Concept explainers

Problem 19-5B

Production transactions, subsidiary records, and source documents

P1 P2 P3 P4

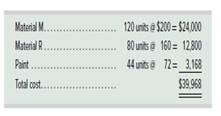

King Company produces variations of its product, a megaton, in response to custom orders from its customers, On June 1, the company had no inventories of work in process or finished goods but held the following raw materials.

On June 3, the company began working on two megatons: Job 450 for Encinita Company and Job 451 for Fargo, Inc.

Required

Using Exhibit 19.3 as a guide, prepare

a. Purchased raw materials on credit and recorded the following information from receiving reports and invoices.

Instructions: Record these purchases with a single

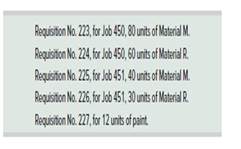

b. Requisitioned the following raw materials for production.

Instructions: Enter amounts for direct materials requisitions on the materials ledger cards and the job cost sheets. Enter the indirect materials amount on the materials ledger card. Do not record a journal entry at this time.

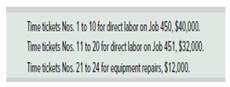

c. Received the following employee time tickets for work in June.

Instructions: Record direct labor from the time tickets on the job cost sheets. Do not record a journal entry at this time.

d. Paid cash for the Mowing items during the month: factory payroll, $84,000, and miscellaneous

Instructions: Record these payments with journal entries.

e. Finished Job 450 and transferred it to the warehouse. The company assigns overhead to each job with a predetermined overhead rate equal to 70% of direct labor cost.

Instructions: Enter the applied overhead on the cost sheet for Job 450, fill in the cost summary section of the cost sheet, and then mark the cost sheet "Finished." Prepare a journal entry to record the job's completion and its transfer to Finished Goods. f. Delivered Job 450 and accepted the customer's promise to pay $290,000 within 30 days,

Instructions: Prepare journal entries to record the sale of Job 450 and the cost of goods sold, g. Applied overhead cost to Job 451 based on the job's direct labor used to date,

Instructions: Enter overhead on the job cost sheet but do not mate a journal entry at tins time. h. Recorded the total direct and indirect materials costs as reported on all the requisitions for the month.

Instructions: Prepare a journal entry to record these. i. Recorded the total overhead costs applied to jobs. Instructions: Prepare a journal entry to record the allocation of these overhead costs. j. Compute the balance in the Factory Overhead account as of the end of June.

Check (h) Dr. Work in Process Inventory, $38,400

(j) Balance in Factory Overhead, $736 Cr., overapplied

Want to see the full answer?

Check out a sample textbook solution

Chapter 19 Solutions

FUND OF ACCT PRIN(LOOSE-LEAF)+ACCESS

- The balanced scorecard approach includes _.arrow_forwardMichiko Industries uses flexible budgets. At a normal capacity of 25,000 units, the budgeted manufacturing overhead is $75,000 variable and $300,000 fixed. If Michiko Industries had actual overhead costs of $385,500 for 27,000 units produced, what is the difference between actual and budgeted costs?arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNaiya Enterprises reported the following results from last year's operations: Sales $2,250,000 Variable expenses $900,000 Contribution margin $1,350,000 Fixed expenses $850,000 Net operating income $500,000 Average operating assets $1,600,000 This year, the company has a $320,000 investment opportunity with the following cost and revenue characteristics: Sales $480.000 Contribution margin ratio 55% of sales Fixed expenses $160,000 The company's minimum required rate of return is 11%. What is the margin % related to this year's investment opportunity?arrow_forwardThe company's statement of cash flows for 2022 reported $860,000 of cash received from customers.arrow_forward

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781285866307Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial & Managerial AccountingAccountingISBN:9781337119207Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning