To determine: The net funds available to the parent corporation (a) if foreign taxes can be applied against the U.S. tax liability and (b) if they cannot.

Answer to Problem 19.1WUE

Explanation of Solution

Given information:

Subsidiary pretax income: $55,000

Local tax: 40.00%

Dividend withholding tax: 5.00%

US tax rate: 34.00%

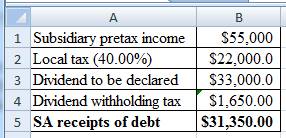

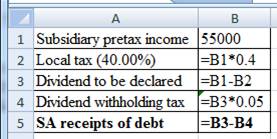

Calculation of the SA receipts of dividend:

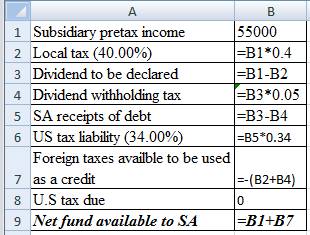

Excel working:

Therefore, the SA receipt of debt is $31,250.

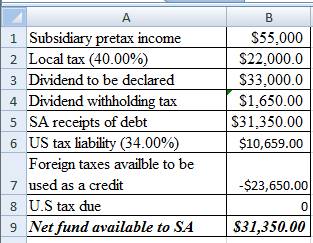

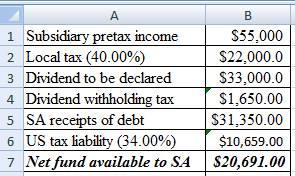

(a) if foreign taxes can be applied against the U.S. tax liability

Calculation of the net fund available to SA:

Excel working:

Therefore, net fund available to SA is $31,500.

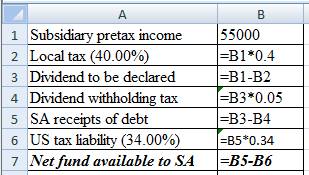

(b) if they cannot.

Foreign taxes cannot be applied against the U.S. tax liability

Excel working:

Therefore, Net fund available to SA is $20,691.00

Want to see more full solutions like this?

Chapter 19 Solutions

Principles of Managerial Finance, Student Value Edition Plus MyLab Finance with Pearson eText - Access Card Package (15th Edition) (Pearson Series in Finance)

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning

Financial Reporting, Financial Statement Analysis...FinanceISBN:9781285190907Author:James M. Wahlen, Stephen P. Baginski, Mark BradshawPublisher:Cengage Learning