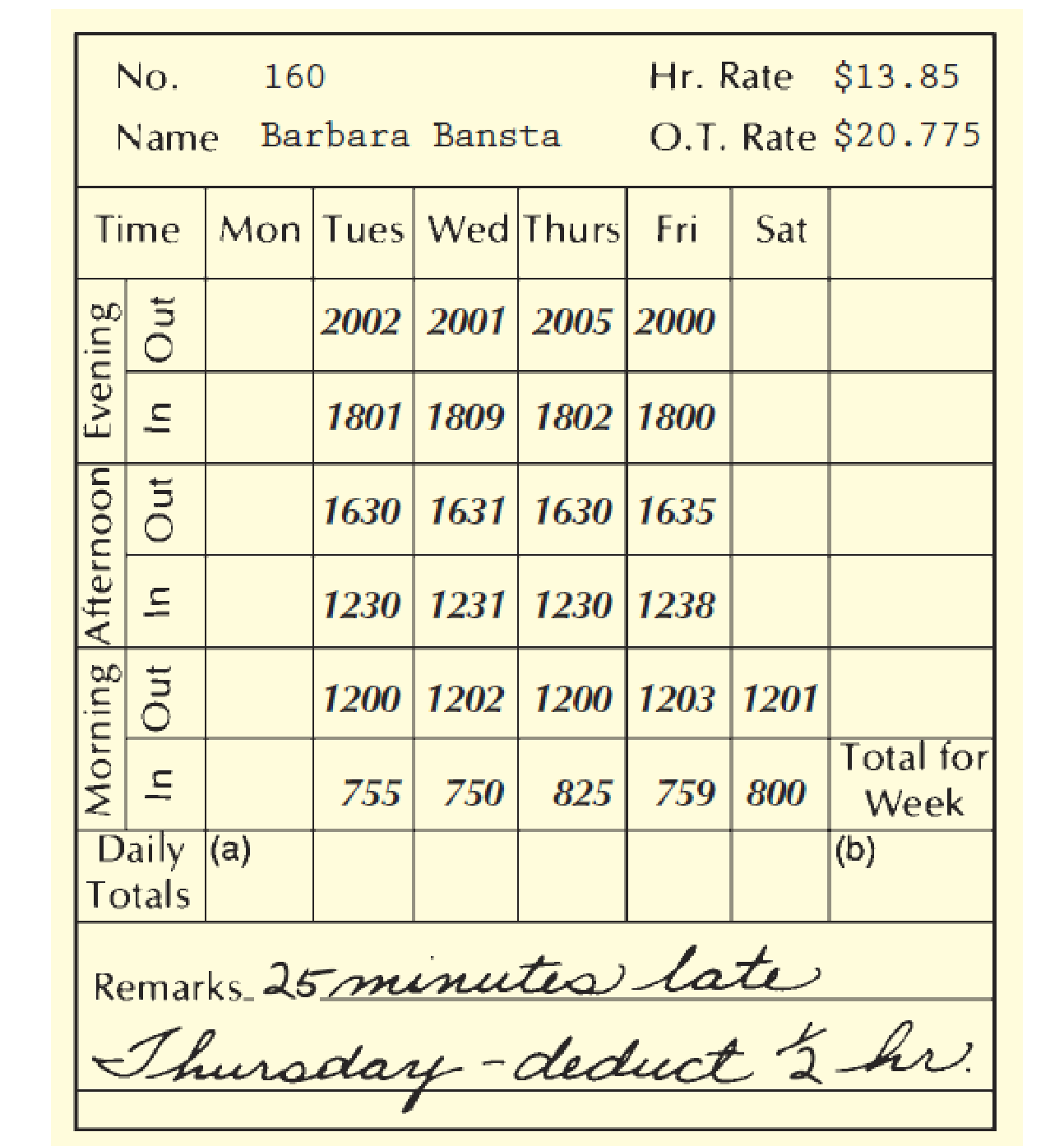

Costa, Inc., recently converted from a 5-day, 40-hour workweek to a 4-day, 40-hour workweek, with overtime continuing to be paid at one and one-half times the regular hourly rate for all hours worked beyond 40 in the week. In this company, time is recorded under the continental system, as shown on the time card on the following page.

Barbara Bansta is part of the Group B employees whose regular workweek is Tuesday through Friday. The working hours each day are 800 to 1200; 1230 to 1630; and 1800 to 2000. The company disregards any time before 800, between 1200 and 1230, and between 1630 and 1800, and permits employees to ring in up to 10 minutes late before any deduction is made for tardiness. Deductions are made to the nearest ¼ of an hour for workers who are more than 10 minutes late in ringing in.

Refer to the time card and compute:

- a. The daily total hours .......................................................................... ___________

- b. The total hours for the week ............................................................... ___________

- c. The regular weekly earnings ................................................................ $___________

- d. The overtime earnings (company rounds O.T. rate to 3 decimal places) ___________

- e. The total weekly earnings ..................................................................... $__________

a.

Calculate the daily total hours for Employee B.

Explanation of Solution

Calculate the daily total hours for Employee B.

| Tuesday | ||

| Session | Time | Hours worked |

| Morning | 755 to 1200 (see Note 1) | 4 hours |

| Afternoon | 1230 to 1630 | 4 hours |

| Evening | 1801 to 2002 | 2 hours, 1 minute |

| Total hours worked | 10.01(rounded to 10 hours) | |

Table (1)

Note 1: In the morning session, Employee B worked from 755 to 1200. The 5 minutes he worked before 800 are forbidden time, and will not be considered as working hour.

| Wednesday | ||

| Session | Time | Hours worked |

| Morning | 750 to 1202 (see Note 1) | 4 hours, 2 minutes |

| Afternoon | 1231 to 1631 (see Note 2) | 3 hours, 59 minutes |

| Evening | 1809 to 2001 | 1 hour, 52 minutes |

| Total hours worked | 9 hours, 53 minutes (rounded to 10 hours) | |

Table (2)

Note 1: In the morning session, Employee B worked from 750 to 1202. He worked for 10 minutes before 800, and 2 minutes after 1200. The time before 800 and the time after 1200 are forbidden time, and will not be considered as working hour.

Note 2: In the afternoon session, he worked from 1231 to 1631. He worked for 1 minute after1630 which is forbidden time, and will not be considered as working hour.

| Thursday | ||

| Session | Time | Hours worked |

| Morning | 825 to 1200 (see Note 1) | 3 hours, 35 minutes |

| Afternoon | 1230 to 1630 | 4 hours |

| Evening | 1802 to 2005 | 2 hours 3 minutes |

| Total hours worked | 9 hours 38 minutes (rounded to 9.30 hours) | |

Table (3)

Note 1: In the morning session, Employee B worked from 825 to 1200. That means, he came 25 minutes late. So, as per the provisions, the company will deduct

| Friday | ||

| Session | Time | Hours worked |

| Morning | 759 to 1203 (see Note 1) | 3 hours, 59 minutes |

| Afternoon | 1238 to 1635 (see Note 2) | 3 hours, 52 minutes |

| Evening | 1800 to 2000 | 2 hours |

| Total hours worked | 9 hours, 51 minutes (rounded to 10 hours) | |

Table (4)

Note 1: In the morning session, Employee B worked from 759 to 1203. He worked for 1 minute before 800 and 3 minutes after 1200. The time before 800 and the time after 1200 are forbidden time, and will not be considered as working hour.

Note 2: In the afternoon session, he worked from 1238 to 1635. He worked for 5 minutes after 1630. The time after 1630 is considered as forbidden time, and will not be considered as working hour.

| Saturday | ||

| Session | Time | Hours worked |

| Morning | 800 to 1201 (see Note) | 4 hours |

| Afternoon | ||

| Evening | ||

| Total hours worked | 4 hours | |

Table (5)

Note 1: In the morning session, Employee B worked from 800 to 1201. He worked for 1 minute after 1,200 which is forbidden time, and will not be considered as working hour.

b.

Calculate the total number of hours worked for the week by Employee B.

Explanation of Solution

Calculate the total number of hours worked for the week by Employee B.

Hence, the total number of hours worked for the week by Employee B is 43 hours 30 minutes.

c.

Calculate the regular weekly earnings for Employee B.

Explanation of Solution

Regular earnings: Generally, employees in a firm work in pre-determined hours (40 hours) and get paid accordingly. The amount of earnings that is calculated based predetermined hours is called as regular earnings of an employee.

Calculate the regular weekly earnings for Employee B.

Hence, the regular weekly earnings for Employee B is $554.

d.

Calculate the overtime earnings for Employee B.

Explanation of Solution

Overtime Earnings: If an employee works more than the stipulated working hours (more than 40 hours) of the employment then, the employee is mandated to get paid one and a half times more than the normal working pay. This one and half times can be termed as overtime premium or earnings.

Calculate the overtime earnings for Employee B.

Step 1: Calculate the number of overtime hours worked.

Step 2: Calculate the overtime earnings:

Hence, the overtime earnings for Employee B is $72.71.

e.

Calculate the total weekly earnings for Employee B.

Explanation of Solution

Total Earnings: It is the amount of employee’s gross earnings during a period. It includes regular earnings plus overtime earnings or any bonus or commission if applicable.

Calculate the total weekly earnings for Employee B.

Hence, the total weekly earnings for Employee B is $626.71.

Want to see more full solutions like this?

Chapter 2 Solutions

PAYROLL ACCT.,2019 ED.(LL)-W/ACCESS

- Five I + Beginning Work-in-Process Inventory Cost of Goods Manufactured Cost of Goods Sold Direct Labor Direct Materials Used Ending Work-in-Process Inventory Finished Goods Inventory 4 of 35 > manufactured. Use the followin Process Inventory, $32,800; an Total Manufacturing Costs Incurred during Period Total Manufacturing Costs to Account Forarrow_forwardDon't use ai given answer accounting questionsarrow_forwardRequirement 1. For a manufacturing company, identify the following as either a product cost or a period cost: Period cost Product cost a. Depreciation on plant equipment Depreciation on salespersons' automobiles Insurance on plant building Marketing manager's salary Direct materials used Manufacturing overhead g. Electricity bill for human resources office h. Production employee wagesarrow_forward

- I want to correct answer general accounting questionarrow_forwardTungsten, Inc. manufactures both normal and premium tube lights. The company allocates manufacturing over machine hours as the allocation base. Estimated overhead costs for the year are $108,000. Additional estimated information is given below. Machine hours (MHr) Direct materials Normal 23,000 $60,000 Premium 31,000 $480,000 Calculate the predetermined overhead allocation rate. (Round your answer to the nearest cent.) OA. $4.70 per direct labor hour OB. $3.48 per machine hour OC. $2.00 per machine hour OD. $0.20 per direct labor hourarrow_forward< Factory Utilities Indirect Materials Used $1,300 34,500 Direct Materials Used 301,000 Property Taxes on Factory Building 5,100 Sales Commissions 82,000 Indirect Labor Incurred 25,000 Direct Labor Incurred 150,000 Depreciation on Factory Equipment 6,300 What is the total manufacturing overhead?arrow_forward

- Discuss the financial reporting environment and financial statements. What is the purpose of accounting? What impact does the AICPA, FASB, and SEC play in accounting, particularly with regards to the financial statements?arrow_forwardK Sunlight Design Corporation sells glass vases at a wholesale price of $3.50 per unit. The variable cost to manufacture is $1.75 per unit. The monthly fixed costs are $7,500. Its current sales are 27,000 units per month. If the company wants to increase its operating income by 30%, how many additional units must it sell? (Round any intermediate calculations to two decimal places and your final answer up to the nearest whole unit.) A. 7,500 glass vases OB. 33,815 glass vases OC. 6,815 glass vases D. 94,500 glass vasesarrow_forwardCan you help me with of this question general accountingarrow_forward

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning