Concept explainers

Analyze Horsepower Hookup, Inc.

Horsepower Hookup, Inc., is a large automobile company that specializes in the production of high-powered trucks. The company is determining cost allocations for purposes of performance evaluation. A portion of company bonuses depends on divisions achieving cost management goals. This necessitates highly accurate support department cost allocation. Management has also stated that it has the means to implement as complex a method as necessary.

The general manager over the Mid-Size D wants to get a good idea of what factors are driving the costs of the support departments in order to make accurate cost allocations, so finding accurate support department cost drivers is important. Support department costs include Janitorial ($163,100) and Security ($285,400). The Janitorial costs vary depending on the number of vehicles produced, increasing with larger production volumes. Security costs are fixed based on the size of the lot, and do not change with respect to how many vehicles are in the lot or warehouse. Joint costs involved in producing the trucks before the split-off point where the various makes, models, and colors are produced are $946,000 for the period. All makes, models, and colors sell at relatively similar margins, but the sports models and metallic colors are normally more difficult to produce during the joint production process.

- a. Which support department cost allocation method (direct, sequential, or reciprocal services) should be used to allocate support department cost?

- b. What driver would be best for allocating Janitorial costs?

- c. What driver would be best for allocating Security costs?

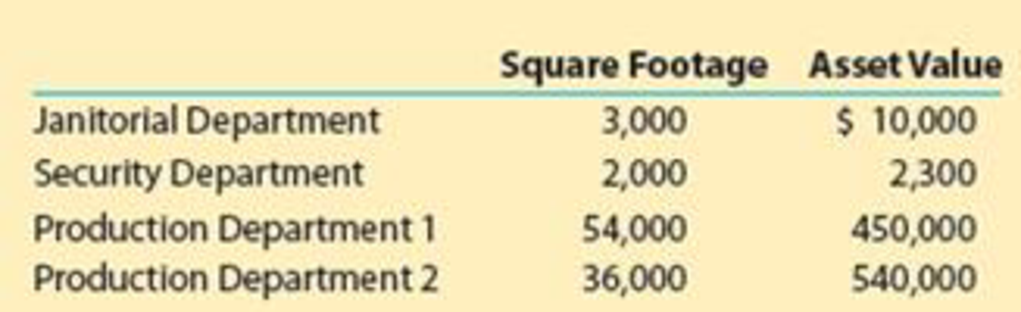

- d. If Janitorial costs were to be allocated based on square footage, and Security costs based on asset value, what percentage of each support department’s costs would be allocated to each production department using the sequential method (allocating Security costs first) given the following:

- e. Should Janitorial and Security costs be considered when evaluating the performance of cost management employees?

- f. What joint cost allocation method should be used for performance evaluation purposes?

Trending nowThis is a popular solution!

Chapter 19 Solutions

Financial and Managerial Accounting - CengageNow

- Can you solve this general accounting problem using appropriate accounting principles?arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forward

- Please explain the solution to this general accounting problem with accurate principles.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardPlease provide the answer to this general accounting question using the right approach.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,