Concept explainers

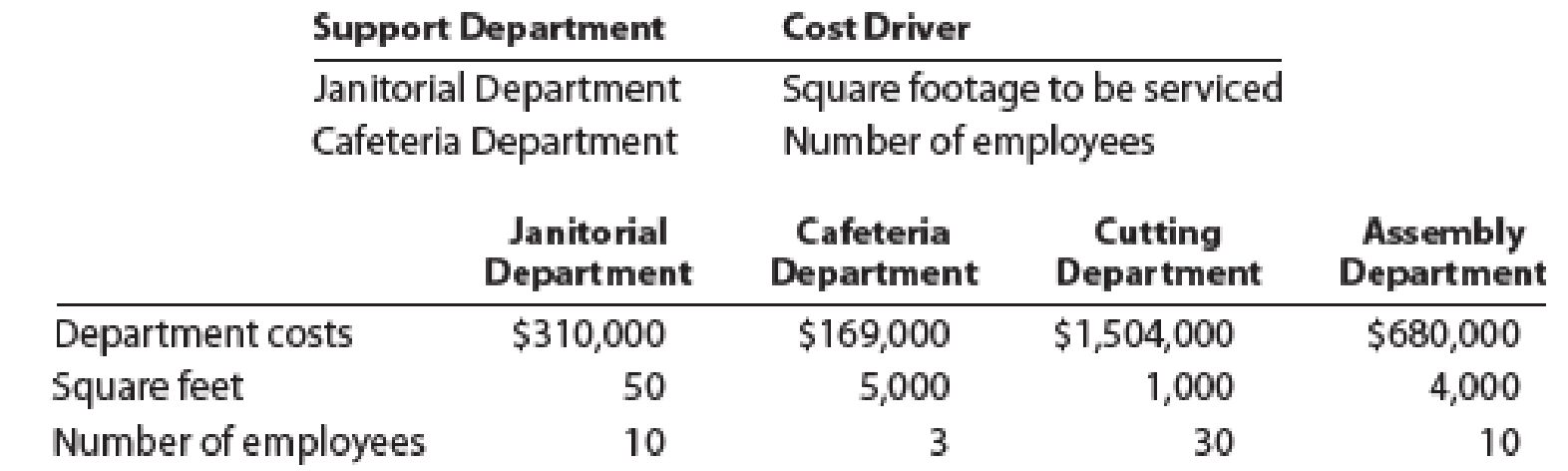

Becker Tabletops has two support departments (Janitorial and Cafeteria) and two production departments (Cutting and Assembly). Relevant details for these departments are as follows:

Allocate the support department costs to the production departments using the direct method.

EX 19-8 Support department cost allocation–sequential method Obj.3

Refer to the information provided for Becker Tabletops in Exercise 7. Allocate the support department costs to the production departments using the sequential method. Allocate the support department with the highest department cost first.

EX 19-9 Support department cost allocation–reciprocal services method Obj.3

Refer to the information provided for Becker Tabletops in Exercise 7. Allocate the support department costs to the production departments using the reciprocal services method.

Compute the total cost of each production department after allocating all support costs to the production departments.

Explanation of Solution

Cost allocation:

The cost allocation refers to the process of allocating the costs associated with the production of the products mainly indirectly and are generally ignored. The main objective of cost allocation is to ensure proper pricing of the products. This can be done by several methods.

Janitorial Department Cost to be allocated:

The total Janitorial Department costs include 20% of the Cafeteria department costs as,

Therefore, the Cafeteria Department cost is,

Cafeteria Department Cost to be allocated:

The total Cafeteria Department costs include 50% of the Janitorial department costs as,

Therefore, the Cafeteria Department cost is,

Substitute the equation for J into the C equation:

Substitute the value of C into the J equation:

Janitorial Department Cost Allocation:

Compute the allocation of costs from Janitorial Department to Cafeteria Department:

The costs allocated from Janitorial Department to Cafeteria Department is $191,000.

Compute the allocation of costs from Janitorial Department to Cutting Department:

The costs allocated from Janitorial Department to Cutting Department is $38,200.

Compute the allocation of costs from Janitorial Department to Assembly Department:

The costs allocated from Janitorial Department to Assembly Department is $152,800.

Cafeteria Department Cost Allocation:

Compute the allocation of costs from Cafeteria Department to Janitorial Department:

The costs allocated from Cafeteria Department to Janitorial Department is $72,000.

Compute the allocation of costs from Cafeteria Department to Cutting Department:

The costs allocated from Cafeteria Department to Cutting Department is $216,000.

Compute the allocation of costs from Cafeteria Department to Assembly Department:

The costs allocated from Cafeteria Department to Assembly Department is $72,000.

Want to see more full solutions like this?

Chapter 19 Solutions

FINANCIAL&MANAGERIAL ACCOUNTING(LL)W/AC

- Please need help with this accounting question answer do fastarrow_forwardJingle Ltd. and Bell Ltd. belong to the same industry. A snapshot ofsome of their financial information is given below: Jingle Ltd. Bell Ltd. Current Ratio 3.2 : 1 2 : 1 Acid - Test Ratio 1.7 : 1 1.1 : 1 Debt-Equity Ratio 30% 40% Times Interest earned 6 5 You are a loans officer and both companies have asked for an equal2-year loan. i) If you could facilitate only one loan, which company wouldyou refuse? Explain your reasoning brieflyii) If both companies could be facilitated, would you be willingto do so? Explain your argument briefly.arrow_forwardDetermine the total fixed costs of these accounting questionarrow_forward

- Perreth Drycleaners has capacity to clean up to 5,000 garments per month. Requirements 1. Complete the schedule below for the three volumes shown. 2. Why does the average cost per garment change? 3. Suppose the owner, Dale Perreth, erroneously uses the average cost per unit at full capacity to predict total costs at a volume of 2,000 garments. Would he overestimate or underestimate his total costs? By how much? Requirement 1. Complete the following schedule for the three volumes shown. (Round all unit costs to the nearest cent and all total costs to the nearest whole dollar.) Total variable costs Total fixed costs Total operating costs Variable cost per garment Fixed cost per garment 2,000 Garments 3,500 Garments 5,000 Garments $ 2,800 2.00 Average cost per garment Requirement 2. Why does the average cost per garment change? The average cost per garment changes as volume changes, due to the component of the dry cleaner's costs. The cost per unit decreases as volume , while the variable…arrow_forwardI need answer of this general accounting questionarrow_forwardCalculate the day's sales in receivables for this accounting questionarrow_forward

- Need help with this accounting questionarrow_forwardWhat is the number of shares outstanding for this accounting question?arrow_forwardQuestion 2Anti-Pandemic Pharma Co. Ltd. reports the following information inits income statement:Sales = $5,250,000;Costs = $2, 173,000;Other expenses = $187,400;Depreciation expense = $79,000;Interest expense= $53,555;Taxes = $76,000;Dividends = $69,000.$136,700 worth of new shares were also issued during the year andlong-term debt worth $65,300 was redeemed.a) Compute the cash flow from assetsb) Compute the net change in working capitalarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning