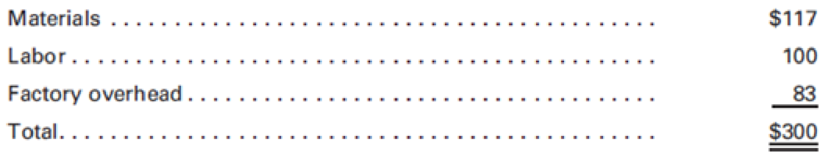

Lloyd Industries manufactures electrical equipment from specifications received from customers. Job X10 was for 1,000 motors to be used in a specially designed electrical complex. The following costs were determined for each motor:

At final inspection, Lloyd discovered that 33 motors did not meet the exacting specifications established by the customer. An examination indicated that 18 motors were beyond repair and should be sold as spoiled goods for $75 each. The remaining 15 motors, though defective, could be reconditioned as first-quality units by the addition of $1,650 for materials, $1,500 for labor, and $1,200 for factory

Required:

Prepare the

- 1. The scrapping of the 18 motors, with the income from spoiled goods treated as a reduction in the

manufacturing cost of the specific job. - 2. The correction of the 15 defective motors, with the additional cost charged to the specific job.

- 3. The additional cost of replacing the 18 spoiled motors with new motors.

- 4. The sale of the spoiled motors for $75 each.

- 5. If the reconditioned motors sell for $400 each, is Lloyd better off reconditioning the defective motors or selling them as is for $75 as spoiled goods?

Trending nowThis is a popular solution!

Chapter 2 Solutions

Principles of Cost Accounting

- Can you explain the process for solving this financial accounting problem using valid standards?arrow_forwardPlease show me the correct way to solve this financial accounting problem with accurate methods.arrow_forwardI am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning