Excel Applications for Accounting Principles

4th Edition

ISBN: 9781111581565

Author: Gaylord N. Smith

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 19, Problem 1R

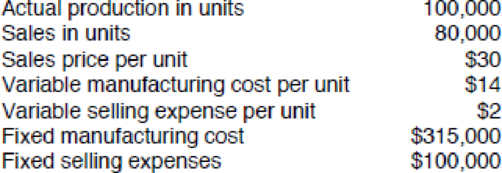

The records of Anderjak Corporation contain the following information for the month of January:

The company has no beginning inventory.

REQUIREMENT

You have been asked to prepare a variable costing (direct costing) income statement and an absorption costing income statement for the month of January. Review the worksheet VARCOST that follows these requirements.

Expert Solution & Answer

To determine

Prepare a income statement for january by using variable costing and absorption costing method.

Explanation of Solution

Prepare a income statement using absorption costing:

| Income statement | ||

| Absorption costing | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | $ 2,400,000 | |

| Cost of goods sold: | ||

| Beginning inventory cost | $ 266,875 | |

| Variable manufacturing costs | 980,000 | |

| Fixed manufacturing costs | 315,000 | |

| Total goods available for sale | $ 1,561,875 | |

| Less: ending inventory | 91,875 | |

| Cost of goods sold | 1,470,000 | |

| Gross profit | $ 930,000 | |

| Selling expenses: | ||

| Fixed selling expenses | $ 100,000 | |

| Variable selling expenses | 160,000 | |

| Total selling expenses | 260,000 | |

| Operating income | $ 670,000 | |

Table (1)

Prepare a income statement using variable costing:

| Income statement | ||

| Variable costing | ||

| Particulars | Amount ($) | Amount ($) |

| Sales | $ 2,400,000 | |

| Cost of goods sold: | ||

| Beginning inventory cost | $ 210,000 | |

| Variable manufacturing costs | 980,000 | |

| Total goods available for sale | $ 1,190,000 | |

| Less: ending inventory | 70,000 | |

| Variable cost of goods sold | 1,120,000 | |

| Manufacturing margin | $ 1,280,000 | |

| Variable selling expenses | 160,000 | |

| Contribution margin | $ 1,120,000 | |

| Fixed costs: | ||

| Fixed manufacturing costs | $ 315,000 | |

| Fixed selling expenses | 100,000 | |

| Total fixed costs | $ 415,000 | |

| Operating income | $ 705,000 | |

Table (2)

Want to see more full solutions like this?

Subscribe now to access step-by-step solutions to millions of textbook problems written by subject matter experts!

Students have asked these similar questions

Please show me how to solve this financial accounting problem using valid calculation techniques.

Given the solution and accounting question

Can you help me solve this general accounting question using valid accounting techniques?

Chapter 19 Solutions

Excel Applications for Accounting Principles

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY