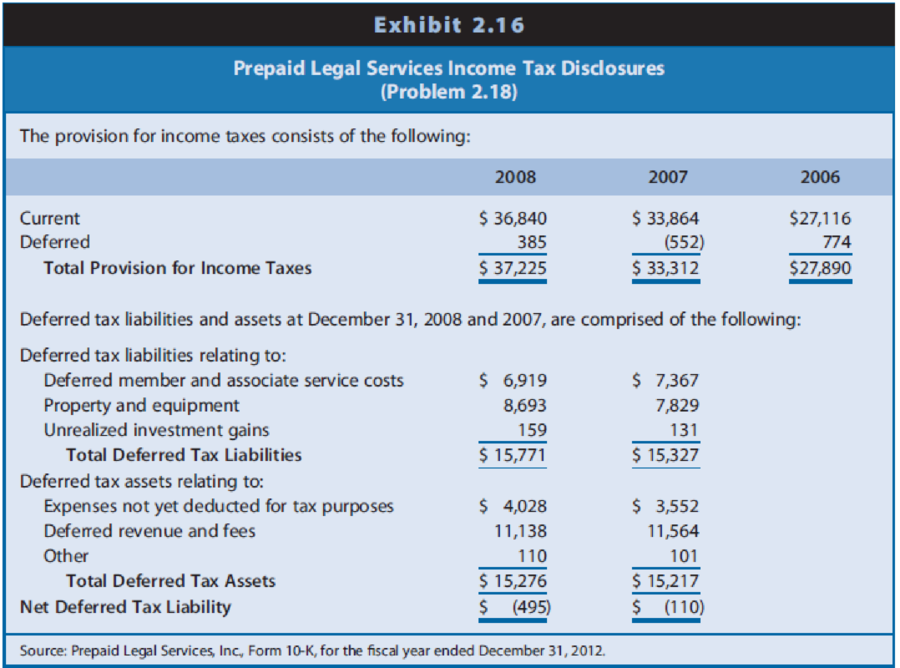

Interpreting Income Tax Disclosures. Prepaid Legal Services (PPD) is a company that sells insurance for legal expenses. Customers pay premiums in advance for coverage ever some specified period. Thus, PPD obtains cash but has unearned revenue until the passage of time over the specified period of coverage. Also, the company pays various costs to acquire customers (such as sales materials, commissions, and prepayments to legal firms who provide services to customers). These upfront payments are expensed over the specified period that customers’ contracts span. Exhibit 2.16 provides information from PPD’s income tax note.

REQUIRED

- a. Assuming that PPD had no significant permanent differences between book income and taxable income, did income before taxes for financial reporting exceed or fall short of taxable income for 2007? For 2008? Explain.

- b. Will the adjustment to net income for

deferred taxes to compute cash flow from operations in the statement of cash flows result in an addition or a subtraction for 2007? For 2008? - c. PPD must report as taxable income premiums collected from customers, although the company defers recognizing them as income for financial reporting purposes until they are earned over the contract period. Why are deferred taxes related to deferred revenue disclosed as a

deferred tax asset instead of adeferred tax liability ? Suggest reasons for the direction of the change in amounts for this deferred tax asset between 2007 and 2008. - d. Firms are generally allowed to deduct cash costs on their tax returns, although they might defer some of these costs for financial reporting purposes. As noted above, PPD defers various costs associated with obtaining customers. Why are deferred taxes related to this item disclosed as a deferred tax liability? Suggest reasons for the direction of the change in amounts for this deferred tax asset between 2007 and 2008.

- e. Like most companies, PPD uses the straight-line

depreciation method for financial reporting and accelerated depredation methods for income tax purposes. Why are deferred taxes related to depredation disclosed as a deferred tax liability? Suggest reasons for the direction of the change in amounts for this deferred tax liability between 2007 and 2008. - f. Based only on the selected disclosures from the income tax footnote provided in Exhibit 2.16 and your responses to Parts d and e above, do you believe that PPD reported growing or declining revenue and profitability in 2008 relative to 2007? Explain.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Brightwoodę Furniture provides the following financial data for a

given enod:

Sales

Aount ($) Per Unit ($)

150,000

13

Less Variable E

-

L96,000

13

Contribwaon Margin c

1C

Less Fixed Expenses

$5,000

et Income

125,000

a. What is the company's CM ratio?

b. If quarterly sales increase by $5,200 and there is no change in fixed

expenses, by how much would you expect quarterly net operating

income to increase?

Please give correct answer dont use chatgpt .

if image is blurr or any data is unclear then please comment i will write values , dont give answer without sure that data in image is showing properly.

Footfall Manufacturing Ltd. reports

information at the end of the current year:

Net Sales

$100,000

Debtor's turnover ratio (based on 2

net sales)

Inventory turnover ratio

1.25

Fixed assets turnover ratio

0.8

Debt to assets ratio

0.6

Net profit margin

5%

Gross profit margin

25%

Return on investment

2%

the

following financial

Use the given information to fill out the templates for income

statement and balance sheet given below:

Income Statement of Footfall Manufacturing Ltd. for the year ending

December 31, 20XX

(in $)

Sales

100,000

Cost of goods

sold

Gross profit

Other expenses

Earnings before

Lax

Tax @50%

Earnings

tax

after

Chapter 2 Solutions

Financial Reporting, Financial Statement Analysis and Valuation

Ch. 2 - Prob. 1QECh. 2 - Asset Valuation and Income Recognition. Asset...Ch. 2 - Trade-Offs among Acceptable Accounting...Ch. 2 - Income Flows versus Cash Flows. The text states,...Ch. 2 - Prob. 5QECh. 2 - Prob. 6QECh. 2 - Prob. 7QECh. 2 - Prob. 8QECh. 2 - Computation of Income Tax Expense. A firms income...Ch. 2 - Computation of Income Tax Expense. A firms income...

Ch. 2 - Costs to Be Included in Historical Cost Valuation....Ch. 2 - Effect of Valuation Method for Nonmonetary Asset...Ch. 2 - Prob. 13PCCh. 2 - Prob. 14PCCh. 2 - Prob. 15PCCh. 2 - Deferred Tax Assets. Components of the deferred...Ch. 2 - Interpreting Income Tax Disclosures. The financial...Ch. 2 - Interpreting Income Tax Disclosures. Prepaid Legal...Ch. 2 - Interpreting Income Tax Disclosures. The financial...Ch. 2 - Analyzing Transactions. Using the analytical...Ch. 2 - Prob. 21PCCh. 2 - Starbucks The financial statements of Starbucks...Ch. 2 - Prob. 1BICCh. 2 - Prob. 1CICCh. 2 - Prob. 1DICCh. 2 - Prob. 1EICCh. 2 - Prob. 1FICCh. 2 - Starbucks The financial statements of Starbucks...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- if image is blurr or data is not clear in image please comment i will write data or upload new image. Don't use chatgpt. confirm i will give unhelpful if answer with using incorrect data .arrow_forwardBright wood Seating sells reclining chairs for $55.00 per unit. The variable cost is 322 per unit. Each reclining chair requires 5 direct labor hours and 3 machine hours to produce. atribution margin pegmachine home* Wrightwood Manufacturing has a break-even point of 1,500 units. The sales price per unit is $18, and the variable cost per u 13. If the company sells 3,500 units, what will its net income be? Creatwood Industries provides the following budget data for its Processing Department for the year 2022: ⚫ Manufacturing Overhead Costs=$250,400 . Direct Labor Costs $1,234,500 Determine the manufacturing overhead application rate underthe base of Direct Labor Costs. Modesto Accessories manufactures two types of wallets leather and canvas. The company allocates manufacturing overhead using a single plant wide rate with direct labor cost as the allocation base. $48 Estimated Overhead Costs = 30,600 Direct Labor Cost per Leather Wallet Direct Labor Cost per Canvas Wallet = $52 Number of…arrow_forwardPlease don't use AI . Chatgpt giving wrong answer . confirm i will give unhelpharrow_forward

- Anti-Pandemic Pharma Co. Ltd. reports the following information inits income statement:Sales = $5,250,000;Costs = $2, 173,000;Other expenses = $187,400;Depreciation expense = $79,000;Interest expense= $53,555;Taxes = $76,000;Dividends = $69,000.$136,700 worth of new shares were also issued during the year andlong-term debt worth $65,300 was redeemed.a) Compute the cash flow from assetsb) Compute the net change in working capital Show all calculations. Please no spreadsheet so that I can clearly understandarrow_forwardAnswer this question Using the Google drive liink below it hhas the case study In the scenario, Sharp’s employer has been putting more emphasis on controlling costsfor the various businesses. With the slowing of overall spending in the construction sector,Travolta had ordered managers to closely monitor expenses. He had sold several companiesand has given vice presidents greater responsibility for statements of financial positions. Whatpositive and negative consequences might this pose to the company in future fraud prevention?Outline at least three of each type. Please use sources and insert intext citiations Apa 7 format in the answer and provide the links and references below. https://docs.google.com/document/d/1MpthrFl3eAnMKR-EprYRP9sMo8Ll0WtbhxhpGtLbdcw/edit?usp=sharingarrow_forwardfile:///C:/Users/rafan/Downloads/Assignment%201%20Paving%20Company%20Case%20S2%202024%20to%202025.pdf Using the link for the fraud case answer only this question below. b) As discussed in units 1 to 4, all frauds involve key elements. Identify and describe usingexamples, the elements of Sharp’s fraud.arrow_forward

- Option should be match experts are giving incorrect answer they are using AI /Chatgpt that is generating wrong answer. i will give unhelpful if answer will not match in option. dont use AI alsoarrow_forwardOption should be match. please don't use ai if option will not match means answer is incorrect . Ai giving incorrect answerarrow_forwardOption should be match. please don't use ai if option will not match means answer is incorrect . Ai giving incorrect answerarrow_forward

- all frauds involve key elements. Identify and describe usingexamples the elements of fraudarrow_forwardSolve for maturity value, discount period, bank discount, and proceeds. Assume a bank discount rate of 9%. Use the ordinary interest method. (Use Days in a year table.) Note: Do not round intermediate calculations. Round your final answers to the nearest cent. face value(principal) $50000rate interest:11%length of note: 95 days maturity value: ?date of note: june 10date note discounted: July 18discount period:?bank discount:?proceeds:?arrow_forwardWhat are the different types of audits and different types of auditors? WHat is an example of each type of audit? What is the significance of each from the perspective of different stakeholders?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Business/Professional Ethics Directors/Executives...AccountingISBN:9781337485913Author:BROOKSPublisher:Cengage

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub

Auditing: A Risk Based-Approach to Conducting a Q...AccountingISBN:9781305080577Author:Karla M Johnstone, Audrey A. Gramling, Larry E. RittenbergPublisher:South-Western College Pub Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Individual Income TaxesAccountingISBN:9780357109731Author:HoffmanPublisher:CENGAGE LEARNING - CONSIGNMENT

Business/Professional Ethics Directors/Executives...

Accounting

ISBN:9781337485913

Author:BROOKS

Publisher:Cengage

Auditing: A Risk Based-Approach to Conducting a Q...

Accounting

ISBN:9781305080577

Author:Karla M Johnstone, Audrey A. Gramling, Larry E. Rittenberg

Publisher:South-Western College Pub

Individual Income Taxes

Accounting

ISBN:9780357109731

Author:Hoffman

Publisher:CENGAGE LEARNING - CONSIGNMENT

Chapter 19 Accounting for Income Taxes Part 1; Author: Vicki Stewart;https://www.youtube.com/watch?v=FMjwcdZhLoE;License: Standard Youtube License