a.

Classify the costs as prevention, appraisal, internal failure, and external failure.

a.

Explanation of Solution

Total Quality Management:

Total Quality Management is a method that eliminates wasteful activities and improves quality throughout the value chain by allocating quality management responsibility, rewarding low-cost, high-quality results and monitoring quality costs.

Components of the costs of quality:

Prevention costs:

Prevention costs denote the cost of resources consumed in activities that prevents defects from its occurrence. Supplier quality evaluation, employee training is some of the example of prevention costs.

Appraisal costs:

Appraisal costs occur in order to determine if products conform to quality standards. Finished goods inventories, monitoring of production process are some of the examples of appraisal costs.

Internal failure costs:

Internal failure costs include additional production-related costs that are incurred to correct the low-quality output. Disposing of scrap, processing engineering change orders are some of the examples of internal failure costs.

External failure costs:

External failure costs are the largest and hardest to measure. These costs are incurred when the quality failures are allowed to enter the market. Warranty costs, product liability costs are some of the examples of external failure costs.

- Quality training is a prevention costs.

- Product inspection and material inspection are appraisal costs.

- Scrap and network are internal failure costs.

- Product warranty is an external failure costs.

b.

Calculate the total quality cost as a percentage of sales for each of the two years. And state the amount of profit increased because of quality improvements between year 1 and year 2.

b.

Explanation of Solution

The total quality cost as a percentage of sales for each of the two years is calculated below:

| Particulars | Year 1 | Year 2 |

| Total Quality Sales | $10,000,000 | $10,000,000 |

| Total Quality Costs | (2) $2,000,000 | (2) $1,545,000 |

| Percent of Sales | (3) 20% | (4) 15.45% |

| Profit Increase | $455,000 | |

Table (1)

Working note:

Calculate the total quality costs for year 1 and year 2:

(1)

(2)

Calculate the percentage of sales for year 1 and year 2:

(3)

(4)

- Percentage of sales for year 1 is 20%.

- Percentage of sales for year 1 is 15.45%.

- The amount of increase in profit is $455,000.

c.

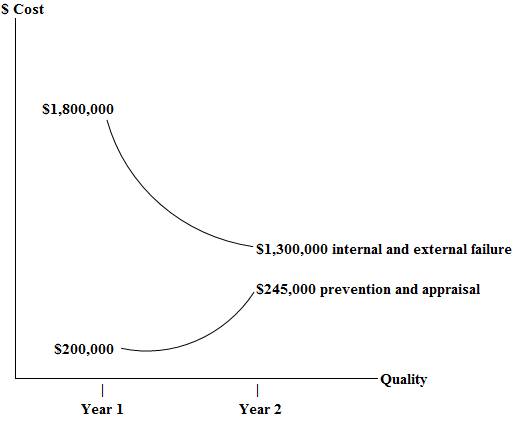

Graph the prevention and appraisal costs versus the internal and external failure costs for year 1 and year 2.

c.

Explanation of Solution

The prevention and appraisal costs versus the internal and external failure costs for year 1 and year 2 are plotted in a graph:

Figure (1)

d.

Identify and explain at least two criticisms associated with the cost-benefit quality model and identify the measures used by Companies to track quality.

d.

Explanation of Solution

- The prevention and appraisal

curves are too steep and in reality they are much flatter. - The relationship between a dollar of prevention and appraisal expended to save some dollars of internal and external failure costs is not stable over time.

- Optimum quality is a moving target and it is a not fixed point.

Want to see more full solutions like this?

Chapter 19 Solutions

FINANCIAL ACCOUNTING (LOOSELEAF)

- Tesla Car Service started the year with total assets of $320,000 and total liabilities of $210,000. During the year, the business recorded $510,000 in revenues, $370,000 in expenses, and dividends of $45,000. What is the net income reported by Tesla Car Service for the year?arrow_forwardThe direct materials quantity variance isarrow_forwardI need help with accounting questionarrow_forward

- I am looking for the most effective method for solving this financial accounting problem.arrow_forwardSuperior Manufacturing uses a predetermined overhead rate based on direct labor hours to allocate manufacturing overhead to production jobs. For 2024, the company's budget includes estimated manufacturing overhead of $720,000 and estimated direct labor hours of 20,000. In March, the production department completed Job #304, which required $8,200 in direct materials and $4,500 in direct labor (representing 250 hours at $18 per hour). The cost accountant needs to determine the predetermined overhead rate, the manufacturing overhead allocated to Job #304, and the total cost of this job.arrow_forwardHi experts please provide answer this accounting questionarrow_forward

- Please explain this financial accounting problem with accurate financial standards.arrow_forwardCan you explain this general accounting question using accurate calculation methods?arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education