EBK FOUNDATIONS OF FINANCE

10th Edition

ISBN: 9780134897288

Author: PETTY

Publisher: VST

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 2, Problem 14SP

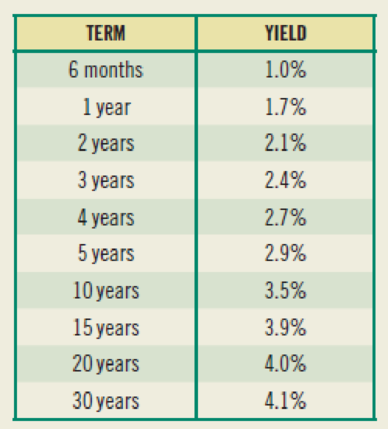

(Yield curve) If yields on Treasury securities were currently as follows:

- a. Plot the yield curve.

- b. Explain this yield curve using the unbiased expectations theory and the liquidity preference theory.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

What does "diversification" aim to achieve in investment?

A) Increase returnsB) Minimize transaction costsC) Reduce riskD) Avoid taxes

no ai

I need help!

Which of these is an example of a growth stock?

A) A stock with high dividends but slow price growthB) A stock in a rapidly growing company with low dividendsC) A stock issued by a government entityD) A stock in a mature company with steady profits

A) To set a company’s stock price

B) To measure a borrower’s creditworthinessC) To determine future cash flowsD) To calculate tax obligations

What is the primary function of a stock exchange?

A) To regulate company operationsB) To facilitate the buying and selling of securitiesC) To issue government bondsD) To monitor inflation rates

Chapter 2 Solutions

EBK FOUNDATIONS OF FINANCE

Ch. 2 - Prob. 1RQCh. 2 - Prob. 2RQCh. 2 - Prob. 3RQCh. 2 - Prob. 4RQCh. 2 - Prob. 5RQCh. 2 - Prob. 6RQCh. 2 - Prob. 7RQCh. 2 - Prob. 8RQCh. 2 - Prob. 9RQCh. 2 - Prob. 10RQ

Ch. 2 - Prob. 11RQCh. 2 - Prob. 12RQCh. 2 - Prob. 13RQCh. 2 - Prob. 14RQCh. 2 - Prob. 15RQCh. 2 - Prob. 1SPCh. 2 - Prob. 2SPCh. 2 - Prob. 3SPCh. 2 - Prob. 4SPCh. 2 - Prob. 5SPCh. 2 - Prob. 6SPCh. 2 - Prob. 7SPCh. 2 - Prob. 8SPCh. 2 - Prob. 9SPCh. 2 - Prob. 10SPCh. 2 - Prob. 11SPCh. 2 - (Interest rate determination) Youre looking at...Ch. 2 - Prob. 13SPCh. 2 - (Yield curve) If yields on Treasury securities...Ch. 2 - (Unbiased expectations theory) Currently you have...Ch. 2 - Prob. 2MCCh. 2 - Prob. 3MCCh. 2 - Prob. 4MCCh. 2 - Prob. 5MC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, finance and related others by exploring similar questions and additional content below.Similar questions

- No use Ai. What does "diversification" aim to achieve in investment? A) Increase returnsB) Minimize transaction costsC) Reduce riskD) Avoid taxesarrow_forwardI need help! What is an IPO? A) Internal Portfolio OptionB) Initial Public OfferingC) Investment Portfolio ObjectiveD) Indexed Price Opportunityarrow_forwardWhat does "diversification" aim to achieve in investment? A) Increase returnsB) Minimize transaction costsC) Reduce riskD) Avoid taxes need help!!arrow_forward

- Need help!! Which of these is an example of a growth stock? A) A stock with high dividends but slow price growthB) A stock in a rapidly growing company with low dividendsC) A stock issued by a government entityD) A stock in a mature company with steady profits B) To measure a borrower’s creditworthiness C) To determine future cash flowsD) To calculate tax obligationsarrow_forwardWhich of these is an example of a growth stock? A) A stock with high dividends but slow price growthB) A stock in a rapidly growing company with low dividendsC) A stock issued by a government entityD) A stock in a mature company with steady profits B) To measure a borrower’s creditworthiness C) To determine future cash flowsD) To calculate tax obligationsarrow_forwardNeed answer!! What is the purpose of a credit rating? A) To set a company’s stock priceB) To measure a borrower’s creditworthinessC) To determine future cash flowsD) To calculate tax obligationsarrow_forward

- No chatgpt!! What is the purpose of a credit rating? A) To set a company’s stock priceB) To measure a borrower’s creditworthinessC) To determine future cash flowsD) To calculate tax obligationsarrow_forwardWhat is the purpose of a credit rating? A) To set a company’s stock priceB) To measure a borrower’s creditworthinessC) To determine future cash flowsD) To calculate tax obligationsarrow_forwardWhat is the formula for calculating Net Present Value (NPV)? A) Future Value ÷ (1 + r)^nB) Σ [Cash Flow / (1 + r)^t] - Initial InvestmentC) (Net Income ÷ Sales) × 100D) Total Assets - Total Liabilitiesneed answer!arrow_forward

- What is the formula for calculating Net Present Value (NPV)? A) Future Value ÷ (1 + r)^nB) Σ [Cash Flow / (1 + r)^t] - Initial InvestmentC) (Net Income ÷ Sales) × 100D) Total Assets - Total Liabilitiesarrow_forwardNeed help! What is the formula for calculating Net Present Value (NPV)? A) Future Value ÷ (1 + r)^nB) Σ [Cash Flow / (1 + r)^t] - Initial InvestmentC) (Net Income ÷ Sales) × 100D) Total Assets - Total Liabilitiesarrow_forwardNeed help! What does "liquidity" refer to in finance? A) The profitability of a companyB) The ability to meet short-term obligationsC) The total assets of a companyD) The debt-to-equity ratioarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Pfin (with Mindtap, 1 Term Printed Access Card) (...FinanceISBN:9780357033609Author:Randall Billingsley, Lawrence J. Gitman, Michael D. JoehnkPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...

Finance

ISBN:9781337395083

Author:Eugene F. Brigham, Phillip R. Daves

Publisher:Cengage Learning

EBK CONTEMPORARY FINANCIAL MANAGEMENT

Finance

ISBN:9781337514835

Author:MOYER

Publisher:CENGAGE LEARNING - CONSIGNMENT

Pfin (with Mindtap, 1 Term Printed Access Card) (...

Finance

ISBN:9780357033609

Author:Randall Billingsley, Lawrence J. Gitman, Michael D. Joehnk

Publisher:Cengage Learning

Portfolio return, variance, standard deviation; Author: MyFinanceTeacher;https://www.youtube.com/watch?v=RWT0kx36vZE;License: Standard YouTube License, CC-BY