Concept explainers

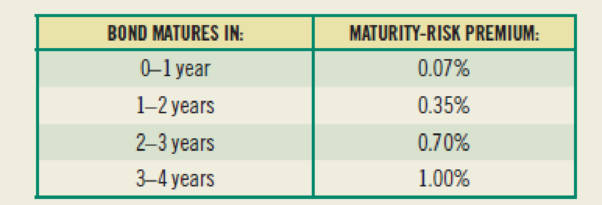

(Interest rate determination) You’re looking at some corporate bonds issued by Ford, and you are trying to determine what the nominal interest rate should be on them. You have determined that the real risk-free interest rate is 3.0%, and this rate is expected to continue on into the future without any change. In addition, inflation is expected to be constant over the future at a rate of 3.0%. The default-risk premium is also expected to remain constant at a rate of 1.5%, and the liquidity-risk premium is very small for Ford bonds, only about 0.02%. The maturity-risk premium is dependent on how many years the bond has to maturity. The maturity-risk premiums are as follows:

Given this information, what should the nominal rate of interest on Ford bonds maturing in 0–1 year, 1–2 years, 2–3 years, and 3–4 years be?

Want to see the full answer?

Check out a sample textbook solution

Chapter 2 Solutions

FOUNDATIONS OF FINANCE-MYFINANCELAB

Additional Business Textbook Solutions

Financial Accounting (12th Edition) (What's New in Accounting)

Financial Accounting, Student Value Edition (5th Edition)

Operations Management

Horngren's Cost Accounting: A Managerial Emphasis (16th Edition)

Financial Accounting: Tools for Business Decision Making, 8th Edition

Engineering Economy (17th Edition)

- A stock split usually results in:A. Higher stock priceB. Lower number of outstanding sharesC. Increased total market valueD. Lower stock price but same market capitalizationarrow_forwardA stock split usually results in:A. Higher stock priceB. Lower number of outstanding sharesC. Increased total market valueD. Lower stock price but same market capitalization need helparrow_forwardNo AI Which of the following is not a component of working capital?A. InventoryB. Accounts PayableC. Long-term DebtD. Casharrow_forward

- Which of the following is not a component of working capital?A. InventoryB. Accounts PayableC. Long-term DebtD. Casharrow_forwardI need help Which of the following is a capital budgeting technique? A. Payback PeriodB. Current RatioC. Debt-to-Equity RatioD. Acid-Test Ratioarrow_forwardCorrect answer Which of the following is a capital budgeting technique? A. Payback PeriodB. Current RatioC. Debt-to-Equity RatioD. Acid-Test Ratio answerarrow_forward

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College