Horngren's Accounting (11th Edition)

11th Edition

ISBN: 9780133856781

Author: Tracie L. Miller-Nobles, Brenda L. Mattison, Ella Mae Matsumura

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem P19.40CP

Accounting for manufacturing

This problem continues the Daniels Consulting situation from Problem P18-42 of Chapter 18. Daniels Consulting uses a job order costing system in which each client is a different job. Daniels assigns direct labor, meal per diem, and travel costs directly to each job. It allocates indirect

At the beginning of 2018, the controller prepared the following budget:

| Direct labor hours (professionals) | 6,250 hours |

| Direct labor costs (professionals) | $ 1,100,000 |

| Support staff salaries | 90,000 |

| Computer leases | 57,000 |

| Office supplies | 40,000 |

| Office rent | 55,000 |

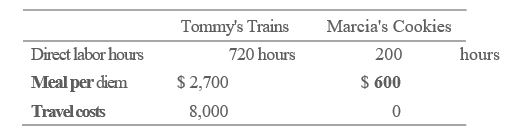

In November 2018, Daniels served several clients. Records for two clients appear here:

Requirements

- Compute Daniels's predetermined overhead allocation rare for 2018.

- Compute the total cost of each job.

- If Daniels wants to earn profits equal to 25% of sales revenue, what fee should it charge each of these two clients?

- Why does Daniels assign costs to jobs?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Which of the following is a temporary account?A. EquipmentB. Accounts PayableC. Utilities ExpenseD. Common Stock

Unearned revenue becomes revenue when:A. A sale is madeB. Cash is receivedC. The service is performedD. The revenue is recorded

What is the effect of a debit to an expense account?A. Decreases expensesB. Increases equityC. Increases expensesD. Decreases assets

Chapter 19 Solutions

Horngren's Accounting (11th Edition)

Ch. 19 - Prob. 1QCCh. 19 - When a manufacturing company uses direct...Ch. 19 - When a manufacturing company uses indirect...Ch. 19 - When a manufacturing company uses direct labor, it...Ch. 19 - What is Gell's predetermined overhead allocation...Ch. 19 - What is Gell's actual manufacturing overhead cost?...Ch. 19 - How much manufacturing overhead would Gell...Ch. 19 - What entry would Gell make to adjust the...Ch. 19 - A manufacturing company completed work on a job....Ch. 19 - Prob. 10QC

Ch. 19 - Why do managers need to know the cost of their...Ch. 19 - What types of companies use job order costing...Ch. 19 - What types of companies use process costing...Ch. 19 - What is the purpose of a job cost record?Ch. 19 - Explain the difference between cost of goods...Ch. 19 - A job was started on May 15, completed on June 27,...Ch. 19 - Give the journal entry for raw materials purchased...Ch. 19 - What is the purpose of the raw materials...Ch. 19 - How does the use of direct and indirect materials...Ch. 19 - Give the journal entry for direct and indirect...Ch. 19 - Give five examples of manufacturing overhead...Ch. 19 - What is the predetermined overhead allocation...Ch. 19 - What is an allocation base? Give some examples.Ch. 19 - How is manufacturing overhead allocated to jobs?Ch. 19 - A completed job cost record shows the unit cost of...Ch. 19 - Explain the journal entry for the allocation of...Ch. 19 - Give the journal entry for the completion of a...Ch. 19 - Why does the sale of a completed job require two...Ch. 19 - Prob. 19RQCh. 19 - If a company incurred $5,250 in actual overhead...Ch. 19 - Refer to the previous question. Give the journal...Ch. 19 - Explain the terms accumulate, assign, allocate,...Ch. 19 - Why would the manager of a service company need to...Ch. 19 - How is the predetermined overhead allocation rate...Ch. 19 - Distinguishing between job order costing and...Ch. 19 - Prob. S19.2SECh. 19 - Prob. S19.3SECh. 19 - Prob. S19.4SECh. 19 - Prob. S19.5SECh. 19 - Prob. S19.6SECh. 19 - Prob. S19.7SECh. 19 - Prob. S19.8SECh. 19 - Prob. S19.9SECh. 19 - Prob. S19.10SECh. 19 - Prob. S19.11SECh. 19 - Prob. S19.12SECh. 19 - Prob. S19.13SECh. 19 - Prob. S19.14SECh. 19 - Distinguishing between job order costing and...Ch. 19 - Defining terminology Learning Objectives 1,2 Match...Ch. 19 - Prob. E19.17ECh. 19 - Prob. E19.18ECh. 19 - Prob. E19.19ECh. 19 - Prob. E19.20ECh. 19 - Prob. E19.21ECh. 19 - Prob. E19.22ECh. 19 - Prob. E19.23ECh. 19 - Prob. E19.24ECh. 19 - Prob. E19.25ECh. 19 - Prob. E19.26ECh. 19 - Prob. E19.27ECh. 19 - Prob. P19.28APGACh. 19 - Prob. P19.29APGACh. 19 - Prob. P19.30APGACh. 19 - Prob. P19.31APGACh. 19 - Prob. P19.32APGACh. 19 - Prob. P19.33APGACh. 19 - Prob. P19.34BPGBCh. 19 - Prob. P19.35BPGBCh. 19 - Prob. P19.36BPGBCh. 19 - Prob. P19.37BPGBCh. 19 - Prob. P19.38BPGBCh. 19 - Prob. P19.39BPGBCh. 19 - Accounting for manufacturing overhead This problem...Ch. 19 - Prob. 19.1DCCh. 19 - Prob. 19.1FC

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardWhich of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardWhat type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenueneed helparrow_forwardno ai What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forward

- Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forwardHelp Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY