Concept explainers

a.

Prepare general ledger accounts, Prepare

a.

Explanation of Solution

General ledger:

General ledger is a ledger which is used to summarize all the entries of the subsidiary ledger. The general ledger is used to record the correcting, adjusting and closing entries.

Journal:

Journal is the method of recording monetary business transactions in chronological order. It records the debit and credit aspects of each transaction to abide by the double-entry system.

Rules of Debit and Credit:

Following rules are followed for debiting and crediting different accounts while they occur in business transactions:

- Debit, all increase in assets, expenses and dividends, all decrease in liabilities, revenues and

stockholders’ equities . - Credit, all increase in liabilities, revenues, and stockholders’ equities, all decrease in assets, expenses.

T-account:

T-account is the form of the ledger account, where the journal

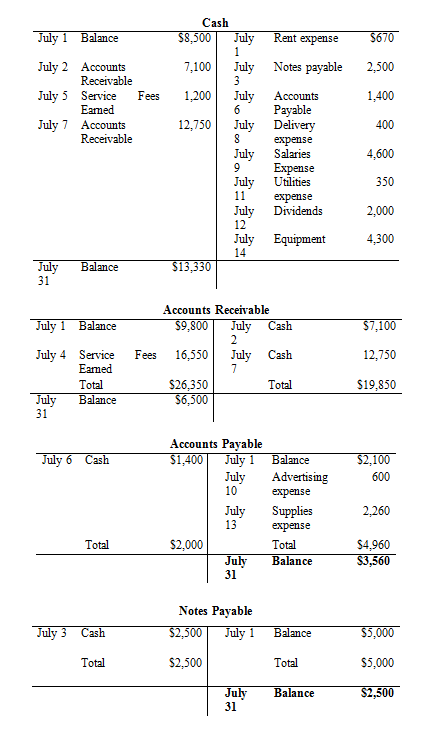

Prepare cash account:

| Cash | ||||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| July 1 | Balance | $8,500 | ||||

Table (1)

Prepare

| Accounts Receivable | ||||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| July 1 | Balance | $9,800 | ||||

Table (2)

Prepare Accounts Payable Account:

| Accounts Payable | ||||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| July 1 | Balance | $2,100 | ||||

Table (3)

Prepare Notes Payable Account:

| Notes Payable | ||||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| July 1 | Balance | $5,000 | ||||

Table (4)

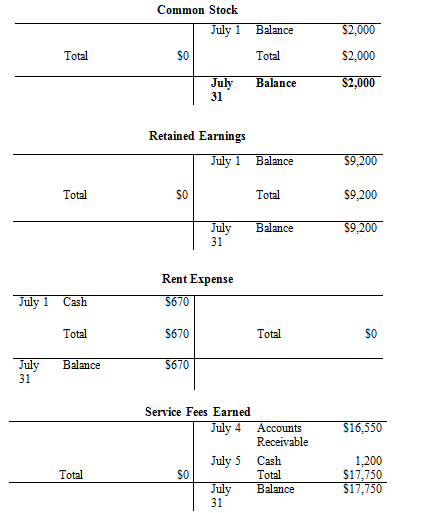

Prepare Common Stock Account:

| Common Stock | ||||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| July 1 | Balance | $2,000 | ||||

Table (5)

Prepare

| Retained Earnings | ||||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| July 1 | Balance | $9,200 | ||||

Table (6)

Record the journal entries for the transactions that occurred during July 1 to July 14:

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 1 | Rent Expense (E–) | 670 | |

| Cash (A–) | 670 | |||

| (To record rent expense payment) | ||||

Table (7)

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 2 | Cash (A+) | 7,100 | |

| Accounts Receivable (A–) | 7,100 | |||

| (To record amount collected from customers) | ||||

Table (8)

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 3 | Notes Payable (A–) | 2,500 | |

| Cash (A–) | 2,500 | |||

| (To record cash paid for notes payable) | ||||

Table (9)

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 4 | Accounts Receivable (A+) | 16,550 | |

| Service Fees Earned (E+) | 16,550 | |||

| (To record services rendered on account) | ||||

Table (10)

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 5 | Cash (A+) | 1,200 | |

| Service Fees Earned (E+) | 1,200 | |||

| (To record services rendered for cash) | ||||

Table (11)

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 6 | Accounts Payable (A–) | 1,400 | |

| Cash (A–) | 1,400 | |||

| (To record cash paid for creditors on account) | ||||

Table (12)

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 7 | Cash (A+) | 12,750 | |

| Accounts Receivable (A–) | 12,750 | |||

| (To record amount collected from customers on account) | ||||

Table (13)

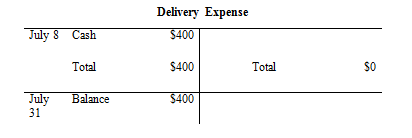

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 8 | Delivery Expense (E–) | 400 | |

| Cash (A–) | 400 | |||

| (To record delivery expense payment) | ||||

Table (14)

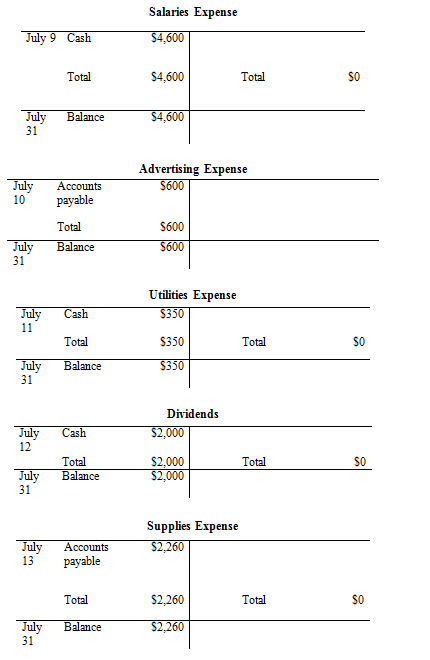

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 9 | Salaries Expense (E–) | 4,600 | |

| Cash (A–) | 4,600 | |||

| (To record salaries expense payment) | ||||

Table (15)

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 10 | Advertising Expense (E–) | 600 | |

| Accounts Payable (L+) | 600 | |||

| (To record advertising expense bill) | ||||

Table (16)

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 11 | Utility Expense (E–) | 350 | |

| Cash (A–) | 350 | |||

| (To record utility expense payment) | ||||

Table (17)

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 12 | Dividends (E–) | 2,000 | |

| Cash (A–) | 2,000 | |||

| (To record dividends payment) | ||||

Table (18)

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 13 | Supplies Expense (E–) | 2,260 | |

| Accounts Payable (L+) | 2,260 | |||

| (To record receipt of advertising expense bill) | ||||

Table (19)

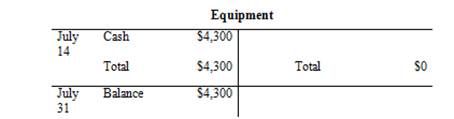

| Date | Account Titles and Explanations | Debit ($) | Credit ($) | |

| July | 14 | Equipment (A+) | 4,300 | |

| Cash (A–) | 4,300 | |||

| (To record purchase of computer) | ||||

Table (20)

Post the journal entries into T-accounts.

b.

Prepare a

b.

Explanation of Solution

Trial balance:

Trial balance is the summary of accounts, and their debit and credit balances at a given time. It is usually prepared at end of the accounting period. Debit balances are listed in left column and credit balances are listed in right column. The totals of debit and credit column should be equal. Trial balance is useful in the preparation of the financial statements.

Preparation of trial balance:

| Company P | ||

| Trial Balance | ||

| As of July 30 | ||

| Account Titles | Debit ($) | Credit ($) |

| Cash | 13,330 | |

| Accounts Receivable | 6,500 | |

| Equipment | 4,300 | |

| Accounts Payable | $3,560 | |

| Notes Payable | 2,500 | |

| Common Stock | 2,000 | |

| Retained Earnings | 9,200 | |

| Service Fees Earned | 17,750 | |

| Rent Expense | 670 | |

| Delivery Expense | 400 | |

| Salaries Expense | 4,600 | |

| Advertising Expense | 600 | |

| Utilities Expense | 350 | |

| Dividends | 2,000 | |

| Supplies Expense | 2,260 | |

| Total | 35,010 | 35,010 |

Table (21)

Want to see more full solutions like this?

Chapter 2 Solutions

Financial Accounting for Undergraduates

- Reffering to fair value of an asset, division, or organization, What exactly is fair value and how is it assessed?arrow_forwardThe following transactions involving intangible assets of Oriole Corporation occurred on or near December 31, 2025. 1.) Oriole paid Grand Company $520,000 for the exclusive right to market a particular product, using the Grand name and logo in promotional material. The franchise runs for as long as Oriole is in business. 2.) Oriole spent $654,000 developing a new manufacturing process. It has applied for a patent, and it believes that its application will be successful. 3.) In January 2026, Oriole's application for a patent (#2 above) was granted. Legal and registration costs incurred were $247,800. The patent runs for 20 years. The manufacturing process will be useful to Oriole for 10 years. 4.) Oriole incurred $168,000 in successfully defending one of its patents in an infringement suit. The patent expires during December 2029. Oriole incurred 5.) $446,400 in an unsuccessful patent defense. As a result of the adverse verdict, the patent, with a remaining unamortized cost of…arrow_forwardNonearrow_forward

- I need help solving this general accounting question with the proper methodology.arrow_forwardI need help with this general accounting question using the proper accounting approach.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

- Can you explain the correct methodology to solve this general accounting problem?arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education