Principles of Economics 2e

2nd Edition

ISBN: 9781947172364

Author: Steven A. Greenlaw; David Shapiro

Publisher: OpenStax

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 19, Problem 29P

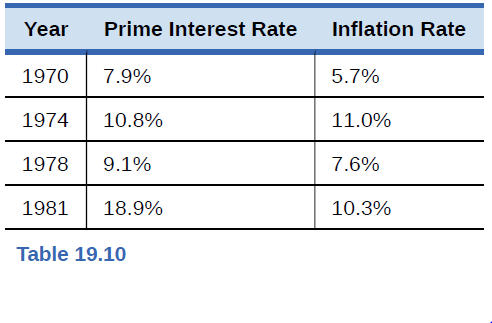

The “prime” interest rate is the rate that banks charge their best customers. Based on the nominal interest rates and inflation rates in Table 19.10, in which of the years would it have been best to be a lender? Based on the nominal interest rates and inflation rates in Table 19.10, in which of the years given would it have been best to be a borrower?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

If interest rate parity holds between two countries, then it must be true that:

Question 3 options:

The interest rates between the two countries are equal.

The current forward rate is an unbiased predictor of the future exchange rate.

The interest rate differential between the two countries is equal to the percentage difference between the forward exchange rate and the spot exchange rate.

Significant covered interest arbitrage opportunities exist between the two currencies.

The exchange rate adjusts to keep purchasing power constant across the two currencies.

If interest rate parity holds between two countries, then it must be true that:

Question 3 options:

The interest rates between the two countries are equal.

The current forward rate is an unbiased predictor of the future exchange rate.

The interest rate differential between the two countries is equal to the percentage difference between the forward exchange rate and the spot exchange rate.

Significant covered interest arbitrage opportunities exist between the two currencies.

The exchange rate adjusts to keep purchasing power constant across the two currencies.

Suppose the indirect exchange rate for the Canadian dollar is 0.93. Based on this, you know you can buy:

Question 2 options:

$1 U.S. for $1.93 Canadian.

$1 U.S. for $1.08 Canadian.

$1 U.S. for $0.93 Canadian.

$1.93 U.S. for $1 Canadian.

$1.08 U.S. for $1 Canadian.

Chapter 19 Solutions

Principles of Economics 2e

Ch. 19 - Country A has export sales of 20 billion,...Ch. 19 - Which of the following are included in GDP, and...Ch. 19 - Using data from Table 19.5 how much of the nominal...Ch. 19 - Without looking at Table 19.7, return to Figure...Ch. 19 - According to Table 19.7, how often have recessions...Ch. 19 - According to Table 19.7, how long has the average...Ch. 19 - According to Table 19.7, how long has the average...Ch. 19 - Is it possible for GDP to rise while at the same...Ch. 19 - The Central African Republic has a GDP of...Ch. 19 - Explain briefly whether each of the following...

Ch. 19 - What are the main components of measuring GDP with...Ch. 19 - What are the main components of measuring GDP with...Ch. 19 - Would you usually expect GDP as measured by what...Ch. 19 - Why must you avoid double counting when measuring...Ch. 19 - What is the difference between a series of...Ch. 19 - How do you convert a series of nominal economic...Ch. 19 - What are typical GDP patterns for a high-income...Ch. 19 - What are the two main difficulties that arise in...Ch. 19 - List some of the reasons why economists should not...Ch. 19 - U.S. macroeconomic data are among the best in the...Ch. 19 - What does GDP not tell us about the economy?Ch. 19 - Should people typically pay more attention to...Ch. 19 - Why do you suppose that U.S. GDP is so much higher...Ch. 19 - Why do you think that GDP does not grow at a...Ch. 19 - Cross country comparisons of GDP per capita...Ch. 19 - Why might per capita GDP be only an imperfect...Ch. 19 - How might you measure a green GDP?Ch. 19 - Last year, a small nation with abundant forests...Ch. 19 - The prime interest rate is the rate that banks...Ch. 19 - A mortgage 105m is a loan that a person makes to...Ch. 19 - Ethiopia has a GDP of 8 billion (measured in U.S....Ch. 19 - In 1980, Denmark had a GDP of 70 billion (measured...Ch. 19 - The Czech Republic has 3 GDP of 1,800 billion...

Additional Business Textbook Solutions

Find more solutions based on key concepts

The exchange rate, potential risk, transfer pricing, tax law differences and strategies are the items affects t...

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

4. JC Manufacturing purchase d inventory for $ 5,300 and al so paid a $260 freight bill. JC Manufacturing retur...

Horngren's Financial & Managerial Accounting, The Financial Chapters (Book & Access Card)

E6-14 Using accounting vocabulary

Learning Objective 1, 2

Match the accounting terms with the corresponding d...

Horngren's Accounting (12th Edition)

Why is the capital-budgeting process so important?

Foundations Of Finance

Discussion Questions 1. What characteristics of the product or manufacturing process would lead a company to us...

Managerial Accounting (5th Edition)

An experimental composite engine block for an automobile will trim 20 pounds of weight compared with a traditio...

Engineering Economy (17th Edition)

Knowledge Booster

Similar questions

- According to the relative purchasing power parity theory, high inflation in country A and low inflation in country B will cause the value of country A's currency to appreciate relative to that of country B. Question 1 options: True Falsearrow_forwardHow might different tax structures influence consumer behavior in luxury versus essential goods?arrow_forwardWhat is a competitive market?arrow_forward

- لا. Assignniend abcpain the the three type of state- and explaining of the decannolly you know + 29 Explain Cu Marginal utility Jaw State the lid of diminishing. Explain the Concept of the aid of ha the relations and marginal uitity. Marginal finishing حومarrow_forwardHow does the change in consumer and producer surplus compare with the tax revenue?arrow_forwardConsidering the following supply and demand equations: Qs=3P-1 Qd=-2P+9 dPdt=0.5(Qd-Qs) Find the expressions: P(t), Qs(t) and Qd(t). When P(0)=1, is the system stable or unstable? If the constant for the change of excess of demand changes to 0.6, this is: dPdt=0.6(Qd-Qs) do P(t), Qs(t) and Qd(t) remain the same when P(0)=1?arrow_forward

- Consider the following supply and demand schedule of wooden tables.a. Draw the corresponding graphs for supply and demand. b. Using the data, obtain the corresponding supply and demand functions. c. Find the market-clearing price and quantity. Price (Thousands USD) Supply Demand2 96 1104 196 1906 296 270 8 396 35010 496 43012 596 51014 696 59016 796 67018 896 75020 996 830arrow_forwardWhat happens to consumer surplus and producer surplus when the sale of a good is taxed?arrow_forwardEconomics Grade 3 CONDUCT RESEARCH ON (the various) MARKET STRUCTURES Research Project/May Explain the concept market structure and explain why there are perfect and imperfect market structures. (5) • Provide reasons as to why the taxi industry is regarded as operating in a monopolistic competitive structure. (10) • How do monopolies impact consumers and the economy. (10) • Use graph(s) to explain the long run equilibrium price and output in a perfect market. (10) • Evaluate the effectiveness of South Africa's competition policy in curbing anticompetitive tendencies in the market. Make use of practical examples. (10) GRAND TOTAL:50 Please turn Copyrightarrow_forward

- UGD KCQ 2: Microeconomic Essentials (page 11 of 20) - Google Chrome mancosaconnect.ac.za/mod/quiz/attempt.php?attempt=1958913&cmid=436375&page=10 MANCOSA Microeconomic Essentials Jan25 Y1 S1 Back Refer to the diagram below to answer the question that follows: Price PH P1 D₁ ㅁ X Quiz navigation 3 4 5 6 Time left 0:58:34 1 2 Question 11 7 8 Not yet answered Marked out of 1.00 13 33 14 S₁ Flag question Q Q1 Quantity Which of the following may result in a shift of the supply curve from S to S1? OA. An increase in price of the good. B. An increase in wages. O C. A decrease in price of the good. O D. An improvement in the technique of production. https://mancosaconnect.ac.za/mod/quiz/attempt.php?attempt=1958913&cmid=436375&page=10#question-2064270-11 19 20 6 10 10 11 12 15 Question 11- Not yet answered Finish attempt... 7:31 PMarrow_forwardEuros per U.S. Doler Consider the model below, showing the supply and demand curves for the exchange market of U.S. Dollars and Euros. If the inflation rate in the U.S. increases (and in the European Union stays the same), how will that change the original equilibrium shown in the graph? 1.10- 1.00- 0.90 0.80- 0.70 0.60 0.50- 0.40- 0.30 0.20 E 4.7 48 49 50 51 52 53 54 55 56 Quantity of U.S. Dollars traded for Euros (trillionsday) O It will decrease the demand for Dollars and increase the supply, so the exchange rate decreases and the impact on the quantity traded is unknown. O It will decrease the demand for Dollars and increase the supply, so the exchange rate decreases, and the quantity traded increases. It will increase the demand for Dollars and decrease the supply, so the exchange rate decreases, and the quantity traded increases. It will increase the demand for Dollars and decrease the supply, so the exchange rate increases and the impact on the quantity traded is unknownarrow_forwardIf the US Federal Reserve increases interests on reserves, how will that change the original equilibrium shown in the graph? Euros par US alar 1.10 1.00 0.90- E 0.80- 0.70 0.60 0.50 0.40- 0.30 0.20 47 48 49 50 51 52 53 54 55 56 Quantity of US Dollars traded for Euros (trillions/day) It will increase the demand for Dollars and decrease the supply, so the exchange rate decreases, and the quantity traded increases. O It will decrease the demand for Dollars and increase the supply, so the exchange rate decreases and the impact on the quantity traded is unknown. O It will increase the demand for Dollars and decrease the supply, so the exchange rate increases and the impact on the quantity traded is unknown O It will decrease the demand for Dollars and increase the supply, so the exchange rate decreases, and the quantity traded increases. Question 22 5 ptsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)EconomicsISBN:9781337617383Author:Roger A. ArnoldPublisher:Cengage Learning

Economics (MindTap Course List)

Economics

ISBN:9781337617383

Author:Roger A. Arnold

Publisher:Cengage Learning