Concept explainers

To determine: The annual rates from year 1 to year 4.

Answer to Problem 14P

The current rate of one-year is 5.65%, two-year is 6.22%, three-year is 6.47% and four-year treasury security is 6.67%.

Explanation of Solution

Determine the current rate of one-year and two-year treasury security

The current rate of one-year treasury security is already given, which is 5.65%.

Therefore, the current rate of two-year treasury security is 6.22%.

Determine the current rate of three-year treasury security

Therefore, the current rate of three-year treasury security is 6.47%.

Determine the current rate of four-year treasury security

Therefore, the current rate of four-year treasury security is 6.67%.

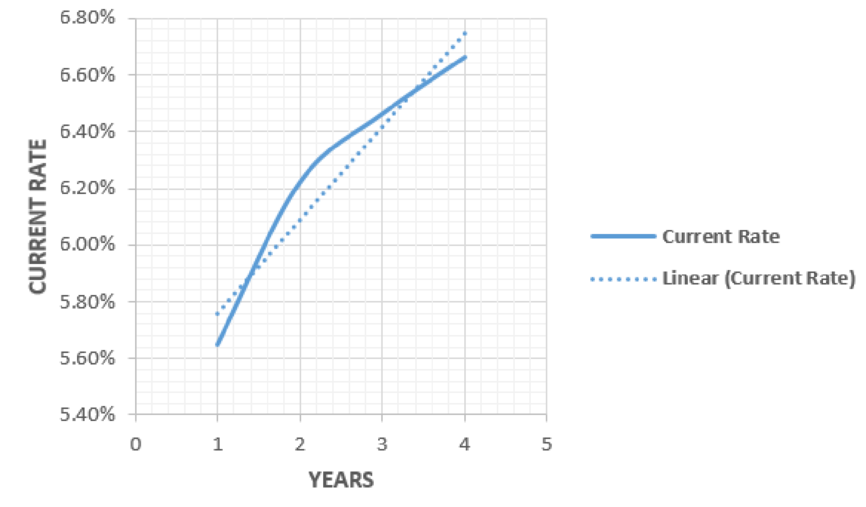

To determine: The yield curve for the current rate.

Explanation of Solution

The yield curve is as follows:

Want to see more full solutions like this?

Chapter 2 Solutions

FINANCIAL MARKETS+INST (LL)-W/ACCESS

- The market where new securities are issued and sold to investors is called: A. Secondary marketB. Money marketC. Primary marketD. Over-the-counter marketarrow_forwardA bond is trading at a premium when: A. Its coupon rate is equal to the yield to maturityB. Its market price is higher than its face valueC. Its market price is lower than its face valueD. It is issued by a well-rated companyarrow_forwardNeed help ! In financial terms, liquidity refers to: A. Profitability of an investmentB. Ability to meet short-term obligationsC. Long-term solvencyD. Market value of equity need answerarrow_forward

- In financial terms, liquidity refers to: A. Profitability of an investmentB. Ability to meet short-term obligationsC. Long-term solvencyD. Market value of equityarrow_forwardNeed help! Which type of risk cannot be eliminated through diversification? A. Market riskB. Credit riskC. Operational riskD. Unsystematic riskarrow_forwardWhich type of risk cannot be eliminated through diversification? A. Market riskB. Credit riskC. Operational riskD. Unsystematic riskarrow_forward

- The term "leverage" in finance refers to: A. Use of debt to increase potential returnsB. Investing in high-risk securitiesC. Paying off liabilitiesD. Issuing new shares need step by step.arrow_forwardDon't use chatgpt, i need help! The term "leverage" in finance refers to: A. Use of debt to increase potential returnsB. Investing in high-risk securitiesC. Paying off liabilitiesD. Issuing new sharesarrow_forwardI need help in this question! The term "leverage" in finance refers to: A. Use of debt to increase potential returnsB. Investing in high-risk securitiesC. Paying off liabilitiesD. Issuing new sharesarrow_forward

- Need help! The term "leverage" in finance refers to: A. Use of debt to increase potential returnsB. Investing in high-risk securitiesC. Paying off liabilitiesD. Issuing new sharesarrow_forwardThe term "leverage" in finance refers to: A. Use of debt to increase potential returnsB. Investing in high-risk securitiesC. Paying off liabilitiesD. Issuing new sharesarrow_forwardDon't use chatgpt! What is the formula of net persent values ? explain.arrow_forward

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Essentials Of InvestmentsFinanceISBN:9781260013924Author:Bodie, Zvi, Kane, Alex, MARCUS, Alan J.Publisher:Mcgraw-hill Education,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson,

Foundations Of FinanceFinanceISBN:9780134897264Author:KEOWN, Arthur J., Martin, John D., PETTY, J. WilliamPublisher:Pearson, Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals of Financial Management (MindTap Cou...FinanceISBN:9781337395250Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education

Corporate Finance (The Mcgraw-hill/Irwin Series i...FinanceISBN:9780077861759Author:Stephen A. Ross Franco Modigliani Professor of Financial Economics Professor, Randolph W Westerfield Robert R. Dockson Deans Chair in Bus. Admin., Jeffrey Jaffe, Bradford D Jordan ProfessorPublisher:McGraw-Hill Education