Kent Tessman, manager of a Dairy Products Division, was pleased with his division’s performance over the past three years. Each year, divisional profits had increased, and he had earned a sizable bonus. (Bonuses are a linear function of the division’s reported income.) He had also received considerable attention from higher management. A vice president had told him in confidence that if his performance over the next three years matched his first three, he would be promoted to higher management.

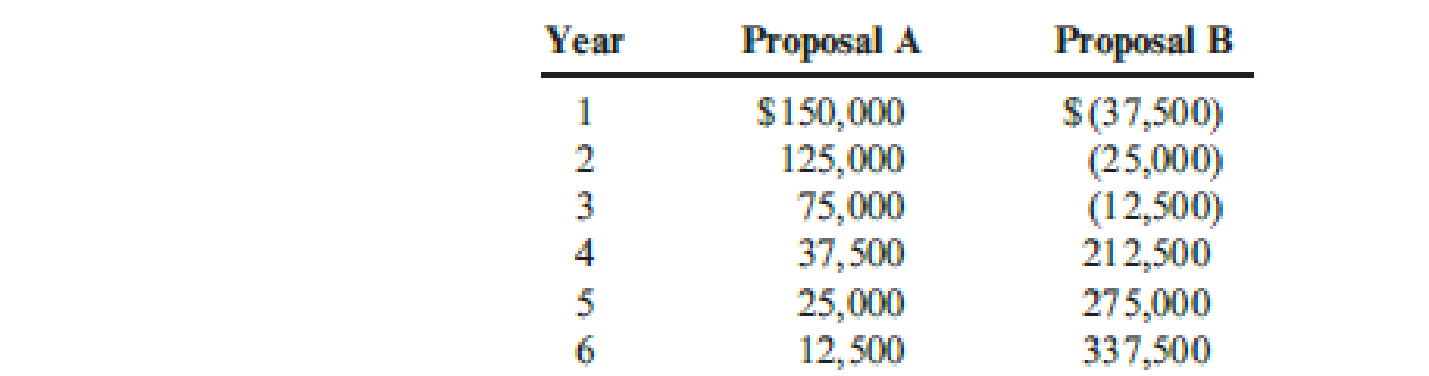

Determined to fulfill these expectations, Kent made sure that he personally reviewed every capital budget request. He wanted to be certain that any funds invested would provide good, solid returns. (The division’s cost of capital is 10 percent.) At the moment, he is reviewing two independent requests. Proposal A involves automating a manufacturing operation that is currently labor intensive. Proposal B centers on developing and marketing a new ice cream product. Proposal A requires an initial outlay of $250,000, and Proposal B requires $312,500. Both projects could be funded, given the status of the division’s capital budget. Both have an expected life of six years and have the following projected after-tax

After careful consideration of each investment, Kent approved funding of Proposal A and rejected Proposal B.

Required:

- 1. Compute the

NPV for each proposal. - 2. Compute the payback period for each proposal.

- 3. According to your analysis, which proposal(s) should be accepted? Explain.

- 4. Explain why Kent accepted only Proposal A. Considering the possible reasons for rejection, would you judge his behavior to be ethical? Explain.

Trending nowThis is a popular solution!

Chapter 19 Solutions

EBK CORNERSTONES OF COST MANAGEMENT

- A company bought a new cooling system for $150,000 and was given a trade-in of $95,000 on an old cooling system, so the company paid $55,000 cash with the trade-in. The old system had an original cost of $140,000 and accumulated depreciation of $60,000. If the transaction has commercial substance, the company should record the new cooling system at _.arrow_forwardcalculate Bethlehem's asset turnover ratio.arrow_forwardQuestion: Variance (accounting) - Wisley Corporation makes a product whose direct labor standards are 0.8 hours per unit and $28 per hour. In April the company produced 7,350 units using 5,380 direct labor hours. The actual direct labor cost was $112,980. The labor efficiency variance for April is ___.arrow_forward

- Chawla Enterprises' fixed monthly expenses are $29,500, and its contribution margin ratio is 60%. Assuming that the fixed monthly expenses do not change, what is the best estimate of the company's net operating income in a month when sales are $98,000? Don't use AIarrow_forwardWhat's the solutionarrow_forward??arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,