a.

Classify the costs as prevention, appraisal, internal failure, and external failure.

a.

Explanation of Solution

Total Quality Management:

Total Quality Management is a method that eliminates wasteful activities and improves quality throughout the value chain by allocating quality management responsibility, rewarding low-cost, high-quality results and monitoring quality costs.

Components of the costs of quality:

Prevention costs:

Prevention costs denote the cost of resources consumed in activities that prevents defects from its occurrence. Supplier quality evaluation, employee training is some of the example of prevention costs.

Appraisal costs:

Appraisal costs occur in order to determine if products conform to quality standards. Finished goods inventories, monitoring of production process are some of the examples of appraisal costs.

Internal failure costs:

Internal failure costs include additional production-related costs that are incurred to correct the low-quality output. Disposing of scrap, processing engineering change orders are some of the examples of internal failure costs.

External failure costs:

External failure costs are the largest and hardest to measure. These costs are incurred when the quality failures are allowed to enter the market. Warranty costs, product liability costs are some of the examples of external failure costs.

- Quality training is a prevention costs.

- Product inspection and material inspection are appraisal costs.

- Scrap and network are internal failure costs.

- Product warranty is an external failure costs.

b.

Calculate the total quality cost as a percentage of sales for each of the two years. And state the amount of profit increased because of quality improvements between year 1 and year 2.

b.

Explanation of Solution

The total quality cost as a percentage of sales for each of the two years is calculated below:

| Particulars | Year 1 | Year 2 |

| Total Quality Sales | $10,000,000 | $10,000,000 |

| Total Quality Costs | (2) $2,000,000 | (2) $1,545,000 |

| Percent of Sales | (3) 20% | (4) 15.45% |

| Profit Increase | $455,000 | |

Table (1)

Working note:

Calculate the total quality costs for year 1 and year 2:

(1)

(2)

Calculate the percentage of sales for year 1 and year 2:

(3)

(4)

- Percentage of sales for year 1 is 20%.

- Percentage of sales for year 1 is 15.45%.

- The amount of increase in profit is $455,000.

c.

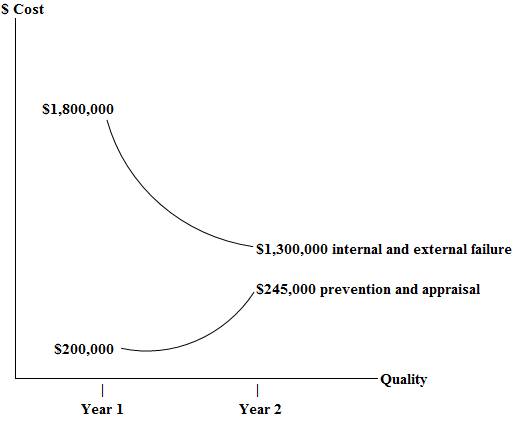

Graph the prevention and appraisal costs versus the internal and external failure costs for year 1 and year 2.

c.

Explanation of Solution

The prevention and appraisal costs versus the internal and external failure costs for year 1 and year 2 are plotted in a graph:

Figure (1)

d.

Identify and explain at least two criticisms associated with the cost-benefit quality model and identify the measures used by Companies to track quality.

d.

Explanation of Solution

- The prevention and appraisal

curves are too steep and in reality they are much flatter. - The relationship between a dollar of prevention and appraisal expended to save some dollars of internal and external failure costs is not stable over time.

- Optimum quality is a moving target and it is a not fixed point.

Want to see more full solutions like this?

Chapter 19 Solutions

Financial & Managerial Accounting

- Please provide the answer to this financial accounting question with proper steps.arrow_forwardI am trying to find the accurate solution to this general accounting problem with appropriate explanations.arrow_forwardCan you solve this financial accounting question with accurate accounting calculations?arrow_forward

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education